The European Stoxx 600 index leaped by 1.1%, poised for a nearly 3% gain this week. Gap Inc. shares surged by 17% in pre-market trading following a third-quarter profit report that exceeded expectations. European bonds rallied, driving yields down as traders now expect the European Central Bank to cut rates by a full percentage point next year.

This week, soft inflation data and US employment figures have reinforced hopes that the aggressive policy tightening cycles by the Federal Reserve and other central banks are finally winding down. According to Bank of America Corp., this sentiment has drawn $23.5 billion into the stock market, marking the second-largest inflow this year. However, there are signs that rate hikes are finally restraining economic growth.

Retail reports released this week also point to deflationary trends, suggesting the anticipated rate cuts next year are likely as corporate earnings drop and consumer spending contracts, which is not good news for the economy and markets. Representatives from the ECB, the Bank of England, and the Fed are set to speak today, and traders will be watching for hints about potential rate cuts next year.

Meanwhile, Bank of America notes that macroeconomic challenges are mounting, and investors should gradually shed risky assets after the recent surge. While easier financial conditions – with yields falling to 4% from 5% – have spurred risk appetite, a further decline to 3% would signal a recession.

In Asia, stocks were shaken by a 10% drop in Alibaba Group Holding shares after the company scrapped plans to list its $11 billion cloud division amid intensifying US-China tensions over technological dominance.

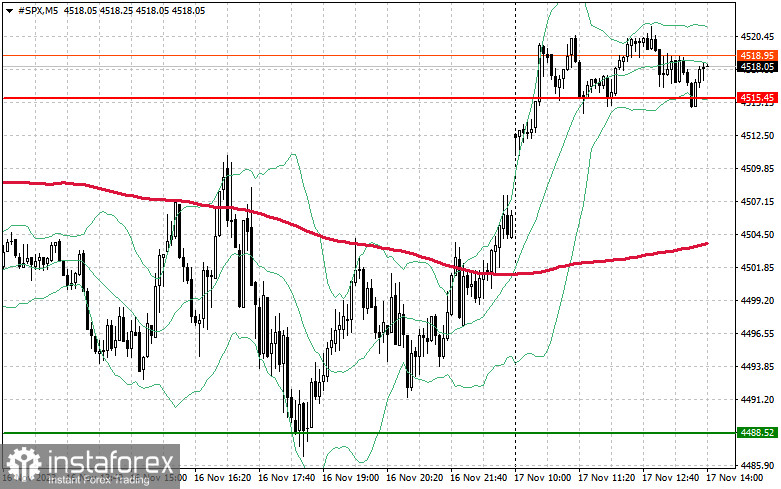

Regarding the S&P 500 index, demand for the trading instrument remains robust. Bulls need to defend $4,515 and take control of $4,539 to strengthen the upward trend and open the path to $4,557. Bulls also should take control over $4,582 to solidify the bull market. In a downward movement due to waning risk appetite, bulls will have to protect $4,515 and $4,488. A breach could quickly push the trading instrument back to $4,469 and pave the way to $4,447.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română