US stocks closed lower on Thursday after two Federal Reserve officials said they were considering raising interest rates by 50 basis points to combat persistently high inflation.

The S&P 500 index and the Nasdaq 100 fell by 1.4% and 1.9%, respectively. The yield on the 10-year US Treasury note climbed above 3.8%, for the first time topping that threshold in 2023.

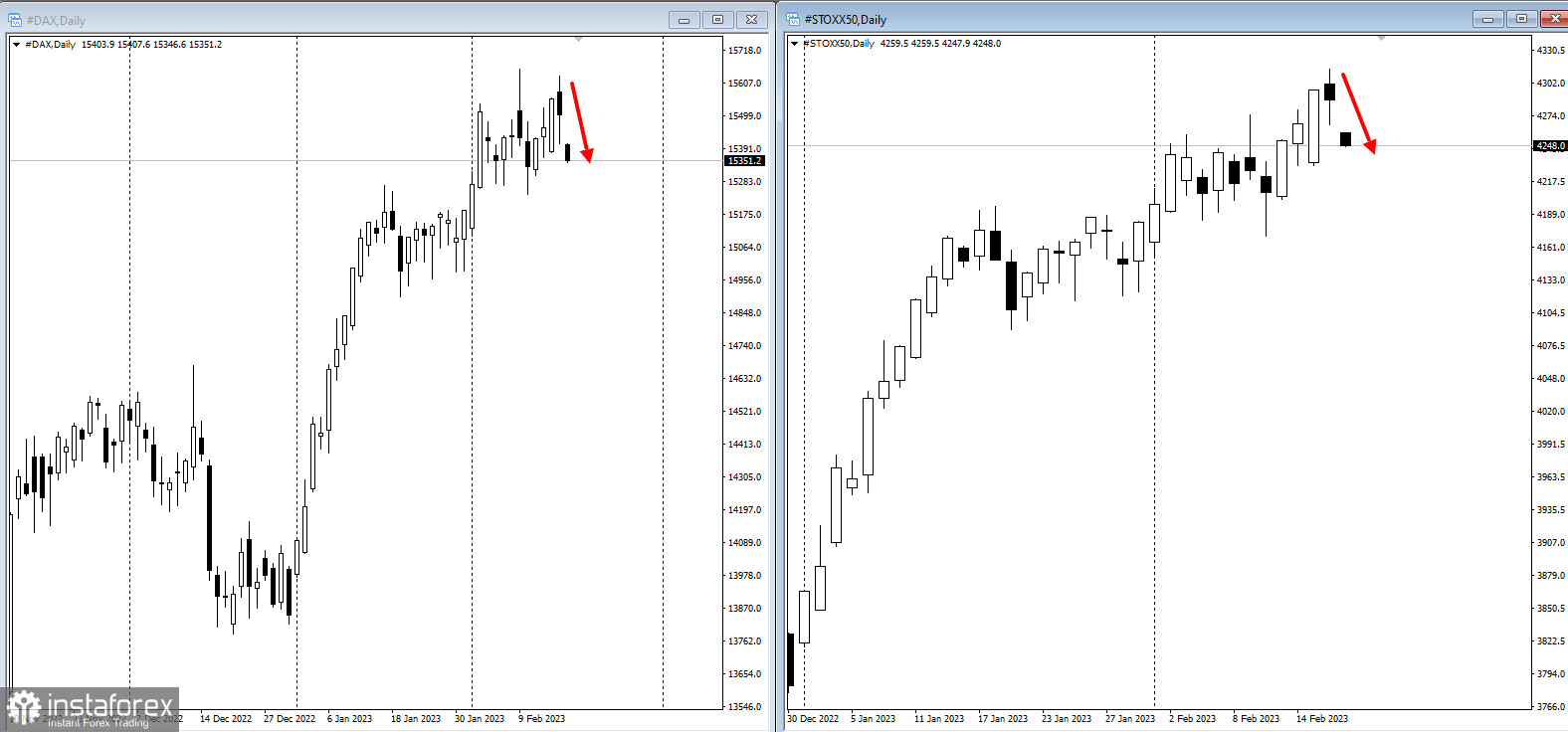

European stock indices also resumed a decline after a month-and-a-half rally:

Cleveland Federal Reserve Bank President Loretta Mester said she sees a "strong economic case" for another 50 basis point hike, and St. Louis Fed President James Bullard noted he would not rule out supporting a half-percentage-point interest-rate increase, rather than the quarter point.

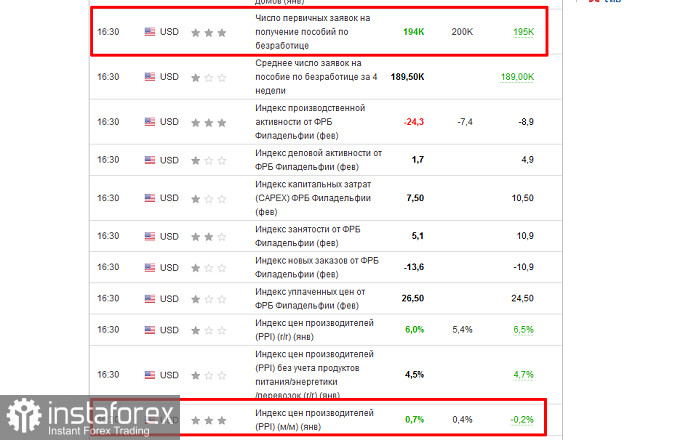

Their warnings came after US producer prices rose in January to the highest level since June. Housing starts fell for the fifth month in a row in January as higher mortgage rates continued to dampen housing demand. Weekly jobless claims dropped to 194,000, below the expected level of 200,000.

Thursday's economic reports provided Fed policymakers planning their rate-hike path with additional information after it was reported on Wednesday that US retail sales jumped the most in almost two years in January.

Investors are increasing their bets on how much the Fed will raise rates in this tightening cycle. Now they expect the federal funds rate to be lifted above 5.2% in July, according to trading in the US financial markets. At the same time, two weeks ago, the markets predicted the rate to peak at 4.9%, while the central bank's current target range is 4.5%-4.75%.

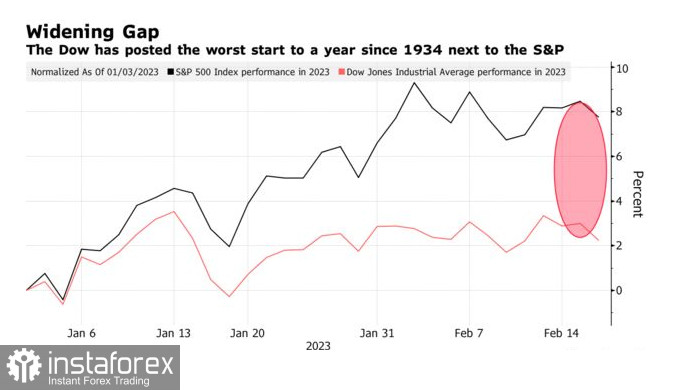

The Dow Jones Industrial Average slid by 1.3%. This year, the index that tracks 30 US blue-chip stocks has been up about 2% compared to a roughly 7% gain in the S&P 500. The 5 percentage-point gap between the two makes the Dow's start to a year the weakest relative to the S&P 500 since 1934, data compiled by Bloomberg showed.

Oil futures fell, as investors weighed the evidence of higher energy demand in China amid a significant increase in US crude oil inventories. Russia's MOEX stock index is in a correction following another collapse:

Key events of this week:

- France CPI, Russia GDP, Friday

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română