EUR/USD overview and trading tips

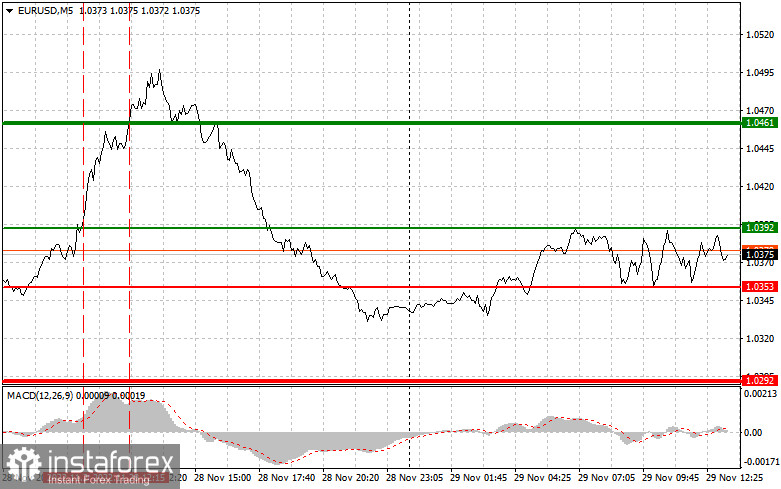

The pair tested the level of 1.0397 by the time when the MACD indicator had advanced far from the zero level, thus limiting the upside potential of the pair. That is why I decided not to buy the euro. However, the pair continued to rise and tested the level of 1.0461 by mid-day. I recommended selling the pair at this point right after a rebound. Unfortunately, a rapid fall in the price did not happen. So those of us who had placed stop-loss orders too close to the level suffered losses. There were no other signals during the day.

Yesterday's statement made by John C. Williams and James Bullard caused a massive sell-off in the European currency which may continue today in the afternoon. The main focus today will be on the consumer confidence index and house prices in the US. If both indicators exceed expectations, the euro will come under pressure and the pair will slump to weekly lows. In case the data is discouraging, the euro will get a chance to exit the channel formed in the first half of the day.

Buy signal

Scenario №1: it is possible to buy the euro when the price hits the level of 1.0392 (a green line on the chart) with an upward target at 1.0461. I recommend closing buy positions at the level of 1.0461 and going short in the opposite direction, considering a retracement of 30-35 pips from the entry point. A deep decline in the pair is unlikely. Traders should pay close attention to the data from the US and statements by Fed officials. Note! Before going long, make sure that the MACD indicator is located above the zero mark or has just started to rise from it.

Scenario №2: you can also buy the euro when the price reaches the level of 1.0353 but make sure that the MACD is holding in the oversold area. This will limit the downside potential of the pair and trigger an upside reversal. In this case, the quote may rise to the levels of 1.0392 and 1.0461.

Sell signal

Scenario №1: selling the euro is possible after reaching the level of 1.0353 (a red line on the chart). At the target of 1.0292, I recommend leaving the market and opening a buy position in the opposite direction, considering a retracement of 20-25 pips from this level. The pair will come under selling pressure if the US data turns out to be strong. Optimistic results will confirm the comments made by Fed officials about the strong US economy. Note! Before going short, make sure that the MACD indicator is located below the zero level or has just started to decline from it.

Scenario №2: you can also sell the euro when the price hits the 1.0392 level but make sure that the MACD is holding in the overbought area. This will limit the upside potential of the price and lead to the downward reversal of the trend. If so, the quote may move lower to the levels of 1.0353 and 1.0292.

On the chart:

The thin green line indicates the entry point for buying the instrument;

The thick green line indicates the estimated level for setting a Take Profit or closing trades manually as the pair is unlikely to move above this line;

The thin red line indicates the entry point for selling the instrument;

The thick red line indicates the estimated level for setting a Take Profit or closing trades manually as the pair is unlikely to move below this line;

When entering the market, it is essential to consider whether the MACD is located in the oversold or overbought area.

Important! Beginners on Forex should be very careful when making a decision to enter the market. It is recommended to stay out of the market ahead of important news releases to avoid sharp fluctuations of the price. If you decide to trade on the news, make sure you set stop-loss orders to minimize losses. Without setting a Stop Loss, you risk losing your entire deposit in no time, especially if you do not use money management and trade with large volumes.

Remember that you need to have a well-developed trading plan similar to the one above to be successful in trading. Spontaneous decision-making based on the current market situation is a losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română