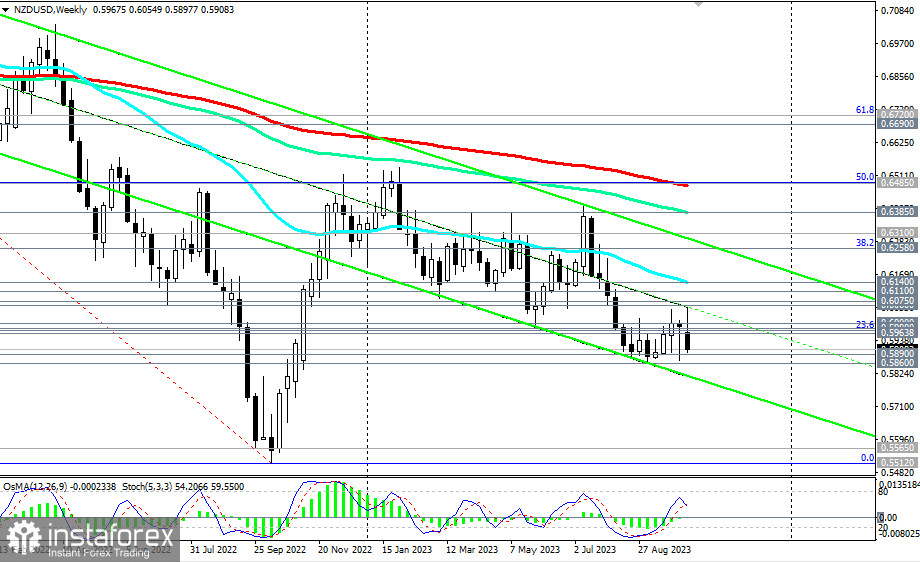

NZD/USD is trading in a bearish market zone: medium-term—below resistance levels at 0.6140 (50 EMA on the weekly chart), 0.6110 (200 EMA on the daily chart), long-term—below resistance levels at 0.6400, 0.6485 (200 EMA on the weekly chart and 50% Fibonacci level in the downward wave from 0.7465 in February 2021 to the level of 0.5510 reached in October 2022). In the primary scenario, we expect a resumption of the decline.

A break below local support levels at 0.5890 and 0.5860 may trigger further declines.

The downside targets are the lows from March 2020 near the levels of 0.5600 and 0.5520.

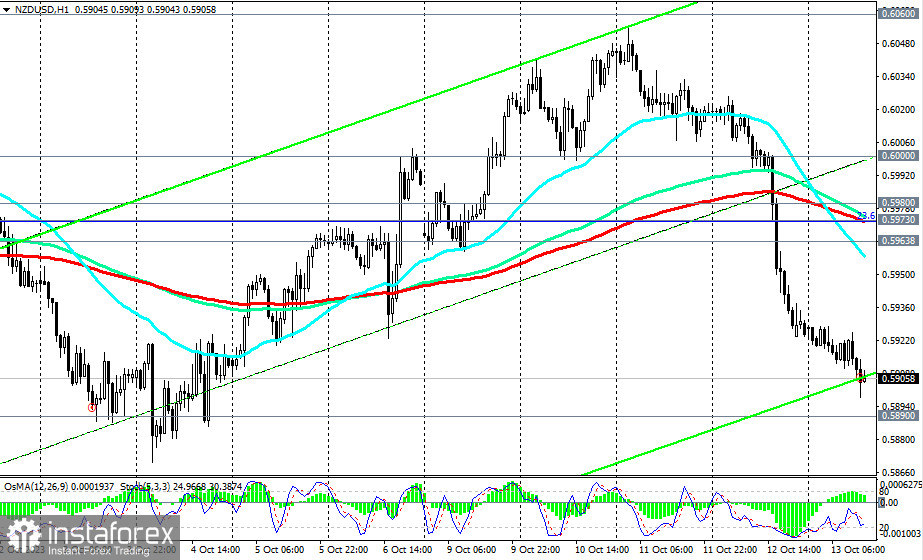

In an alternative scenario, the first signal for a resumption of long positions could be a breakout of today's high at 0.5928, with confirmation being a breakout of the important resistance level at 0.5973 (200 EMA on the 1-hour chart and 23.6% Fibonacci level), with the prospect of rising to the local resistance level and the upper boundary of the upward channel on the daily chart at 0.6060.

However, only a break of the key resistance level at 0.6140 will take the pair into the medium-term bullish market zone.

Short positions remain preferable.

Support Levels:0.5900, 0.5890, 0.5860, 0.5800, 0.5700, 0.5600, 0.5565, 0.5510

Resistance levels: 0.5928, 0.5964, 0.5973, 0.5980, 0.6000, 0.6060, 0.6075, 0.6100, 0.6110, 0.6140, 0.6200, 0.6258, 0.6310, 0.6385, 0.64 00, 0.6485, 0.6500, 0.6510

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română