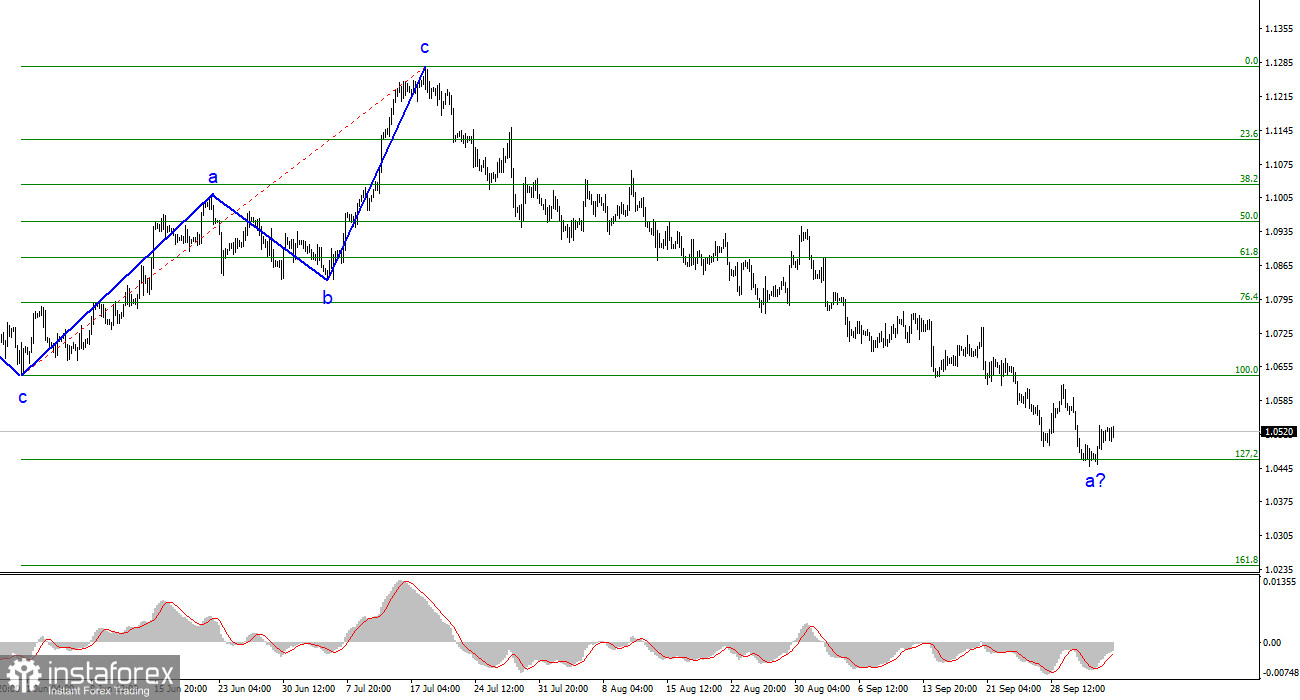

The wave analysis of the 4-hour chart for the euro/dollar pair remains quite clear. Over the past year, we have only seen three-wave structures that constantly alternate with each other. Over the past few months, I have regularly mentioned that I expect the pair to approach the 5th figure, from where the construction of the last upward three-wave movement began. This target was achieved after a two-month decline. The assumed first wave of the new downtrend segment may continue its formation, although there are currently some signs of its completion.

None of the recent price increases resembled a full-fledged wave 2 or b. Therefore, all of these were internal corrective waves in 1 or a. If this is indeed the case, the decline in quotes may continue for some time during this wave. This does not mean the end of the overall decline of the European currency, as the construction of the third wave is still required. Within the first wave, five internal waves are already visible, so its completion is approaching. An unsuccessful attempt to break through the 1.0463 level, which is equivalent to 127.2% according to Fibonacci, indicates the market's readiness to start building a correctional wave.

The euro/dollar pair's exchange rate increased by 20 basis points on Thursday. Demand for the euro continues to rise for the second day in a row, but it is rising very slightly. Based on this, I cannot be sure that the construction of the first wave of the new downtrend segment is complete. An unsuccessful attempt to break the 127.2% Fibonacci level allows for this scenario, but I would like to remind you that the first attempt to break the 100.0% Fibonacci level was also unsuccessful. The euro currency currently lacks the most crucial thing: market support. And there is no market support because the news background is either weak or does not allow the euro to rise significantly. Today, the news background was absent altogether, but, as usual, members of the ECB Governing Council were speaking.

