On Tuesday, the EUR/USD currency pair was already trading considerably more steadily than it had the day before. We are still unsure of what caused those "roller coasters" that we saw. Yes, there were several unscheduled speeches by Fed officials on Monday, but for some reason, it is hard for us to recall the last time Bullard or Williams gave a routine speech that resulted in such "flights." Furthermore, none of them provided any brand-new, crucial information. Recall that a few weeks ago, Jerome Powell said that the Fed rate could rise a little bit longer than initially anticipated. If the market had previously set a rate of 5% for the pair, the upper limit is now gradually moving in the direction of 5.25% or even 5.5%. But given that this year's expectations for the rate have only increased, what is surprising about this?

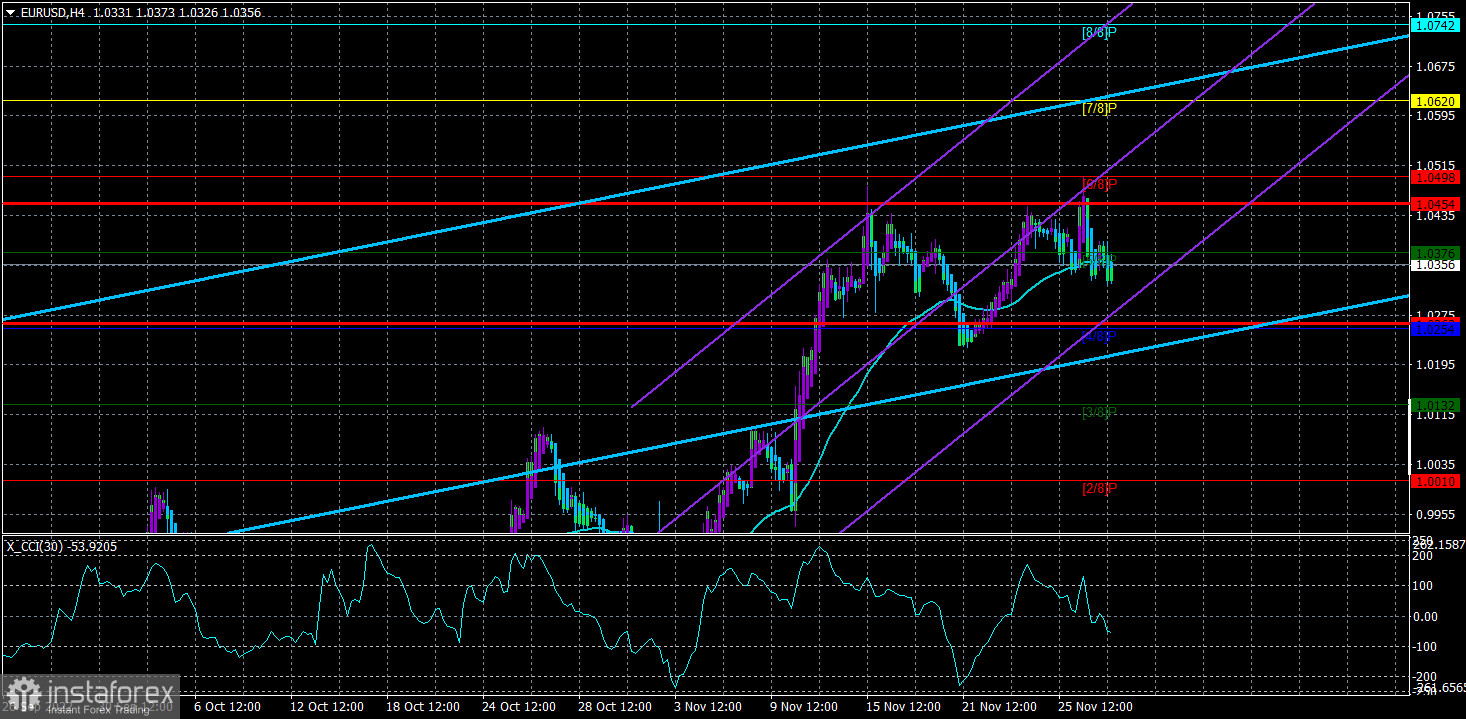

Remember how one of the Fed's most vocal "hawks," James Bullard, suggested raising the interest rate to 3% at the beginning of the year? Then, as time went on, this value increased gradually to 3.5%, then to 4.5%, and now we are discussing "5% or more." As a result, rates are expected to rise throughout the year, but inflation has only recently started to fall and is doing so at a slow pace. As a result, we are not surprised by the upcoming increase in the "upper limit" of the rate. Furthermore, the market had to figure out these performances in a convoluted manner if at all. The dollar should increase in strength and speed if there is a growing likelihood that new monetary policy tightening will occur. Remember that we have been anticipating a significant downward correction since early last week, but the market has been looking for any justifications to avoid purchasing US currency. The moving average line needs to fix below for the US dollar to start strengthening. In two attempts, the pair was unable to surpass the Murray level of "6/8" - 1.0498, and the total increase from its 20-year lows is already close to 1000 points. Although we still anticipate a sharp decline, we think the euro currency has grown sufficiently to this point.

The euro currency may be under stress as a result of the EU inflation report.

