Bitcoin is approaching the end of the trading week in a state of uncertainty, as the asset failed to recover above $43k after a sharp collapse following the approval of the spot BTC-ETF. The cryptocurrency is consolidating near the $42.5k level, but any attempts to resume the upward movement end in a pullback. Simultaneously, sellers are intensifying pressure on the cryptocurrency's quotes, which may lead to further price decreases.

The news background also remains uncertain. Geopolitical and macroeconomic risks are strengthening the position of the U.S. dollar, creating additional pressure on Bitcoin's quotes. Overall, there is a situation where there are more reasons for further decline in BTC/USD than for consolidation or, moreover, resumption of the upward movement. However, to develop a long-term strategy, it is important to determine whether the BTC price decrease can be considered a full-fledged change in trend.

Is Bitcoin's Trend Changing?

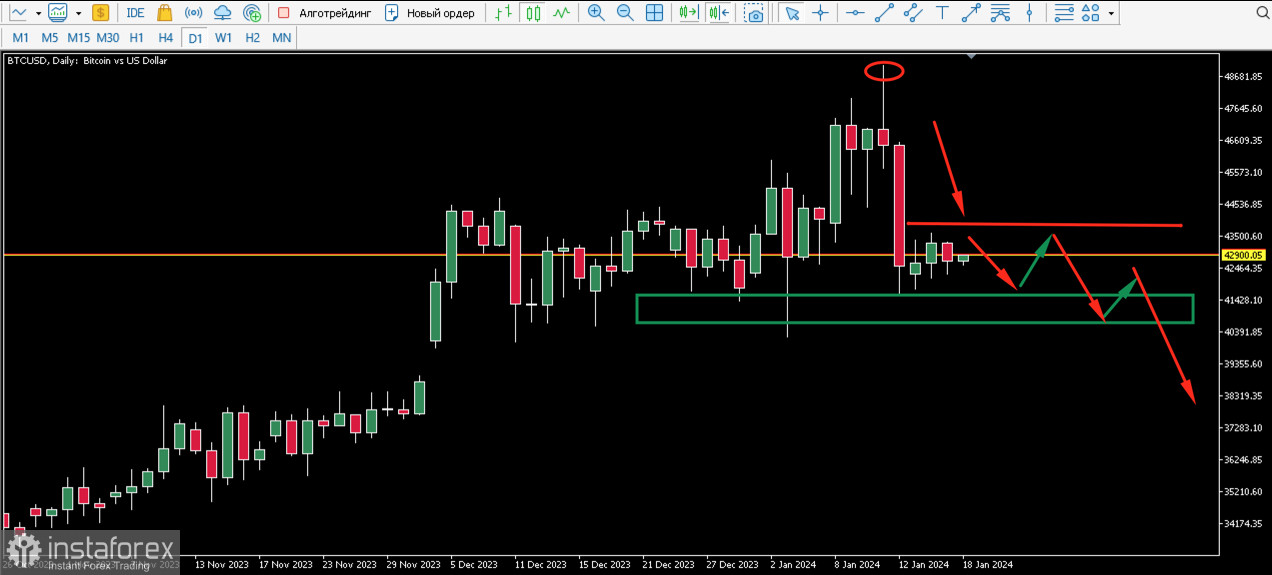

After the approval of the spot BTC-ETF last week, Bitcoin made an upward surge and updated the local price high at the $48.9k mark. Subsequently, the cryptocurrency faced a significant collapse to $41k amid substantial activation of sellers. Much of this process was conditioned by the fact that more than 90% of addresses were in profit, so portfolio unloading and further consolidation were inevitable. As of January 18th, Bitcoin had recovered above $42.5k and firmly established itself at this position.

The key support level of $40.5k also remains untouched, so there is no talk of a change in trend. This consolidation level is a key support for the BTC/USD movement to $48.9k, and its maintenance indicates relatively strong buyer positions above $40k. Analysts at Fidelity share a similar view, noting that the current BTC price drop is a short-term phenomenon associated with the approval of the BTC-ETF.

