All significant events happen unexpectedly. On the eve of the December FOMC meeting, investors assumed that the updated FOMC forecasts would differ little from those in September, and Federal Reserve Chairman Jerome Powell would punish the markets for overconfidence. Supposedly, they were too aggressive in estimating the prospects of the federal funds rate in 2024. This was the baseline scenario. The question was only whether the markets would listen to Powell. In reality, everything turned out differently. The dovish pivot finally happened! It was this turn of events that triggered a swift rally in EUR/USD.

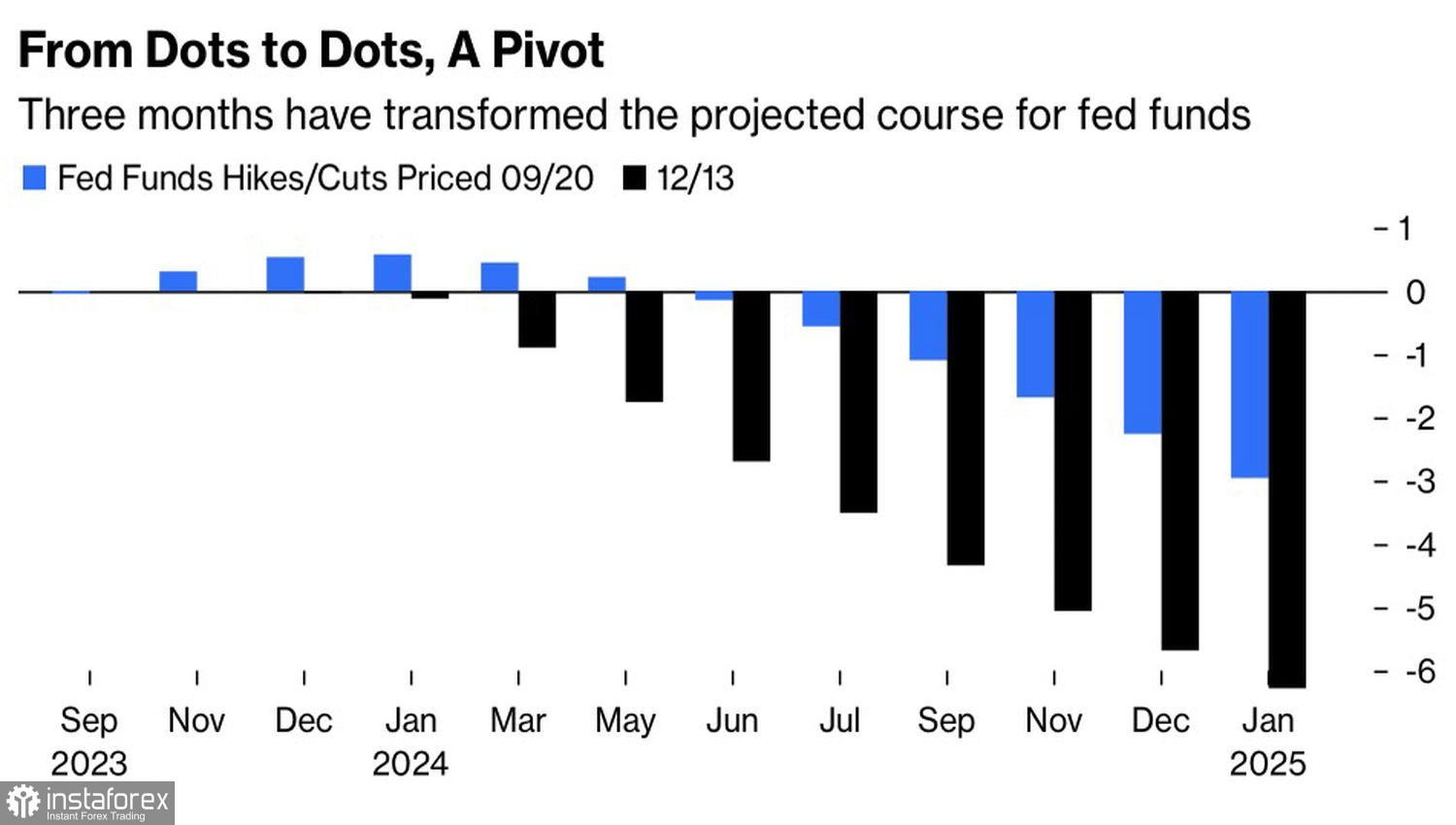

Just three months ago, 10 FOMC members thought the federal funds rate at the end of 2024 would be 5% or higher. Now, only three believe in this. The average estimate has fallen by 50 basis points, and one official believes that the cost of borrowing will collapse below 4%. The Fed plans to carry out three acts of monetary expansion in 2024 and four more in 2025.

