Bitcoin is starting the first month of winter with a bang, confirming the approach of the New Year holidays with a bright display of upward price impulses. Over the past six days, the cryptocurrency has gained more than 15% in value, indicating a high level of optimism in the financial markets, including the cryptocurrency market. At the end of Tuesday's trading day, the price of BTC/USD made a bullish breakout and settled above the $43.5k level.

The reasons for the current price rally of Bitcoin remain relevant, unlike the targets, which are becoming more ambitious. If, at the beginning of this week, the $42k target seemed optimistically achievable within a 7-day timeframe, now the level of expectations has reached up to the psychological level of $45k. However, even in this scenario, a more profound upward movement is likely until the BTC price encounters strong seller resistance.

Fundamental Factors

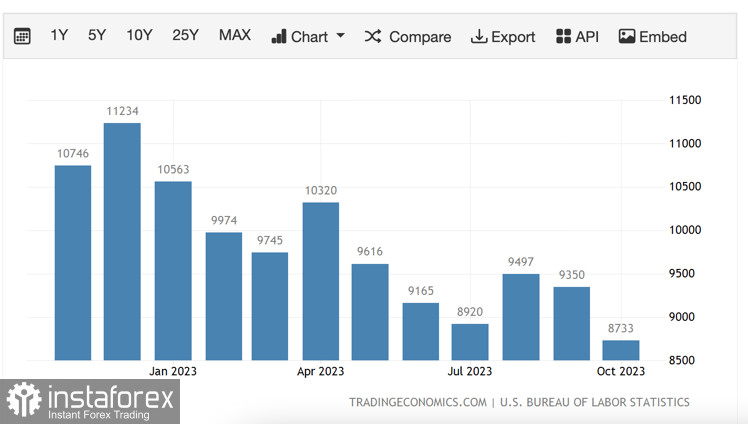

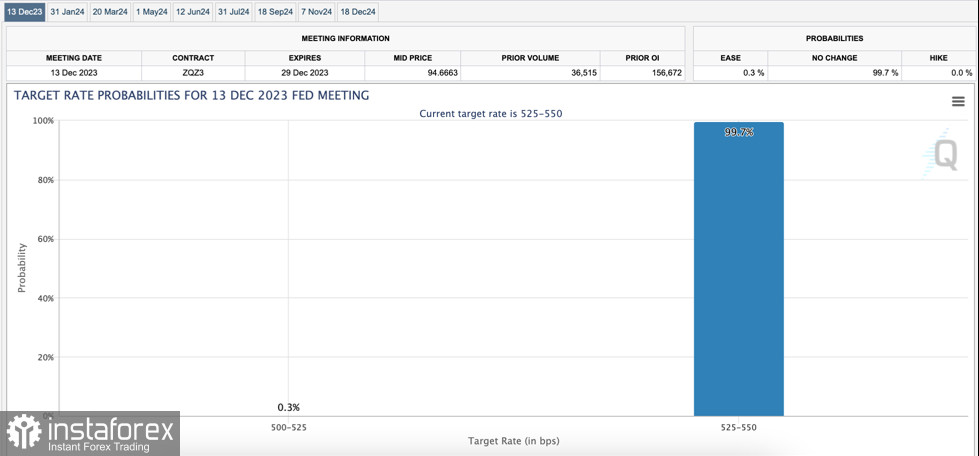

The overall macroeconomic situation remains positive due to increasing evidence that the interest rate hike cycle is completed. Fed Chairman Jerome Powell's thesis about the likelihood of a recession and, consequently, a cautious monetary policy received a new interpretation after data on the number of new job vacancies in the United States was released. With a forecast of a decrease in the number of vacancies to 9.2 million, the actual figures fell to 8.7 million.

This is a positive signal for the financial markets, confirming problems in the U.S. labor market, which further reduces the probability of a rate hike at the December 12 meeting. The employment index in the U.S. non-manufacturing sector from ISM also showed a slight increase to 50.7, with a forecast of a rise to 51.7. These facts became key reasons for the positive sentiment of investors on December 5.

In addition, the market continues to anticipate the approval of a spot BTC ETF, and more voices in the American media space indicate a high probability of approval for such a product. The BTC ETF story gained new strength following the example of a gold ETF fund, after which the precious metal continuously rose for many years. The upcoming BTC halving also instills optimism in investors, as according to CNBC, cryptocurrency will become scarcer than gold after April 2024.

Is Bitcoin heading to $45k?

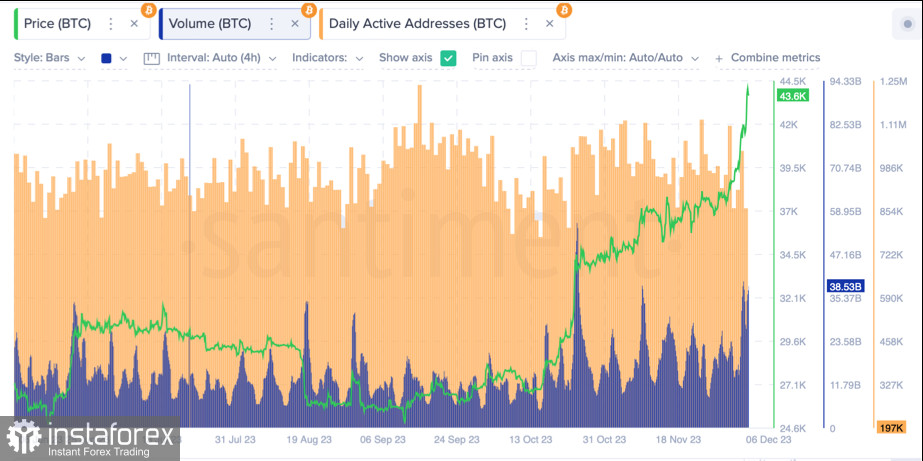

Bitcoin continues its impulsive price movement, adding 4%-5% daily, allowing the cryptocurrency to successfully surpass the $40k level and continue towards $45k. As of December 6, the cryptocurrency is trading near the $43.5k level, with daily trading volumes around $38.5 billion. Along with the price increase, trading activity has resumed, but there is an important nuance.

This week, profit-taking volumes significantly exceed the indicators of the previous week. As of December 4, short-term holders locked in profits amounting to $1.5 billion, and the sale of BTC for the past week reached the $4.5 billion mark. Meanwhile, Bitcoin entered the overbought zone, further confirmed by the gradual increase in bearish volumes.

Technical metrics do not show signals indicating an imminent correction. Moreover, positive news background and "greed" in the market may extend the momentum of Bitcoin's upward movement due to high absorption of bearish volumes. Additionally, it is worth noting that next week, the market awaits the release of inflation data and the Federal Reserve meeting, which are likely to bring additional positivity to the markets.

Conclusion

Considering the fundamental situation and the complete dominance of bulls in the current price movement, further price growth for BTC should be expected. Among potential targets, the levels of $44k-$45k stand out as a psychological area, after which we can anticipate another stage of increased selling volumes. However, overall, further updates to the local price peak should be expected, and only after that will bears have a chance to change the situation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română