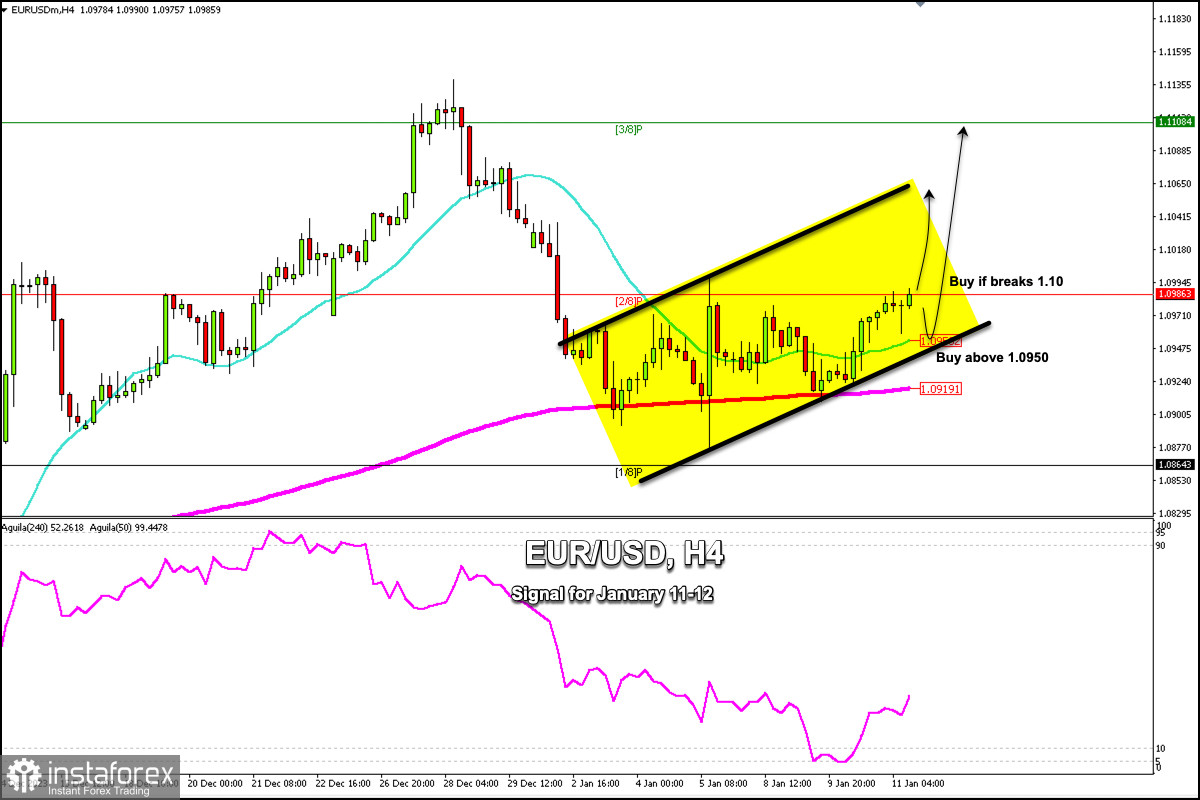

Early in the American session, the EUR/USD pair is trading around 1.0985, just testing the strong resistance of 2/8 Murray and approaching the psychological level of 1.10.

Investors are faced with the uncertainty of the data that will be published in the United States regarding inflation. A higher CPI above 3.2% could favor the dollar, so the Euro could fall towards the 21 SMA located at 1.0950 and could even reach the 200 EMA (1.0919) and break the bullish trend channel formed since the beginning of January.

On the contrary, if the euro manages to consolidate above the psychological level of 1.10 and above 2/8 Murray, it is expected to continue rising and could reach the top of the bullish trend channel around 1.1065 and could even reach 3/8 Murray around 1.1108.

The eagle indicator has been giving a positive signal since January 8, but the euro is facing strong resistance at 1.10. Therefore, any decline as long as EUR/USD trades above 1.0900 will be seen as an opportunity to buy.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română