Dynamics of Fed's Forecasts for the Federal Funds Rate

No matter how many basis points the FOMC shows a reduction in the cost of borrowing in its updated forecasts, the market will add another three. Should we be surprised by expectations of a 150 basis point reduction in the federal funds rate? According to derivatives, the ECB deposit rate will fall at least the same. If not more. On paper, bears on EUR/USD could benefit from a faster pace of monetary expansion in the eurozone than in the U.S., but in reality, it's not that simple.

Loosening monetary policy, especially if it is massive, is a paradise for risky assets. That is why the S&P 500 skyrocketed into the stratosphere, and according to Bloomberg data, many assets marked their best trading day in the last 15 years.

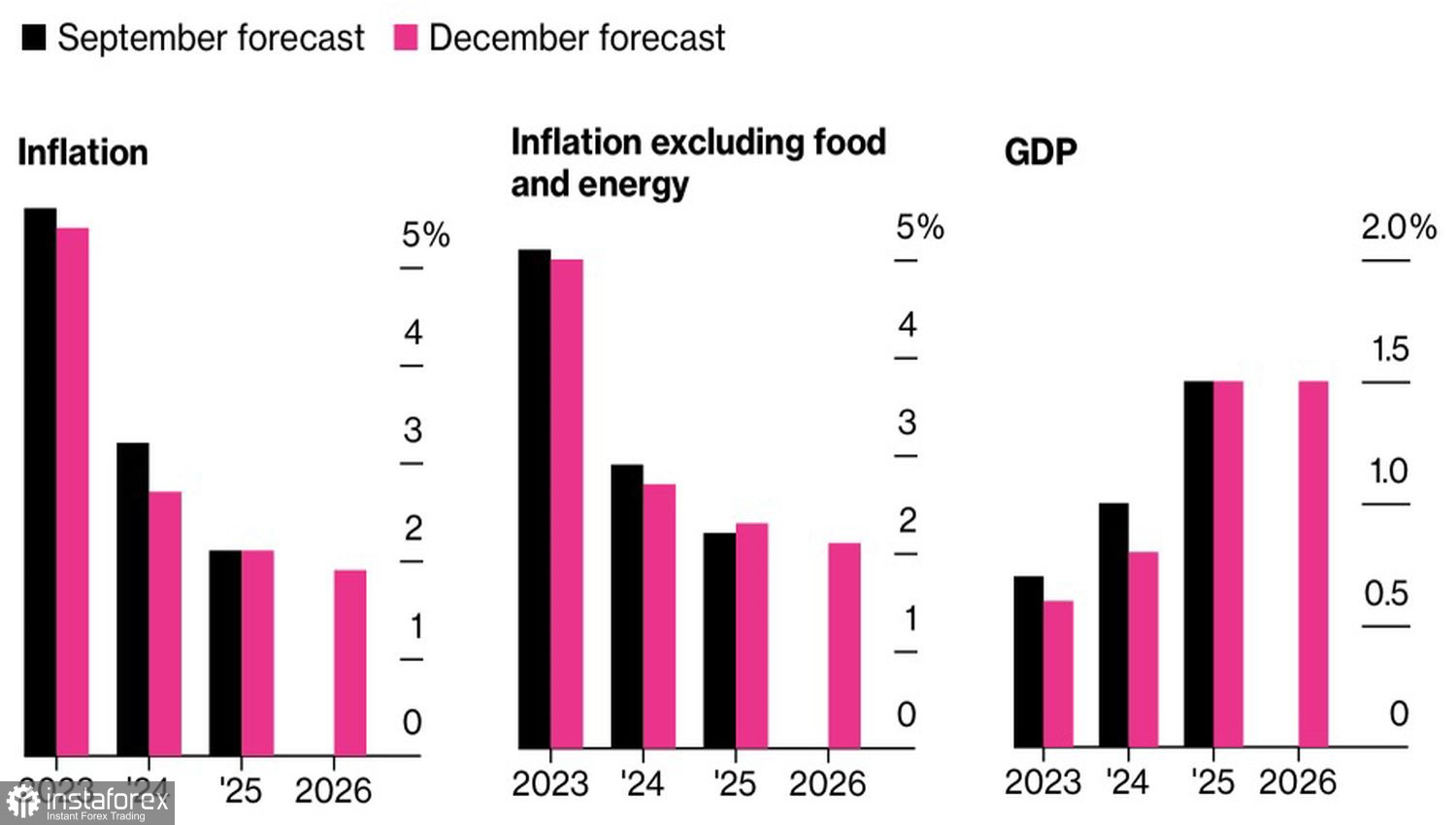

The Federal Reserve was also supported by the European Central Bank. At its December meeting, it kept the deposit rate at 4% and announced that its current level would make a significant contribution to returning inflation to the 2% target. Inflation forecasts were lowered, including to 2.7% in 2024 and 2.1% in 2025. Estimates of economic growth also fell. The ECB believes that a weaker economy will contribute to lower prices.

