The attack by the USA and the UK on Yemen helped gold to rise from the recent lows of this month at $2,013 per ounce to almost $2,060. In the near term, the threat of an expanding war in the Middle East may surpass the role of the dollar and interest rates.

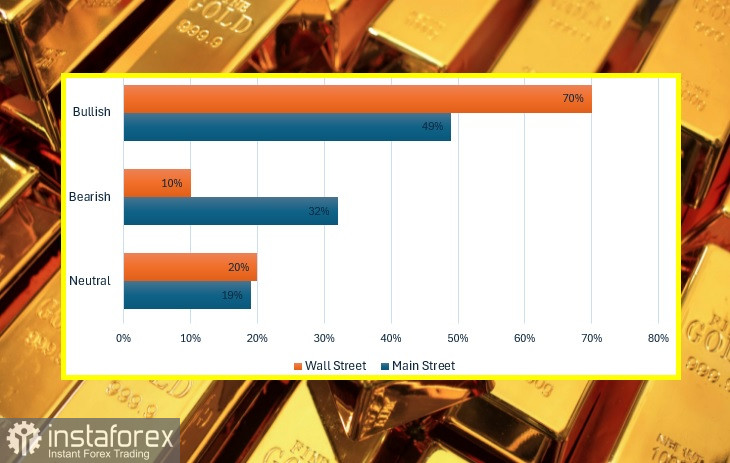

The latest weekly gold survey showed a continuation of last week's sentiments: half of the retail investors predict an increase in the precious metal this week, and more than two-thirds of market analysts have taken a bullish position.

Most analysts believe that the main reason for the future rise in gold prices is geopolitics in the east. Among them are Bob Haberkorn, Senior Commodities Broker at RJO Futures; Marc Chandler, Managing Director at Bannockburn Global Forex; Darin Newsom, Senior Market Analyst at Barchart.com; Mark Leibovit, publisher of the VR Metals/Resource Letter; Colin Cieszynski, chief market strategist at SIA Wealth Management, and others.

Adrian Day, President of Adrian Day Asset Management, believes that in the near future, the prices of the yellow metal will rise as far as they can.

Colin Cieszynski believes that gold remains very sensitive to expectations of the Federal Reserve's actions regarding interest rates—in other words, sensitive to the dollar. And even though the consumer price index indicators turned out to be lower than expected, they do not compensate for a hotter report on the consumer price index. The reality is that the producer price index is more volatile. But central banks never talk about the producer price index. The core consumer price index and wage growth are much more important to central banks than the producer price index.

At the same time, Cieszynski noted a significant rise in oil prices after the U.S. and UK air strikes on the Houthi rebels in Yemen, while the movement of gold was much slower but steady. "Gold is not as volatile as crude oil, and there's more factors driving gold," he said. It's not just a story about commodity prices and inflation. There is a defensive story both politically and in terms of the financial system. This all makes the U.S. dollar.

The only dissenting voice regarding the rise of gold this week was James Stanley, senior market strategist at Forex.com, who expects a decline in prices.

Ten Wall Street analysts participated in the survey. And they were even more optimistic than last week. Seven of them, or 70%, believe that the price will rise, and only one analyst, representing 10%, predicts a price drop. The remaining two analysts, or 20%, are neutral.

In the online poll, 121 votes were cast. Market participants continue to exercise caution. 59 retail investors, making up 49%, expect the price of gold to rise. Another 39, or 32%, are waiting for a price decrease. And 23 investors, or 19%, are neutral.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română