The European Central Bank (ECB) is creating short-term risks for the advancing euro, raising concerns about a possible sell-off if there is a dovish shift at the meeting in Frankfurt next week.

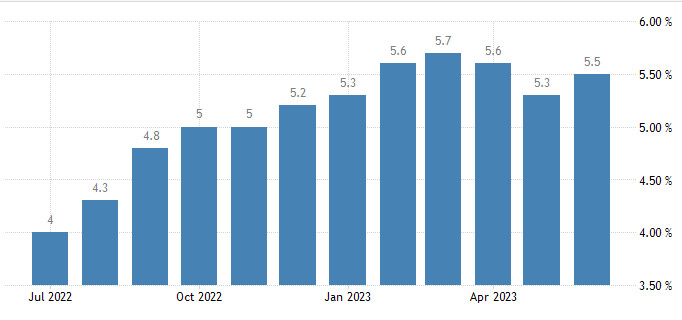

The ECB is on the verge of raising interest rates by 25 basis points as it battles inflation that exceeds its 2% target. Market prices indicate that another rate hike is expected in September.

However, Commerzbank's analysis warns that these expectations may not materialize.

This warning comes amid a sharp recovery of EUR/GBP, with the pair rising to 0.8660 from 0.8505 over the week amid ongoing support for the eurozone currency while the pound weakens further.

Focus on euro

The euro is currently the third highest-yielding major currency of 2023, thanks to improved economic prospects related to falling gas prices and a steady increase in ECB interest rates.

Currencies generally follow market expectations regarding future rate hikes, strengthening as these expectations rise and weakening when expectations change. For example, lower expectations of a rate hike have sent the pound sterling downwards this week.

The question for the euro is whether it will face a similar recovery, especially given the growing signs of deflationary global dynamics, as highlighted by the drop in inflation in the UK in June.

ECB Governing Council members are monitoring the global economic situation, and this week seems to have confirmed market expectations that the July rate hike by the ECB could be the last move of the cycle.

One of the most hawkish members of the ECB's board, Klaas Knot, said this week that it appears the core inflation in the eurozone has plateaued, and that he expected inflation to return to the target rate of 2% in 2024.

"From July onward, I think we have to carefully watch what the data tells us on the distribution of risks surrounding the baseline," Knot noted in an interview with Bloomberg TV.

What bankers and strategists think

The head of the Bundesbank, Joachim Nagel, stated that the rate hike at the September meeting now depends entirely on incoming data. This means the ECB is no longer following a predetermined path of rate increases.

It seems that the September move could be called into question.

Strategists at Convera noted that making any decision on interest rates one or two months in advance could not be justified. Therefore, European policymakers have recently softened their tone, leaving the decision in September open and subject to incoming data

Core inflation will follow overall inflation, though with a delay. The overall inflation rate will return to the 2% target.

Currency strategists at Commerzbank believe that if the market concludes that a rate hike in September is ruled out, the euro could temporarily face significant devaluation pressure.

Barclays's strategists stated in their latest weekly note that they saw no basis for further strengthening of the euro from current levels.

This conclusion was reached after EUR/USD broke out of the six-month range between 1.0800 and 1.1000 last week and reached a high of 1.1275.

From a technical point of view, EUR/USD appears to be one of the most overbought pairs at the moment.

Bank economists believe that higher prices in the eurozone are still necessary for more sustainable euro growth.

Meanwhile, analysts at ING Bank report that their short-term fair value financial model implies a 3% increase for EUR/USD due to the recent rally of the pair.

On the other hand, UBS declared this week that they maintained a constructive position on the euro, even though they have decided to keep their September target unchanged at 1.1200. Limited growth is expected from this point for the rest of the summer.

UBS believes there is no need to change their forecasts. By December, they expect the pair to reach 1.1400, 1.1600 by March, and 1.1800 by the middle of next year.

Technical analysis by City

According to the latest technical analysis from City Index, EUR/USD may decline in the near term before continuing its overall upward trend.

The recently observed narrow range indicates short-term overbought conditions, which may lead to some weakness. It is possible that EUR/USD may decline below the 1.1200 level.

Nevertheless, the long-term forecast for EUR/USD remains bullish. The explosive breakout last week supports the bullish trend, and bulls are likely to control price movements in the near future.

An upsurge is expected towards 1.1220, where the pair may encounter some resistance. Then the upward movement will continue towards 1.1380 before EUR/USD possibly reaches a temporary or long-term peak.

From a support perspective, holding onto 1.1140 is very important, as it is a critical level for EUR/USD in the short term. If this level is breached, the next support level will be the April high at 1.1095. From there, further growth towards a more significant support level around 1.1000 will be possible.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română