Over the past seven days, Bitcoin quotes have grown by 16%, causing additional excitement in the cryptocurrency market. The asset managed to consolidate above $40k and continue its upward movement towards the current local high at $44.4k. Meanwhile, the macroeconomic background remains positive, reinforcing bullish interest in the cryptocurrency and setting the mood for updating the local high at $45k.

Simultaneously with the rise in cryptocurrency quotes, the percentage of investors who are beginning to make a profit is also increasing. As of December 7, this indicator stands at over 80%. At the same time, Bitcoin reaches the overbought zone, which some investors may perceive as the final stage of the bullish rally. As a result, profit-taking volumes for BTC from various categories of investors show a significant increase and threaten the further rally in price.

Will profit-taking trigger a Bitcoin correction?

As of December 7, Bitcoin is one step away from retesting the $44k level, which will become the final obstacle on the way to updating the local high above the $45k level. Meanwhile, market sentiments remain at the "greed" mark, and fundamental news rules out the possibility of an increase in the key interest rate by the Federal Reserve. Despite this, various categories of investors have started to fix their short-term targets.

Over the past two days, volumes of realized profits have exceeded the $2 billion mark, and BTC sales over the last seven days have surpassed $5 billion. The bullish potential of Bitcoin within the current upward movement without a single correction is gradually approaching its finale. In the coming weeks, further increases in realized profits are expected, which will worsen Bitcoin's position.

Nevertheless, a swift and powerful correction is not anticipated due to the active accumulation and storage period of BTC by long-term investors. The profit-taking process has been ongoing for three weeks, but thanks to buying activity, all bearish volumes are being absorbed. As a result, for the first time in history, 30% of all BTC in circulation have not moved for more than five years. Santiment also reports that the number of wallets with a balance of 100+ BTC has been increasing for a week after profit-taking at the end of November.

BTC/USD Analysis

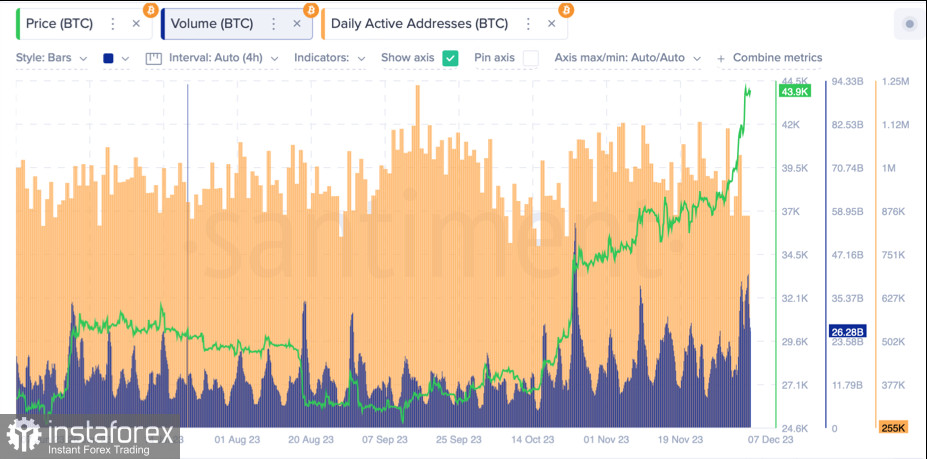

From a fundamental point of view, all these facts indicate that, despite a significant increase in profit-taking volumes, BTC is confidently moving towards updating the local high. As of December 7, the cryptocurrency is trading near the $43.9k level, with daily trading volumes around $26.5 billion. Due to Wednesday's price movement, BTC/USD positions worth over $300 million were liquidated.

For the first time in six days, Bitcoin has formed a red candle, interrupting the bullish rally after consolidating near $38k. BTC/USD encountered a strong resistance zone near $43.9k–$44.4k. Despite this, the stochastic oscillator shows prerequisites for the formation of another bullish impulse, and the MACD confirms the strengthening of buying activity over the last few days.

There will be no more fundamental news this week, and therefore, Bitcoin is entirely dependent on investor sentiment, which remains in euphoria. Considering this, there will be a retest of the $43.9k–$44.4k level in the coming days, after which the asset will continue its upward movement. The publication of inflation data and the Fed's meeting next week will be key events for the year-end, and that's when the main bullish impulse for BTC/USD will occur.

Conclusion

In the early stages of a bull market, technical analysis takes a back seat as emotions drive the market. The increase in volatility levels raises the chances of margin calls due to massive liquidity in the BTC market, making long-term holding and averaging down crucial at this stage. The current Bitcoin rally has passed the equator, making the situation more unpredictable, and the likelihood of sharp price movements in both directions poses a significant threat.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română