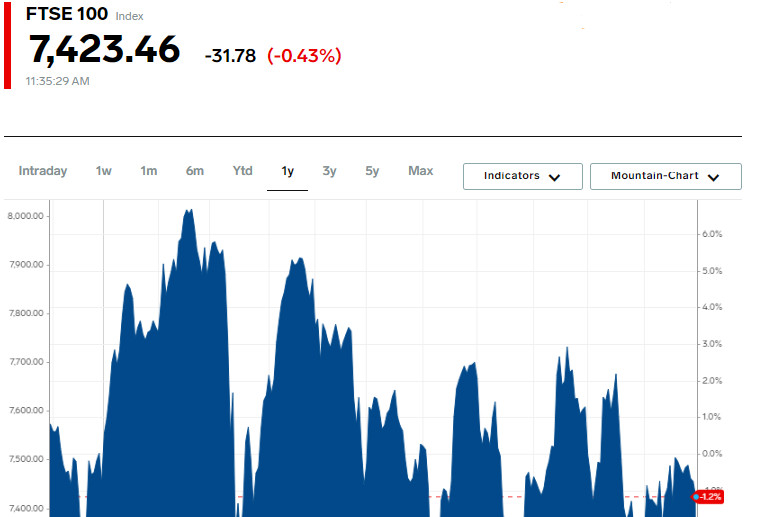

FTSE 100 and FTSE 250: Diverging Trends

The FTSE 100 index, representing the largest companies in the UK, fell by 0.4%. At the same time, the FTSE 250 index, which covers medium-sized companies with a more significant domestic market orientation, showed an increase of 0.4%.

Position of Andrew Bailey, Head of the Bank of England

Andrew Bailey, the head of the Bank of England, made a statement about the bank's readiness to take measures to reduce inflation to the target level of 2%. Bailey emphasized that there is currently insufficient progress in achieving this goal, which has caused concern in the market.

Decline in the Life Insurance Sector

The life insurance sector, including companies such as Aviva and Prudential, showed a decline of 1.7%, being among the least successful on the FTSE 100. Prudential recorded a decrease of 3.5% after Deutsche Bank downgraded its target stock price. Insurance company Aviva also showed a decline of 2.1% following a revision of its stock rating from "buy" to "hold".

Downturn in the Banking Sector

Shares of banking institutions fell by 1.0%, amid shares of Standard Chartered, which showed a decline of 3.3%.

Growth in the Precious Metals Mining Sector

The precious metals mining sector rose by 2.6%, thanks to an increase in gold prices due to expectations of a reduction in interest rates by the US Federal Reserve in the first half of next year. David Morrison, senior market analyst at Trade Nation, speculated that gold could reach the record closing level set in August 2020, at $2070.

Growth in Retail Trade

Shares in retail trade companies (.FTNMX404010) increased by 1.3%, largely due to a 5.7% rise in the shares of JD Sports (JD.L), a company specializing in sports apparel.

This increase followed positive forecasts from Foot Locker (FL.N), an American footwear retailer, which predicted annual profits above market expectations.

Rise of Spirent Communications

Spirent Communications (SPT.L) showed an impressive rise of 5.9% and took leading positions in the mid-cap index.

This growth is associated with the company, which provides IT and network services, signing a deal with a financial organization to automate laboratory and testing capabilities.

Success of Pets at Home Group

Shares of Pets at Home Group (PETSP.L) rose by 5.1%, attributed to the anticipated increase in retail sales in the lead-up to Christmas.

Growth in Rate-Sensitive Sectors

Shares in the real estate (.FTUB3510), real estate investment trusts (.FTNMX351020), and house building sectors (.FTNMX402020) rose by more than 1.2% each, demonstrating their resilience to rising interest rates.

Housing Market Forecasts

An analytical survey suggests that UK housing prices will fall in 2024 after decreasing by 4% this year. This is linked to expectations that the Bank of England will continue to maintain high-interest rates.

Dynamics of the British Pound

The British pound strengthened, reaching a three-month high against the dollar, which in turn weakened in anticipation of a possible reduction in Federal Reserve interest rates next year.

Decline in Halfords Group Shares

Shares of Halfords Group plummeted by 19.6% after the company, which specializes in the sale of parts and accessories, revised its annual financial forecast, lowering its upper limit.

This dynamic situation in the UK stock market demonstrates the influence of macroeconomic factors, such as interest rates and market forecasts, on the prospects of individual companies and sectors. While some sectors face challenges, others find opportunities for growth, highlighting the complexity and variability of market conditions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română