Traders are showing a renewed appetite for the euro at the start of this week. However, it is essential to remain cautious. The trend remains bearish, and the eurozone calendar remains almost empty. The US dollar is under the spotlight this week. Meanwhile, some predict another US dollar rally.

What to expect from EUR/USD this week?

The euro will likely face pressure against the greenback in the coming weeks, especially after dipping below a critical level last week. With no new data from the eurozone, the Fed's upcoming rate decision might not add to this pressure and could even boost the pair's quotes. Everything hinges on the message from the US regulator.

The following trading sessions will be tense. The direction for the EUR/USD pair remains unclear, even if some think otherwise. As we know, markets can quickly shift their sentiment.

Following the European Central Bank's (ECB) recent decision on interest rates, the euro began to decline. The decision confirmed rates would remain steady for the foreseeable future, signaling a pause in rate hikes.

The euro hovered near 1.0675, the lowest level since March 2023.

There were initial attempts for a euro rally after the ECB decided to hike rates by 25 basis points, peaking at 1.0729, but these efforts did not bear fruit. This could lead to a test of this year's range between 1.0500 and 1.1000.

Markets expect the ECB to tighten its policy by approximately 11 basis points and cut by 25 basis points in July 2024. This could pressure the euro, especially if followed by a soft review.

The current instability of the EUR/USD pair suggests a stronger dollar position, especially after falling below the 200-day moving average on the daily chart.

Analysts at Societe Generale say that this looks ominous.

Upcoming economic data is anticipated to show a slowdown, implying a downturn in the eurozone due to high interest rates. This economic slowdown will work against the euro.

The euro might remain at risk until economic growth in the eurozone starts to rebound.

The only silver lining for the euro or British pound, in a context where growth forecasts drive currency trajectories, is that growth expectations for the UK and eurozone are already bleaker than in the US.

This should help prevent a dramatic drop in the EUR/USD or GBP/USD pairs, but the pound could still reach 1.2000 and the euro could fall below 1.0500 if we do not see any positive economic news in the near future.

Euro Technical Analysis

The EUR/USD pair is bracing for a rebound from the multi week low of 1.0630 that was recorded on Friday.

If the pair breaks the 15 September low of 1.0631, the next targets will be the 15 March low of 1.0516 and then the 6 January 2023 low of 1.0481.

If the pair breaks through the level of 1.0827 (200-day simple moving average), it could encourage a bullish move to 1.0922 and then the August 30 high of 1.0945.

A break above this level could facilitate a test of the psychological level of 1.1000 and the August 10 peak at 1.1064.

Fed meeting

The US central bank is preparing to release its latest decisions and recommendations, which may cause volatility for the US dollar. However, many experts believe that major changes in the Fed's monetary policy are unlikely.

Highlights include

Rate Forecasts: Many economists expect the Fed to keep rates at 5.25-5.50%.

Fed Dot Plot. This chart will show how FOMC members see future interest rate movements. Most members will likely indicate that the current rate level will remain unchanged through the end of 2023.

Risks for the US dollar. If the dot plot shows that some Fed members are considering a rate cut in 2024, it could put pressure on the dollar.

Fed Summer Indicators. Two CPI inflation reports are expected to be close to consensus. These data, along with other economic indicators, will confirm that the current level of interest rates is likely adequate to stabilize inflation.

Based on these projections and analysis, the Fed's decisions may confirm the current trend in monetary policy and, as a result, the resilience of the dollar in global markets.

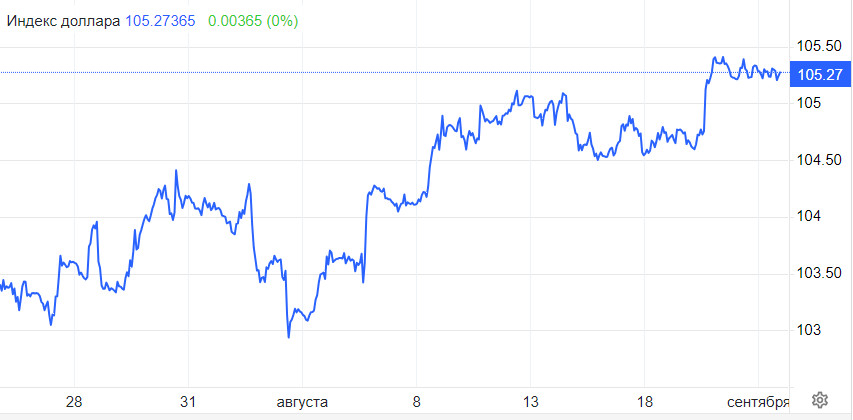

US Dollar Technical Analysis

The US dollar index is near its 2023 high of 105.88. Short-term support and resistance levels are located at 104.44 and 105.88 respectively. The long term support level is marked at 103.04.

Bullish Scenario. If the DXY closes above 105.88 during the week, it could signal further dollar strength in the medium term.

Bearish Scenario. If the index reverses and breaches the level of 104.44, it could signal a significant decline to 103.04.

Economic Outlook. Despite the current difficulties, the US dollar continues to attract investors due to high interest rates, especially compared to the economic situation in Europe and elsewhere.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română