Could Bitcoin Fall Below $40k?

As of January 18th, this possibility exists, but it is minimal. Sellers tried to enter the support zone of $40.5k–$40.8k, but to no avail. This support zone was the main accumulation cluster for bulls before the move to $48.9k, so a smooth breakthrough of it seems unlikely. Considering that the market is currently quiet, related to a period of consolidation, and uncertainty regarding the Federal Reserve's policy, a spike in volatility in the crypto market should not be expected.

As of writing, Bitcoin is under pressure from sellers who continue to unload portfolios. Geopolitical instability strengthens the U.S. dollar index, putting pressure on cryptocurrency quotes. In total, the current decrease and stagnation of Bitcoin are related to the coincidence of several factors that have provoked a local lull and pause in the market. There is no talk of a global trend change, but the possibility of BTC breaking the $40k level remains.

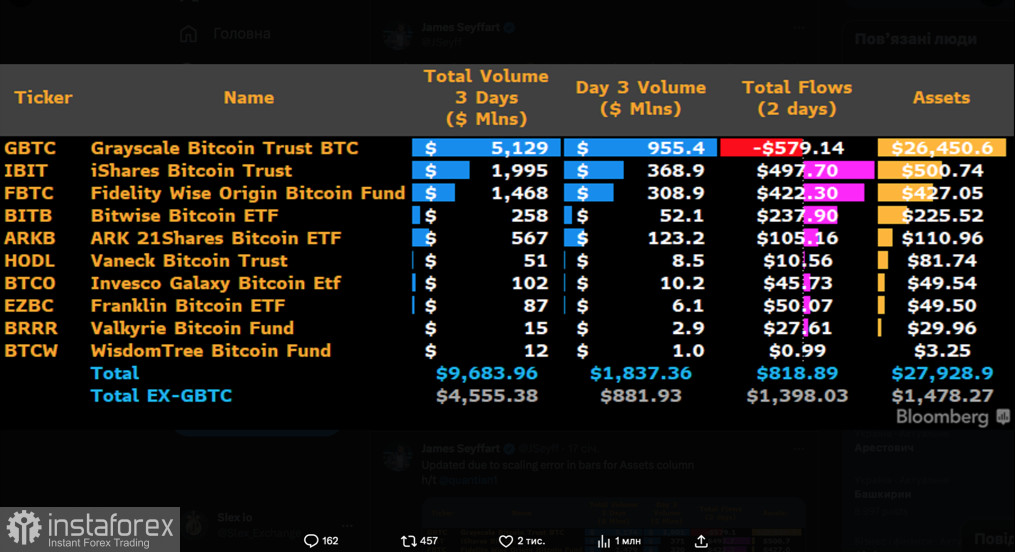

BTC-ETF Bears First Fruit

The trading volumes of spot BTC-ETFs have reached the $10 billion mark, which will positively affect the capitalization of the crypto market and Bitcoin in the medium term. For now, investors are following the rule of "buy he rumor, sell the news." Given the scale and period of accumulation, it's clear that portfolio unloading will also take time. However, alongside this, major funds and other institutional investors are investing in BTC through ETFs.

ProShares has filed applications for registration of five new BTC-ETFs, including a leveraged product, which could further increase trading volumes in the BTC market. Another BTC-ETF issuer, BlackRock, announced that it continues to buy Bitcoins, including to back the spot BTC-ETF. Company representatives stated that the investment giant's balance sheet includes about 16,000 BTC, totaling over $700 million.

Conclusion

The inertial unloading of portfolios by large and short-term investors following the approval of the spot BTC-ETF, along with macroeconomic and geopolitical tensions, has led to a local lull in the Bitcoin market. As of January 18th, there is a large-scale process of consolidation and capital redistribution in the BTC market. It is quite possible that as part of this process, the price of Bitcoin will break the $40k level, which will prolong the consolidation process and may lead to a deeper correction. However, until this happens, the cryptocurrency is within an upward trend, and the medium-term target should be set at a movement to $50k.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română