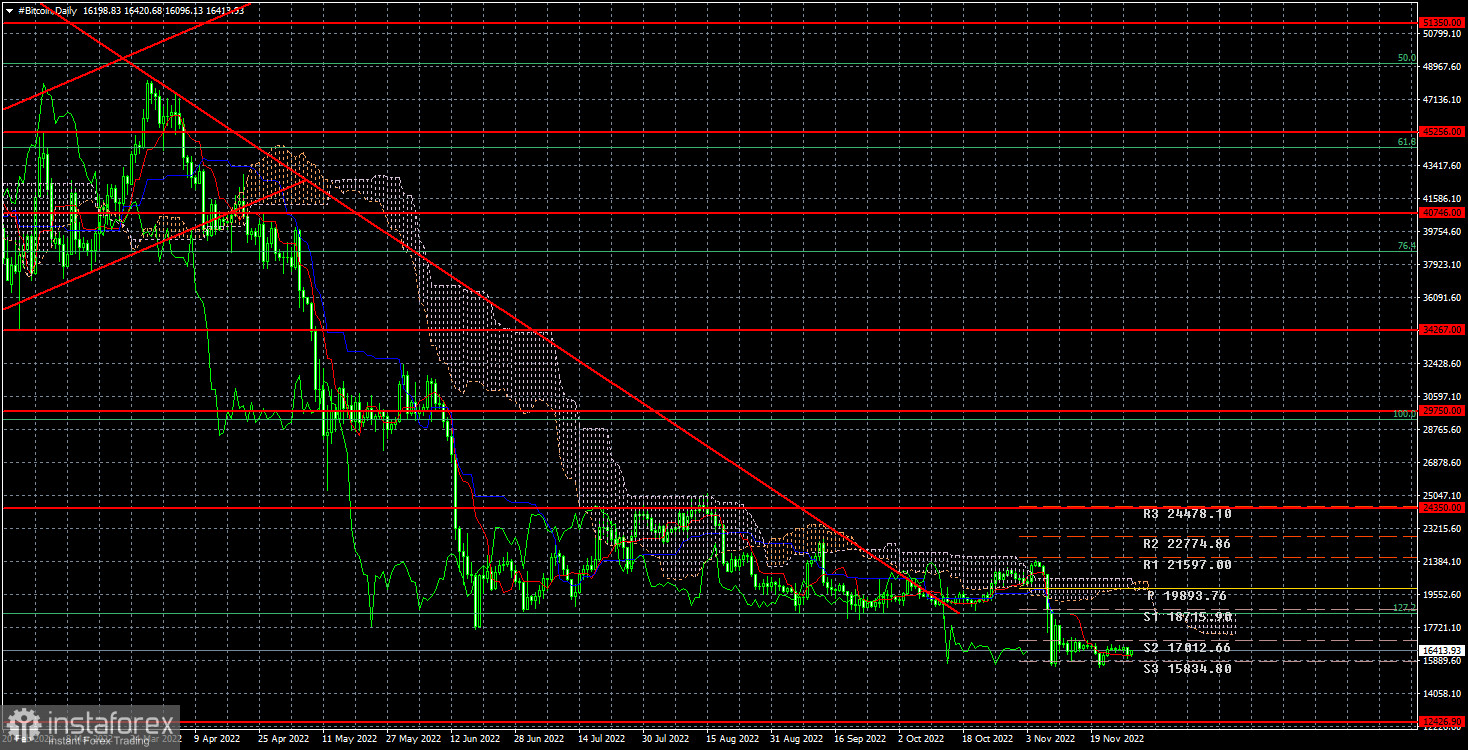

The bitcoin cryptocurrency is still below the Fibonacci level of 127.2% ($18,500) and has not yet made any attempts to rise above this level. In theory, everything proceeds as we have repeatedly described: first, bitcoin is flat for several weeks or months, then it abruptly collapses, and then it is flat once more. We must therefore wait for a new collapse because it is currently in the first or third stage. Of course, figuring out when it will occur is very difficult. The bankruptcy of the FTX exchange was one of the very specific causes of the previous collapse. But many experts and knowledgeable individuals already claim that at least a few more cryptocurrency companies are struggling with severe liquidity issues.

Additionally, we have written extensively about this. Where is the assurance that other exchanges and businesses won't act similarly if, as it recently emerged, the FTX exchange and its owner were not entirely honest and used clients' money for their interests? Additionally, the FTX bankruptcy itself has the potential to trigger a wave of insolvencies at other businesses that, for instance, invested in its FTT token. Additionally, this token is now worthless. Furthermore, a lot of businesses made loans at the expense of depositors. If one or more tokens now "fly down," that signals the start of a liquidity crisis and many bankruptcies. Naturally, every subsequent crash will give the cryptocurrency market as a whole a new justification for continuing its upward trend. As a result, in our opinion, bitcoin's future is not only unclear, but it has also become increasingly challenging to explain why its price has increased.

Don't forget that the Fed is still reducing its balance sheet as part of the QT program and tightening monetary policy. Both of these elements work against all risky assets. Therefore, even in the absence of news in the cryptocurrency industry, bitcoin may still decline. Another crucial point is that there are currently hardly any buyers in the market. If this were not the case, they would be drawn to the current, extremely low-cost levels. Since many "experts" predict that bitcoin will inevitably return to a "bullish" trend and cost $100,000 or more. Why are investors not rushing to purchase the first cryptocurrency, then? Bitcoin may eventually cost $100,000 or $200,000, but until then, it might drop so low that it would take years for it to recover.

The "bitcoin" quotes finally made a successful attempt to surpass the level of $18,500 for a 24-hour period. Now that we have a target in mind of $12,426, the fall may continue. As we previously stated, since the price was concurrently in a side channel, crossing the downward trend line does not signify the end of the "bearish" trend. The quotes may now drop further as the lower channel limit has been reached.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română