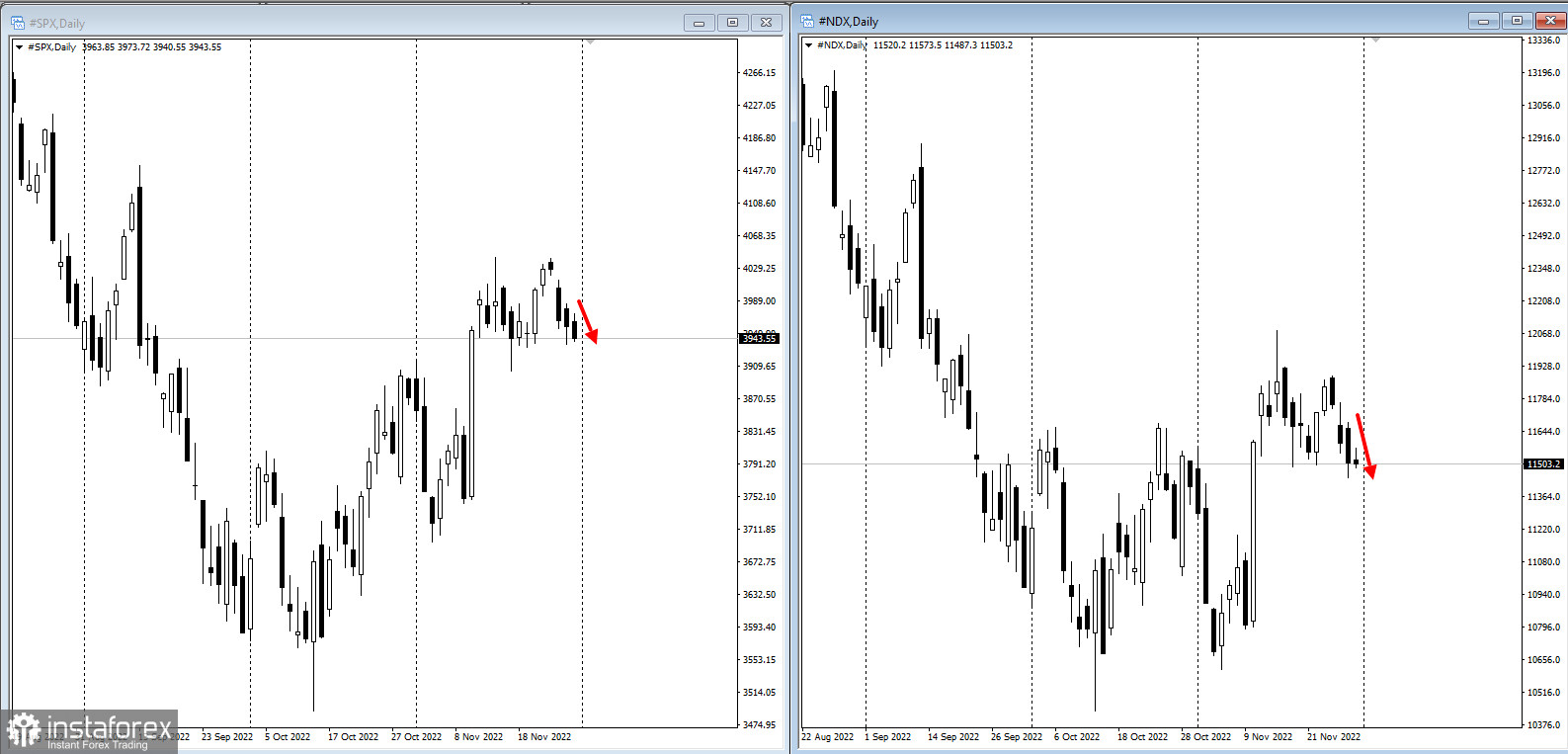

Stock markets saw another downturn as traders considered latest economic data and Fed Chairman Jerome Powell's speech for clues as to whether the central bank will ease the pace of rate hikes to prevent a hard landing.

On the bright side, the S&P 500 is still on track for a monthly gain despite recent losses. This is the longest streak since August 2021.

Bond yields have also risen.