Peter Kazimir put an end to the entire central bank's rate hike question today. "I believe that the September tightening was the last," he said. With this statement, he not only made it clear that other bank managers hold the same opinion but also that he himself will not vote for a rate hike at the next meetings. And how can market demand for the euro increase with such an informational background? After all, at the same time, FOMC members are hinting at a new tightening in November. And the Fed's rate is much higher than the ECB's rate. In general, there are fewer reasons to increase demand for the dollar.

General conclusions:

Based on the analysis conducted, I conclude that the construction of a downtrend set of waves continues. The targets around 1.0500–1.0600 have been ideally worked out, but the decline may continue for some time. Since the attempt to break through the 1.0463 level is currently unsuccessful, I would advise not to rush into new sales but to gradually get rid of old ones. The likelihood of the start of an upward wave is high. If the 1.0463 level is breached, selling the euro currency will be possible with targets around the 1.0242 level, which corresponds to 161.8% according to Fibonacci.

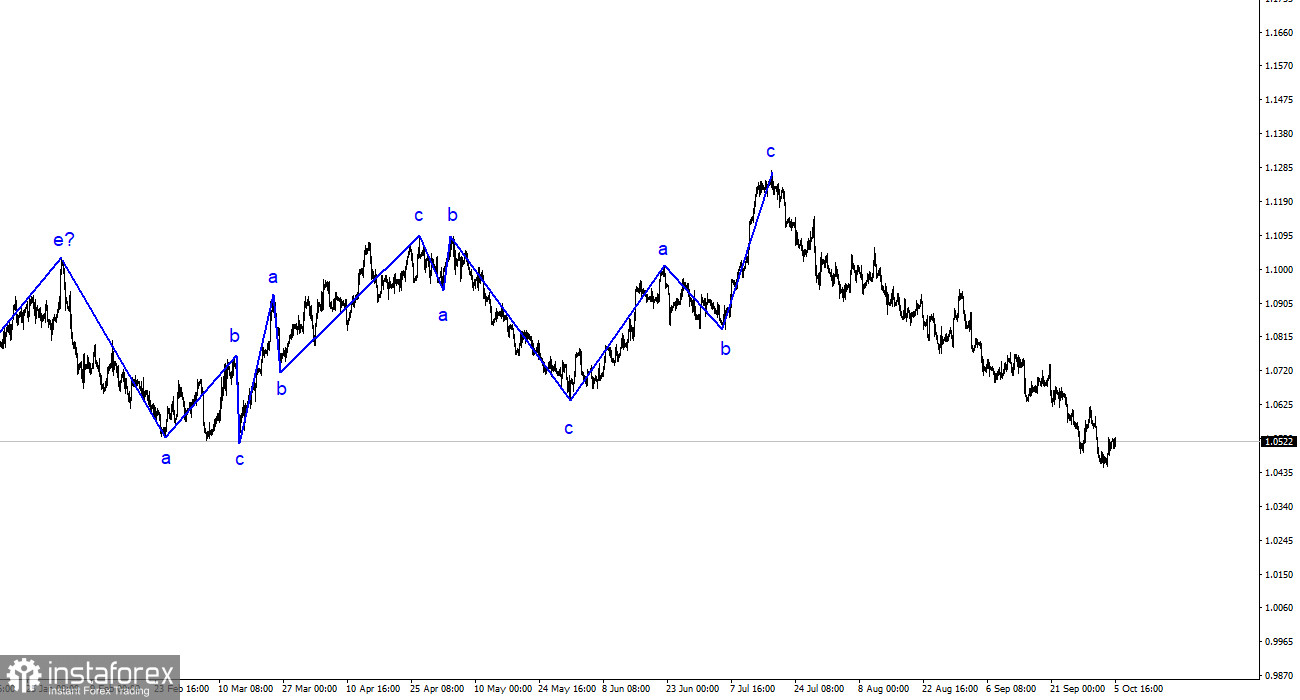

On a larger wave scale, the wave analysis of the ascending trend segment has taken on an elongated form but is likely to be completed. We have seen five upward waves, which are most likely a structure of a-b-c-d-e. The pair then built four three-wave movements: two down and two up. Currently, it has likely entered the stage of building another extended downward three-wave structure.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română