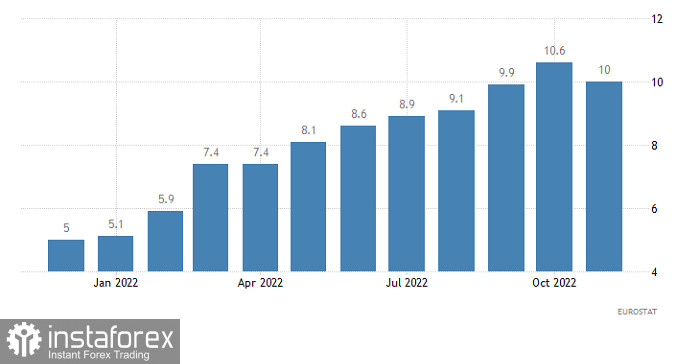

Inflation in Europe hit 10.0% in November, slowing for the first time since June last year. Of course, it is difficult to draw any conclusions from this, but the fact that it fell means that the European Central Bank may consider easing the pace of interest rate hikes next year. This should have prompted euro to weaken in price; however, the recent statement of Fed Chairman Jerome Powell hinted that the Fed may its interest rate by only 50 basis points in December, so dollar demand dipped, resulting in a rise in EUR/USD.

Inflation (Europe):

Most likely, dollar will remain under pressure because the upcoming US labor market data are presumed to be negative. In particular, the number of initial jobless claims is expected to rise by 18,000, while repeated claims should increase by 9,000.

Number of jobless claims (United States)

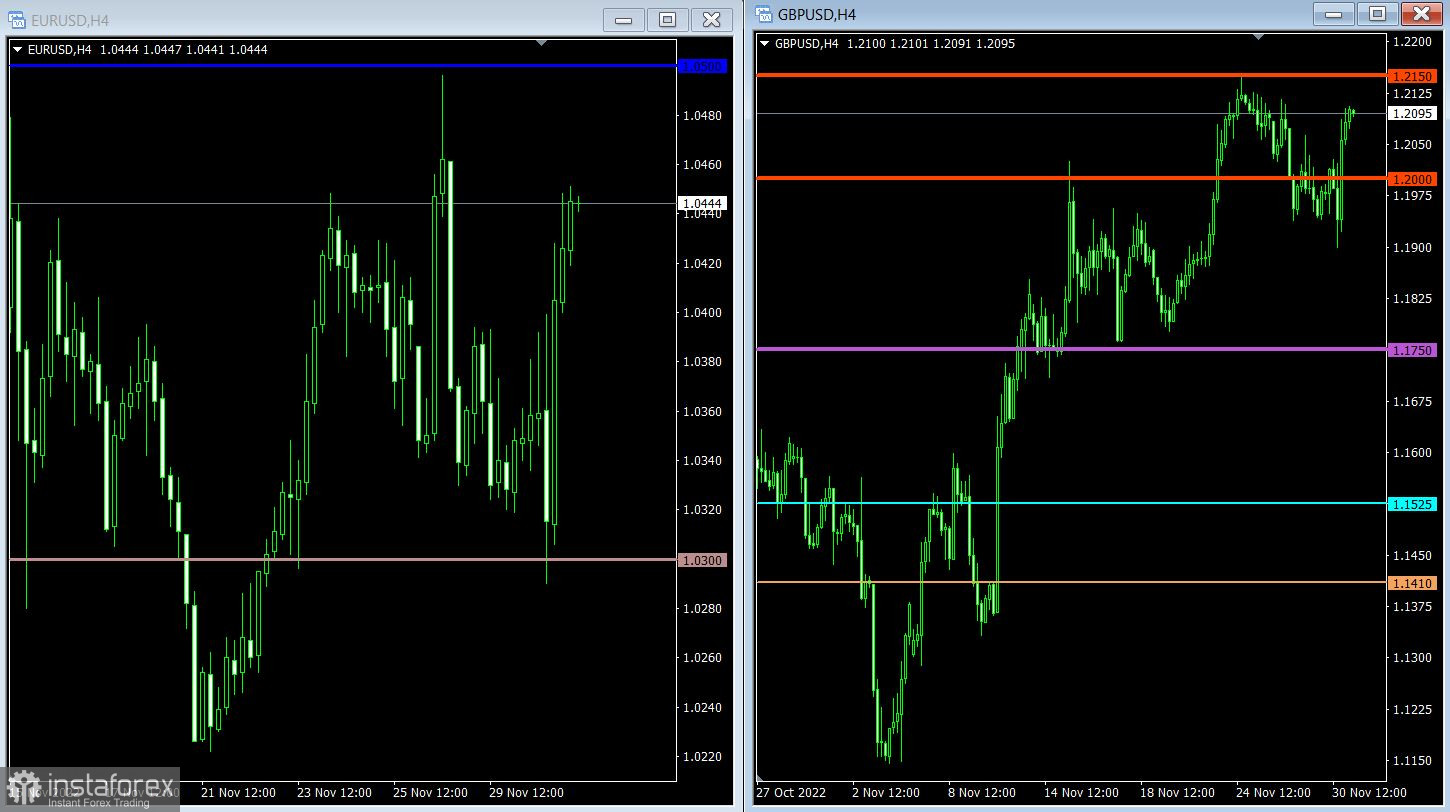

EUR/USD bounced back from the support level of 1.0300 because of the sudden increase in the volume of long positions. But even if the price surged, the pair is still within the range of 1.0300-1.0500, so no drastic changes have been observed so far.

GBP/USD remains the same. 1.1950/1.2000 is still a key support level, while 1.2150, where the pair rebounded last week, is still a strong resistance for speculators.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română