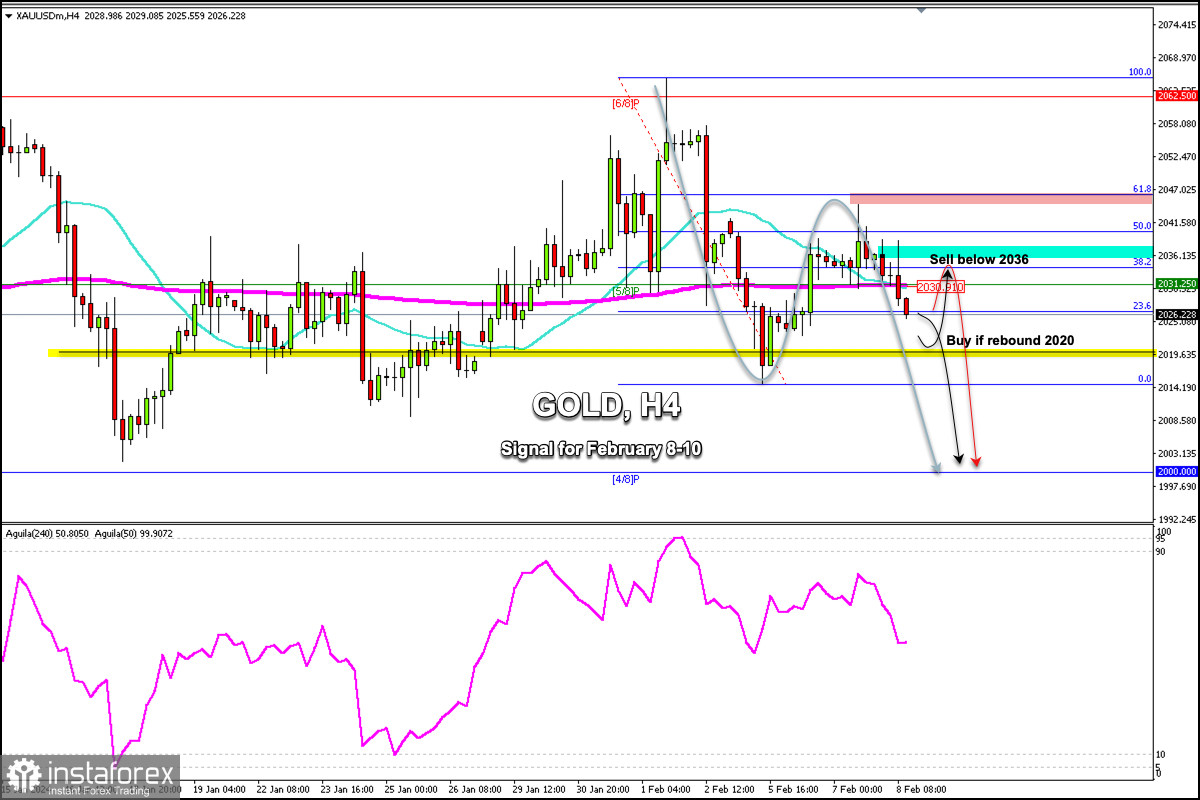

Gold is trading around 2,026.22 with a sharp drop below the 21 SMA and 200 EMA. Both moving averages are located at the same level of 2,030. This strong technical correction in gold could mean that a strong bearish acceleration could occur in the next few days, but first, the instrument should face the support located at 2,020.

In case gold bounces around 2,020, it could offer an opportunity to buy and its price could reach 2,030 and 2,037. These levels have now become strong resistance. Below this level, the bearish cycle is likely to resume and gold could reach 4/8 Murray around $2,000 in the next few days.

If gold continues to fall in the next hours, we should wait for the 2,020 area to buy only in case the metal trades above this zone. Then, we anticipate a technical rebound with targets at 2,030 and 2036 (daily pivot point).

On the other hand, in case gold breaks below the 2,019 low, a bearish acceleration could occur and the price could reach the February 5 low around 2,015 and even $2,000.

Plotting the Fibonacci indicator, we observe that the gold retraced to 61.8% at 2,045 and from there resumed its fall, which indicates that the XAU could continue its slide in the next few days.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română