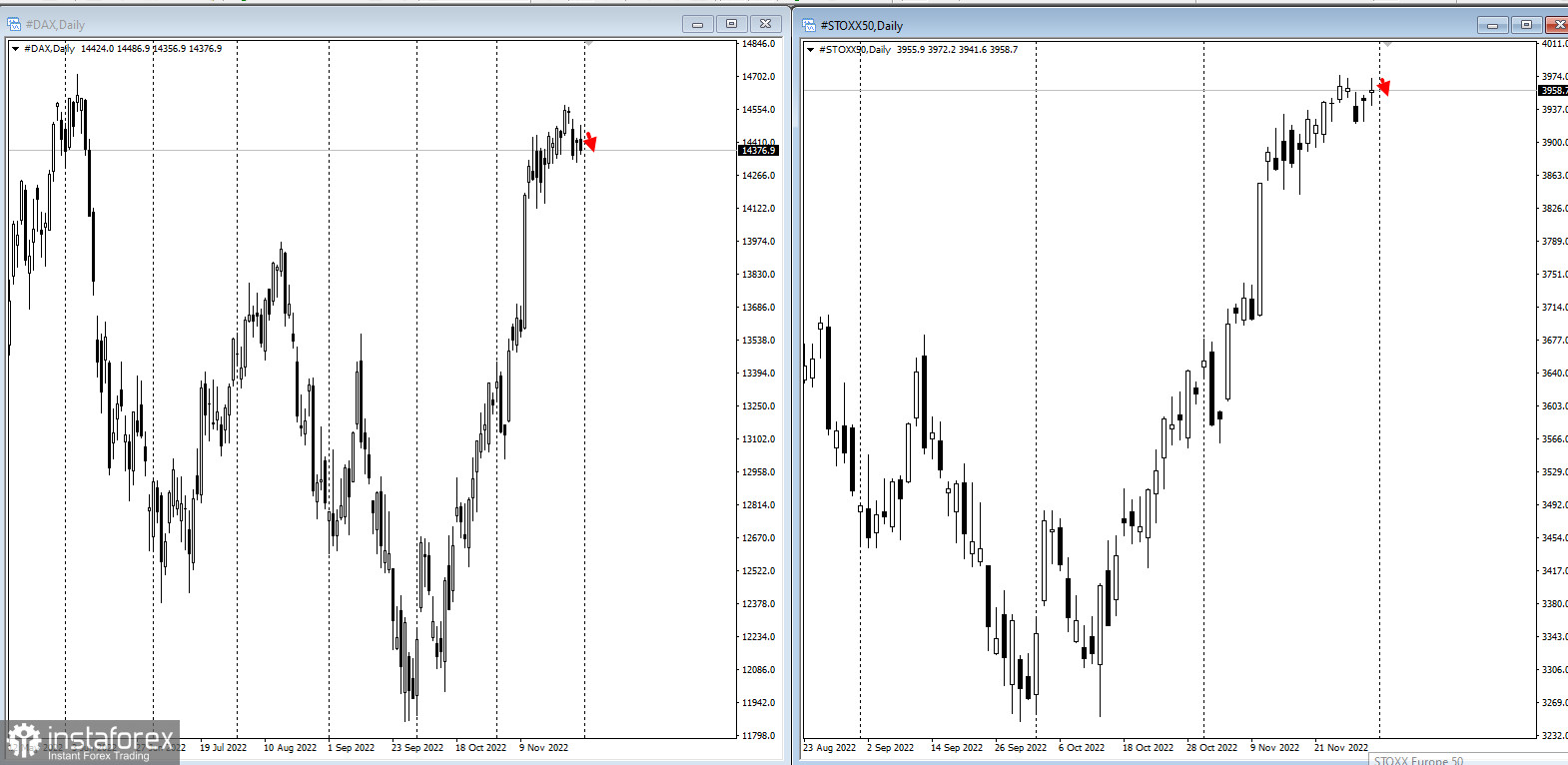

As for European stock indices, they are more confident, thanks to falling inflation in the eurozone.

Powell's speech is expected to stress that the fight against inflation will last until 2023. It may not be an overly hawkish tone, but it will be hawkish nonetheless.

But this does not mean that stock markets will collapse because given the real Fed targets right now, a strong year-end rally is less likely than many think.

A slew of economic data was also released, with key US activity indicators painting a mixed picture in the third quarter. Jobless claims falling in October is an encouraging sign for the Fed as it seeks to curb demand.

Key events this week:

- S&P Global PMI, Thursday

- US construction spending, consumer income, initial jobless claims, ISM Manufacturing, Thursday

- BOJ's Haruhiko Kuroda speech, Thursday

- US unemployment, nonfarm payrolls, Friday

- ECB's Christine Lagarde speech, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română