U.S. employers added more jobs than projected and wages rose the most in almost a year, indicating lingering inflationary pressures that raise the likelihood of an interest rate hike by the Federal Reserve. This came as a complete surprise to the dollar bears and caused the dollar to significantly strengthen.

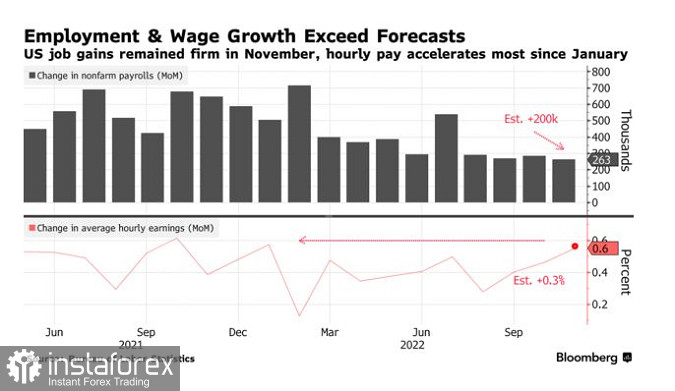

NonFarm Payrolls increased by 263,000 in November, the Bureau of Labor Statistics announced on Friday. Data for October was revised higher to show payrolls rising 284,000 instead of 261,000 as previously reported. About 186,000 people left the labor force, keeping the unemployment rate unchanged at 3.7%. Average hourly earnings rose twice as much as forecast after data for October was revised higher.

Average estimates in the economists' survey called for an increase of 200,000 wages and a jobless rate of 3.7%. U.S. stocks opened lower and Treasury yields rose as investors anticipated a more aggressive stance by the Fed.

"The net read is that the labor market is still far too tight and cooling only very gradually," Mizuho economists Alex Pelle and Steven Ricchiuto said. "It suggests that the economy is resilient and can handle more rate hikes and restrictive policies for longer."

The gains in employment were concentrated in several categories, led by the leisure and hospitality sector, as well as healthcare and social assistance industries. But retail trade employment fell with most of the losses in general merchandise stores. Transportation and warehousing payrolls also decreased, as well as temporary help jobs falling due to downsizing.

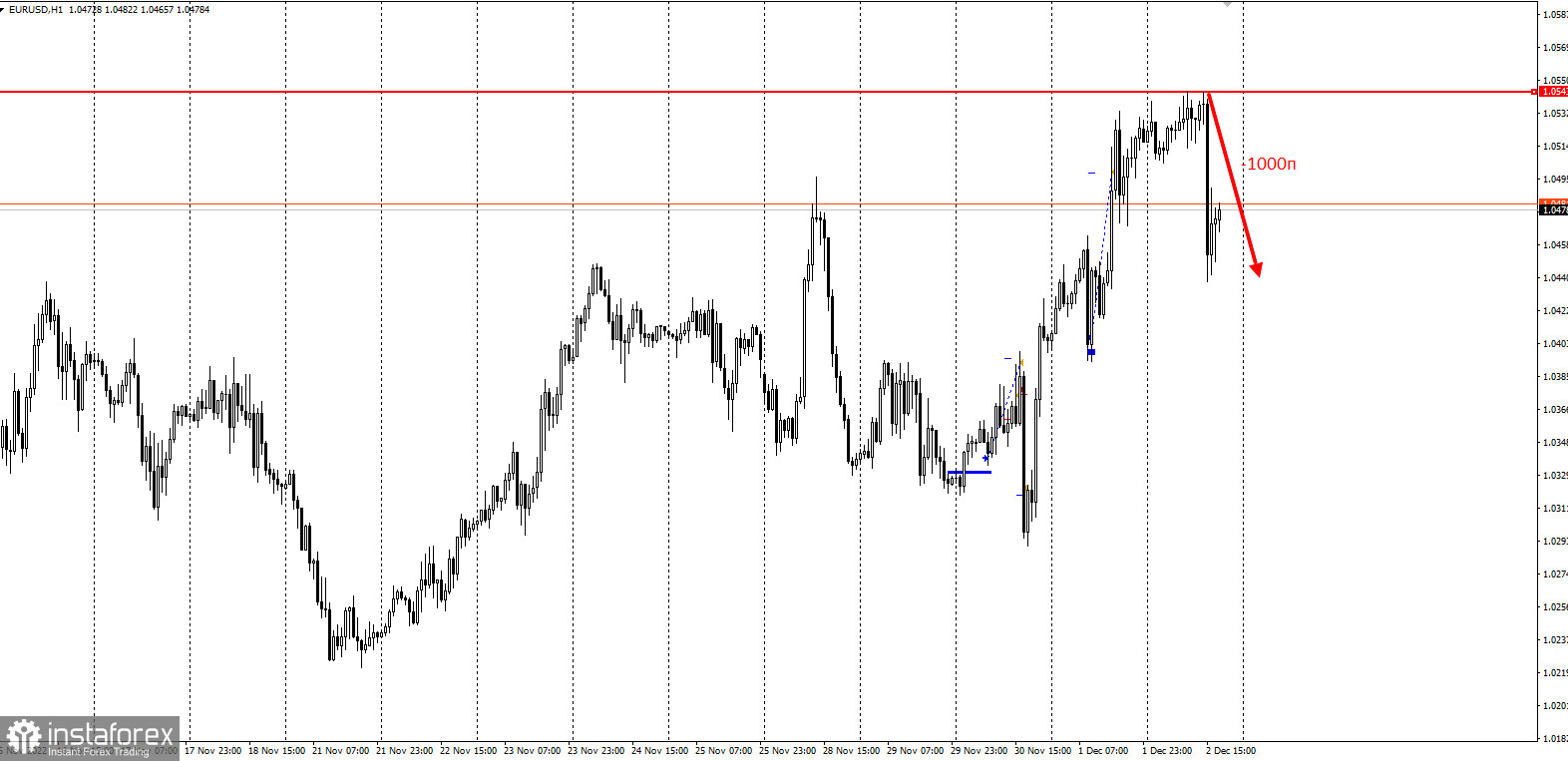

The EURUSD lost 1000 momentarily on this news:

Higher-than-expected wage growth highlights the continued strength of the labor market despite rising interest rates and fears of an impending recession. The persistent mismatch between supply and demand for workers continues to support wage growth and has led many economists to expect businesses to be more hesitant to lay off workers in the event of a potential economic downturn.

Nevertheless, some sectors are beginning to show more visible signs of easing. Many economists expect unemployment to rise next year - in some cases significantly - as tighter Fed policies risk pushing the U.S. into recession.

This is the last employment report that Fed officials will have at their disposal before the December policy meeting, at which the central bank is expected to scale back the pace of its interest rate hikes to a still aggressive half a percent. Inflation data from last month showed that price pressures are slowly easing but remain very elevated.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română