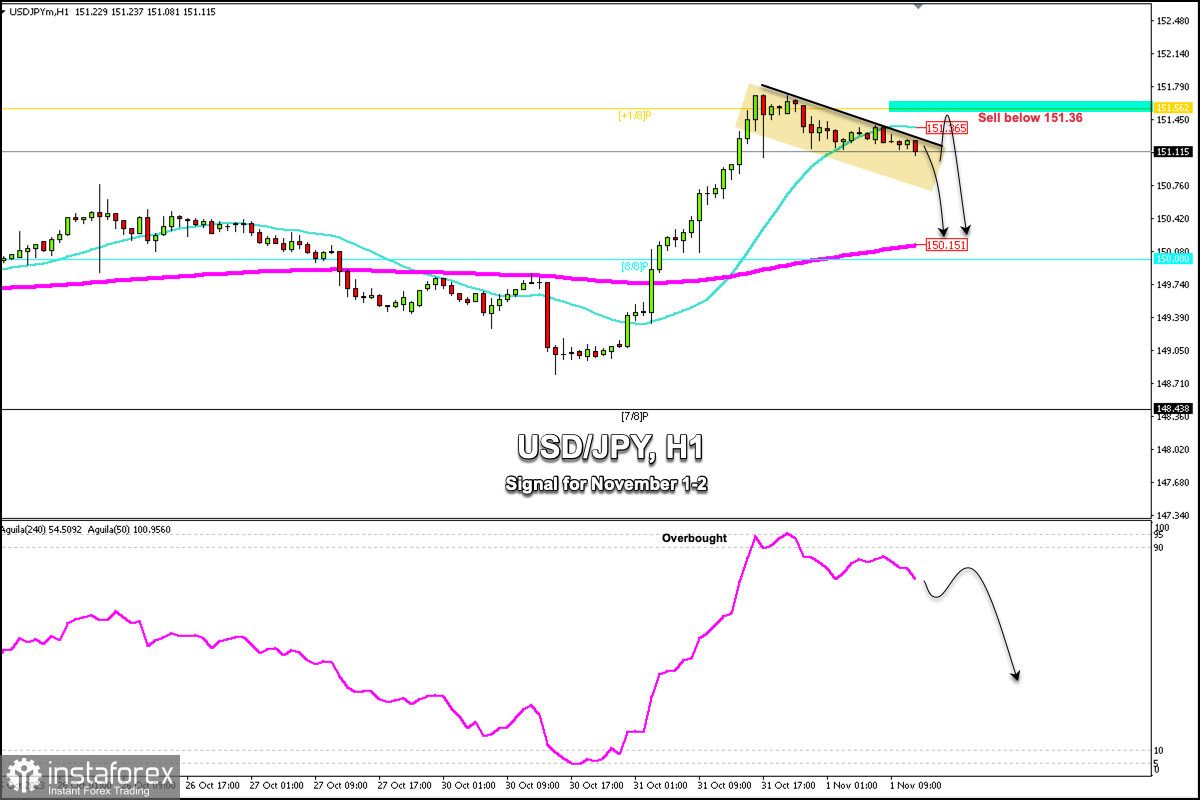

Early in the American session, the Japanese yen (USD/JPY) is trading around 151.15, below the 21 SMA, and below +1/8 Murray. Yesterday during the American session, it reached a high at about 151.70. Since then, we've been watching a technical correction to last for a few days until the price reaches the 200 EMA located at 150.15.

In case the Japanese breaks above 151.56 (+1/8 Murray) and consolidates above this level, this could be a resumption of the bullish cycle and USD/PY could reach +2/8 Murray located at 153.12.

USD/JPY could face resistance near the highs of 151.94 reached in October 2022, which aligns with a psychological level of 152.00. If the Yen reaches this level and fails to break above it, it would be a clear sign of a technical reversal and the instrument could fall to 1.4500 in the medium term.

The eagle indicator is giving an extremely overbought signal, which means that if the Japanese yen trades below 151.50, any technical bounce could be used as an opportunity to sell with targets at 150.15 (200 EMA) and at the psychological level of 150.00.

Today, there will be strong volatility amid the Fed's interest rate decision and the post-meeting statement. The Fed is widely expected to maintain the funds rate at 5.50%. Jerome Powell's press conference could give a clue to investors whether to continue buying the pair USD/JPY or to start a massive sell-off.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română