To start, market reactions to inflation reports in the European Union are significantly weaker than those to comparable reports in the United States. It so happened that in 2022, market participants received a larger share of any news and messages coming from abroad. So, from the outset, we don't anticipate a significant response to this report. Additionally, it is now quite challenging to comprehend how the market decides anything at all. Perhaps the decline we observed on Monday evening and Tuesday during the day is the market's "advance" response to the inflation report? After all, the European Union's consumer price index may slow down for the first time in a long time. At least, this is what the most recent official forecasts indicate. The rate of price growth is anticipated to decrease from 10.6% y/y to 10.3-10.4% y/y. Let it be a modest triumph nonetheless. This situation might be the start of the end for the euro as a currency.

Remember that the dollar started to lose value precisely after US inflation started to slow down a few months ago. The market perceived a sharp decline in the likelihood of a Fed rate hike as a result of the slowdown in price growth. The euro currency is now capable of the same thing. The ECB will no longer need to raise interest rates as quickly as possible if inflation in the EU starts to decline. Of course, the Fed increased the rate by 0.75% twice more following the initial slowdown, so the ECB may follow. But we're attempting to predict how the market might respond. As soon as the market realized that inflation was decreasing, it started to reject buying dollars. Therefore, it makes no difference when the ECB slows the rate of tightening; the market can start selling off the euro right away or has commenced this process. Given the current technical landscape and historical context, we think that this course of events would be the most logical.

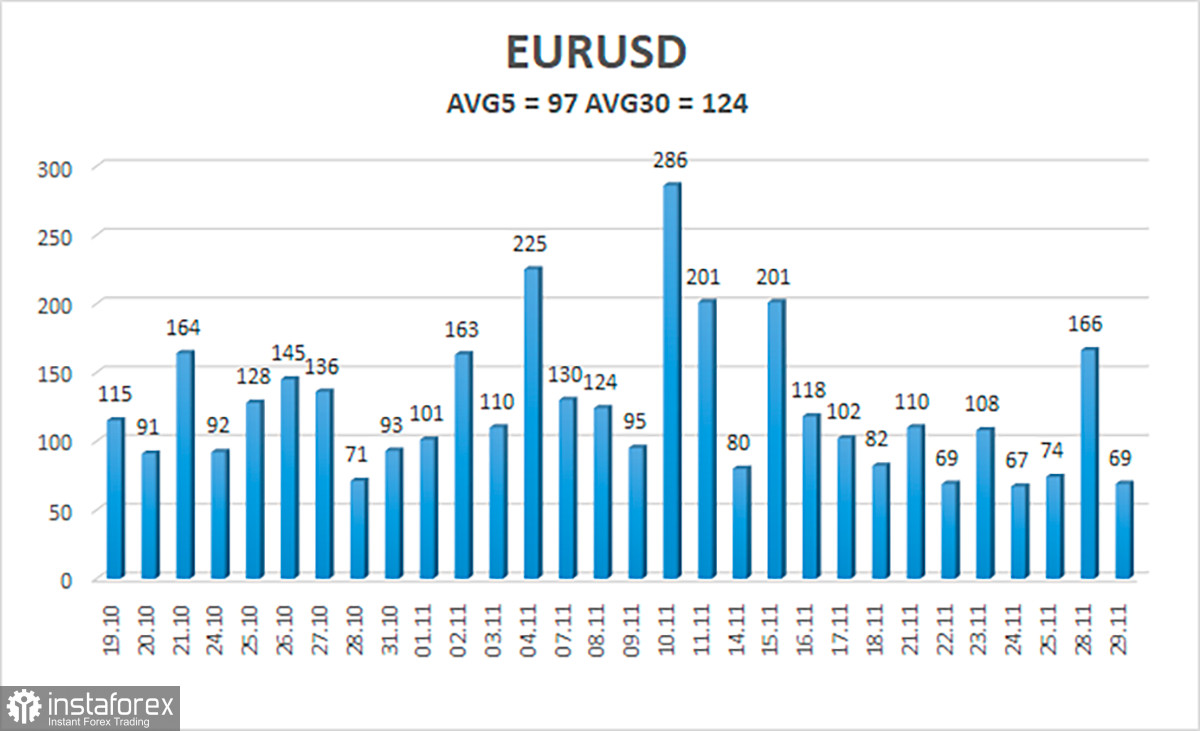

As of November 30, the euro/dollar currency pair's average volatility over the previous five trading days was 97 points, which is considered to be "high." So, on Wednesday, we anticipate the pair to fluctuate between 1.0262 and 1.0454. A potential continuation of the upward movement will be indicated by an upward turn of the Heiken Ashi indicator.

Nearest levels of support

S1 – 1.0254

S2 – 1.0132

S3 – 1.0010

Nearest levels of resistance

R1 – 1.0376

R2 – 1.0498

R3 – 1.0620

Trading Suggestions:

The EUR/USD pair is still positioned close to the moving average. In light of this, we should now consider opening new long positions with targets of 1.0454 and 1.0498 if the Heiken Ashi indicator reverses its trend upward. No earlier than fixing the price below the moving average line with targets of 1.0254 and 1.0132, sales will become significant.

Explanations of the illustrations:

Linear regression channels – help determine the current trend. If both are directed in the same direction, then the trend is strong now.

The moving average line (settings 20.0, smoothed) – determines the short-term trend and the direction in which trading should be conducted now.

Murray levels are target levels for movements and corrections.

Volatility levels (red lines) are the likely price channel in which the pair will spend the next day, based on current volatility indicators.

The CCI indicator – its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română