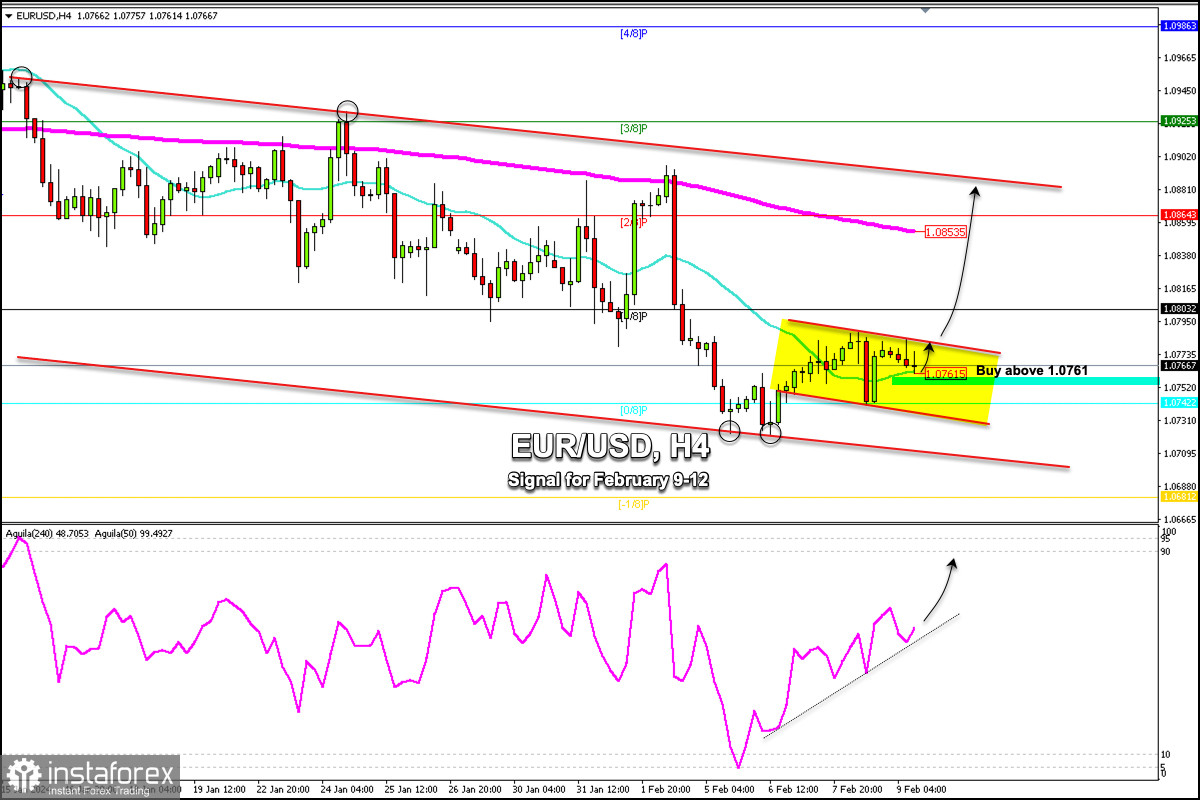

Early in the American session, the Euro is trading around 1.0766, above the 21 SMA, and within a secondary downtrend channel formed on the H4 chart. The Euro could be consolidating in the coming hours if it trades above 0/8 Murray around 1.0742.

There is a strong probability that EUR/USD will continue to bounce and could reach 1/8 Murray at 1.0803. Above this zone, the instrument could continue rising until it reaches the top of the downtrend channel around 1.0885.

In case the euro falls below 1.0761, it is likely that the next support of 0/8 Murray could offer a bottom and could allow the EUR to recover. From that level, we could buy. This support is the last support the euro has. As long as EUR/USD trades above this area, the outlook could continue to be positive.

With a sharp break of the secondary bearish channel as long as the euro trades above 1.0775, we could buy with targets at 1.0803, 200 EMA located at 1.0853, 1.0864 and finally, at 1.0890.

In case the euro falls below 1.0740, we should avoid buying or should take part of our losses and exit our strategy because the euro could continue its bearish cycle and reach -1/8 Murray at 1.0681.

Our trading plan for the next hours is to buy the euro above 1.0761 or above 1.0742 in case of a technical rebound with the target at 1.0853 (200 EMA).

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română