Trend analysis

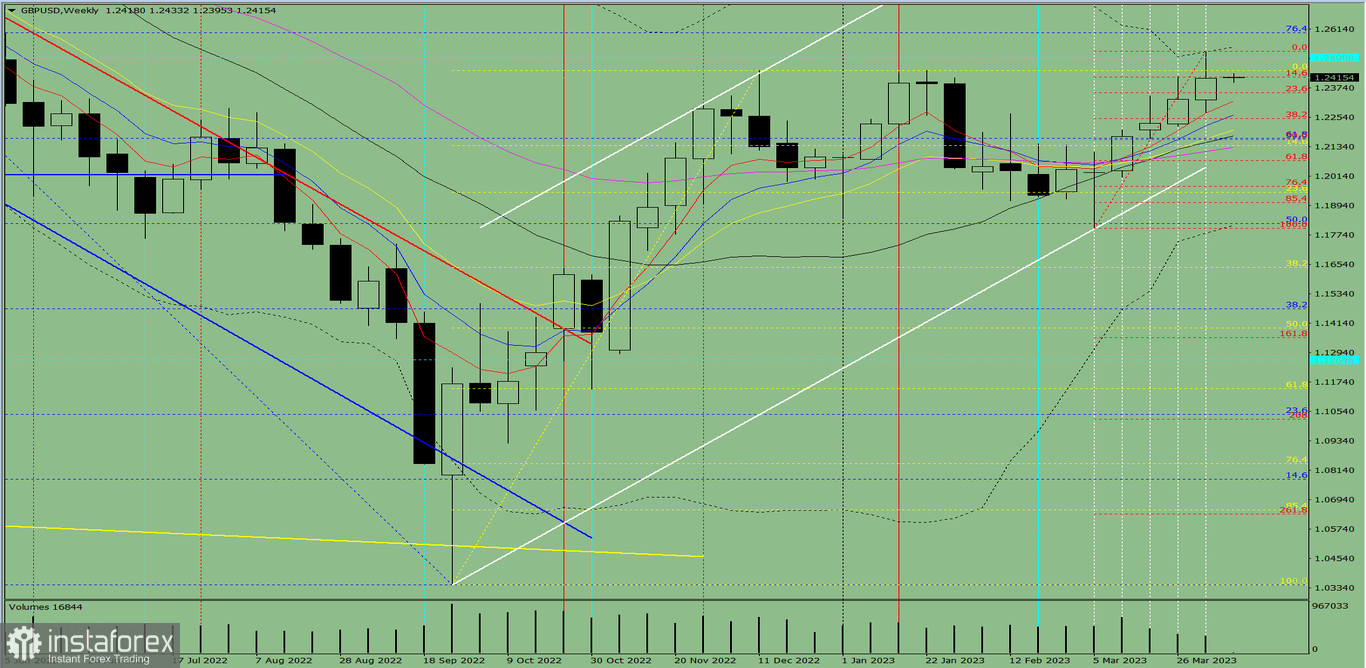

GBP/USD may start moving down this week, starting from the level of 1.2414 (closing of the last weekly candle) to the 1.2351, which is the 23.6% retracement level (red dotted line). Upon reaching this price, the pair will resume an upward movement towards 1.2499, which is the historical resistance level (blue dotted line).

Fig. 1 (weekly chart)

Comprehensive analysis:

Indicator analysis - downward

Fibonacci levels - downward

Volumes - downward

Candlestick analysis - downward

Trend analysis - upward

Bollinger bands - upward

Monthly chart - downward

All these point to a downward movement in GBP/USD.

Conclusion: The pair is likely to have a bearish trend, with no first upper shadow on the weekly black candle (Monday - down) and a second lower shadow (Friday - up).

So during the week, pound may begin falling from the level of 1.2414 (closing of the last weekly candle) to the 23.6% retracement level at 1.2351 (red dotted line), and then rise to the historical resistance level at 1.2499 (blue dotted line).

Alternatively, the quote could move down from 1.2414 (closing of last week's candle) to the 38.2% retracement level at 1.2246 (red dotted line), and then rise to the historical resistance level at 1.2499 (blue dotted line).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română