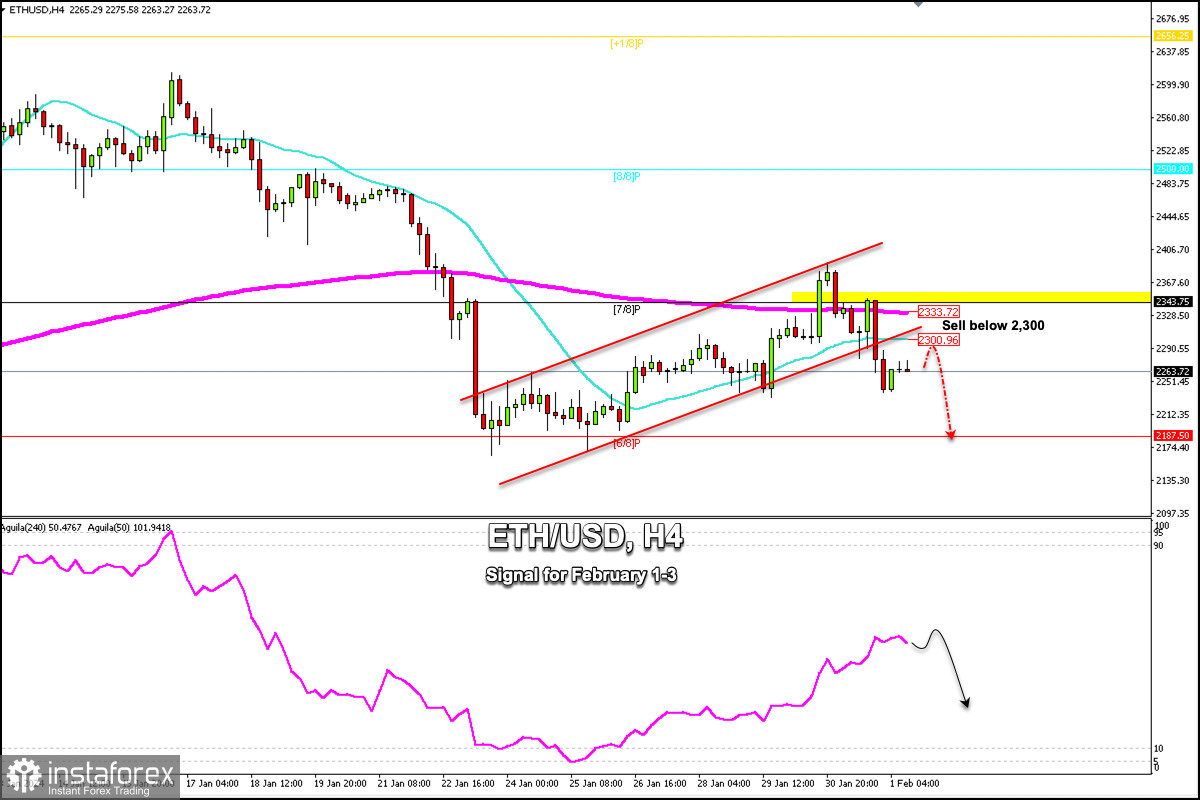

Early in the American session, ETH/USD is trading around 2263.72, below the 200 EMA, and below the 21 SMA. We can see that Ether sharply broke the bullish trend channel formed since January 24 and is now consolidating below 7/8 Murray. It is likely that ETH could continue its fall in the coming days and could reach 6/8 Murray at 2,187. If bearish pressure prevails, ETH could reach the psychological level of $2,000.

In case Ether tries to return above 2,333, the price could face strong resistance because the 200 EMA is located there which acts as a solid barrier. Below there, the token could come under strong downward pressure that will be seen as an opportunity to sell.

A daily consolidation above 2,350 could favor the recovery of ETH/USD and it could reach 8/8 Murray around the psychological level of 2,500.

The outlook remains negative for Ether as long as it trades below 2,343. Any technical bounce towards this area will be seen as an opportunity to sell. Technically, the eagle indicator is giving a negative signal and a drop in ETH/USD will likely occur in the coming days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română