ECB Forecasts for Inflation and GDP

Bloomberg experts believe the ECB will cut the deposit rate by 75 basis points to 3.25% in 2024. This process will start in June. The markets are more aggressive. They predict six acts of monetary expansion starting in March. Overall, the fact that the European Central Bank is acting in sync with the Fed is good news for risky assets and the euro.

On the other hand, the verdict of the Governing Council on a faster unwinding of the quantitative easing program restrains attacks by the "bulls" on the main currency pair. In this case, we are talking about tightening monetary policy, which is bad for European stock indices.

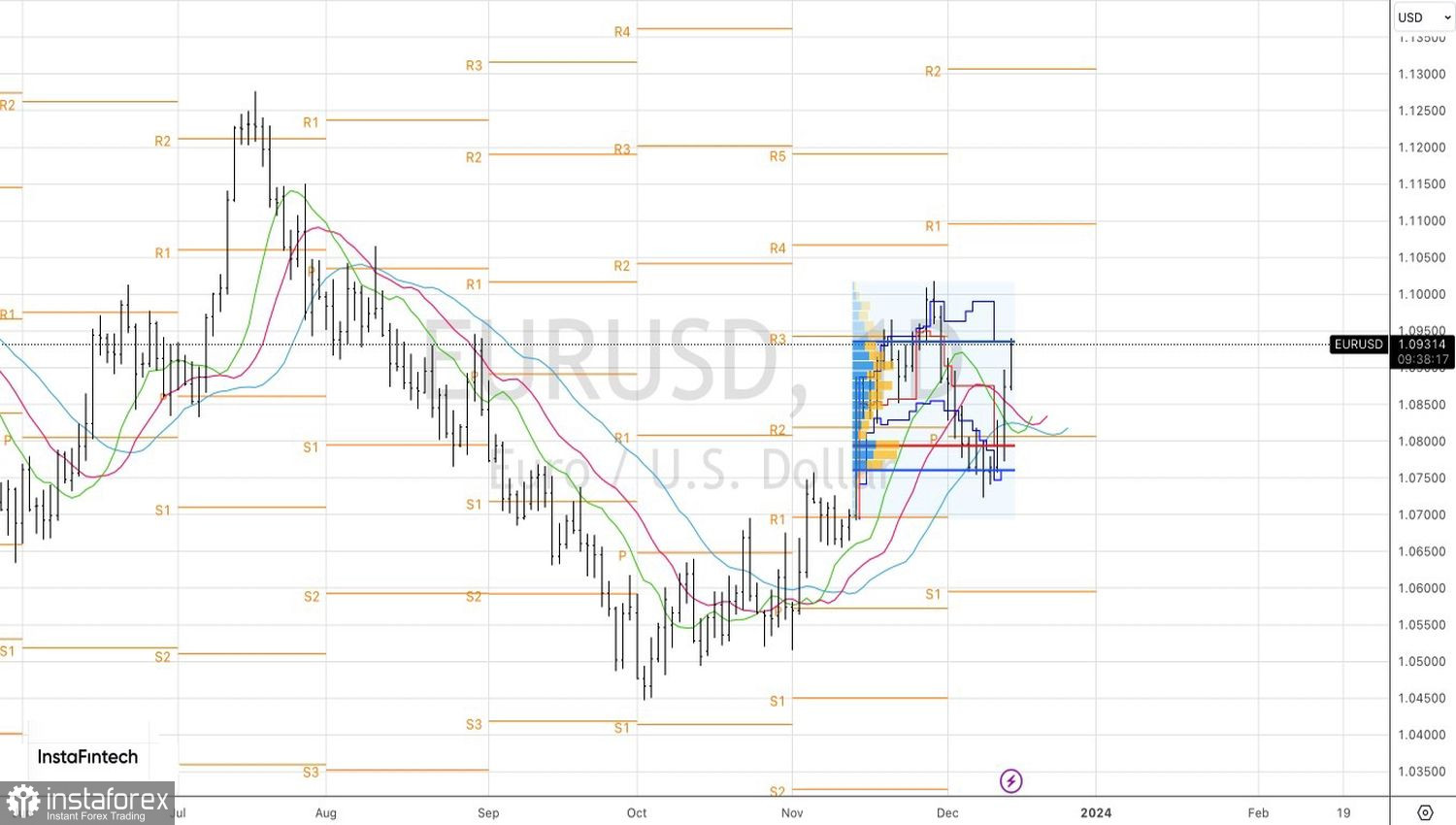

Technically, for the growth of formed longs from 1.0865 on EUR/USD, a confident breakthrough of the upper border of the fair value range 1.076-1.094 is required. Otherwise, the pair risks getting stuck in consolidation.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română