After reaching a record high the Friday before last, gold continued its movement from the same point where it paused last week, setting several record highs on both the spot and futures markets, even despite Federal Reserve Chairman Jerome Powell's testimony on Capitol Hill. Additionally, parallel record highs were set in stock markets and Bitcoin.

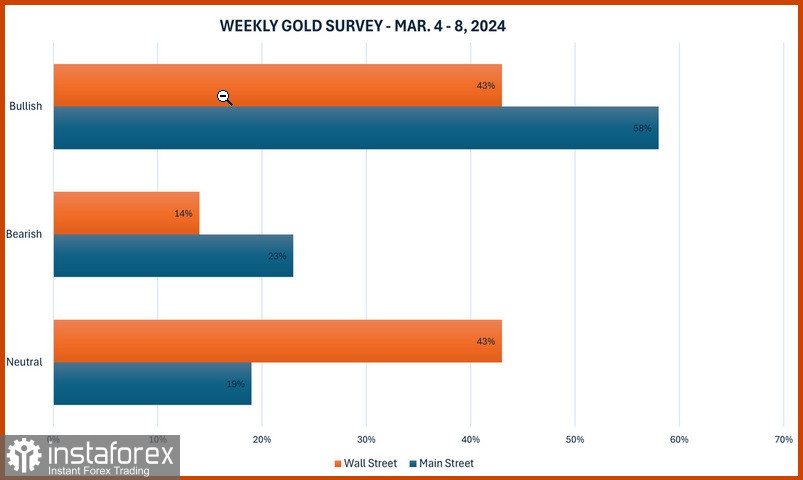

According to the latest weekly gold survey, bullish sentiments have completely solidified on Wall Street and Main Street.

Ole Hansen, head of commodity strategy at Saxo Bank, was one of the few analysts expressing bearish sentiments for the current week. According to him, as the metal now seriously needs consolidation after a rally significantly ahead of schedule, prices should trade lower.

Sean Lusk, co-director of commercial hedging at Walsh Trading, believes all signs indicate that this rally is caused by sovereign purchases. He said China is quietly supporting the market by replenishing reserves. Not only are they buying the precious metal, but many central banks are also doing so to support their currency.

Lusk thinks that in this situation of global uncertainty, both stocks and gold are at record highs. And the path of least resistance for the yellow metal currently lies upwards. He added that after the metal surpassed the target, there is reason to believe it can double its outstanding performance. Their target last week was $2,175.

On Wall Street, 14 analysts participated in a survey dominated by optimism. Six analysts, or 43%, expect price increases this week, with an equal share predicting that gold will trade sideways. Only two analysts, constituting 14%, expect price declines.

In an online poll with 296 votes, the overwhelming majority of Main Street investors also forecast further gold growth. 173 retail traders, accounting for 58%, expect price increases. Another 67 respondents, or 23%, believe the price will decrease, while 56 respondents, or 19%, took a neutral stance regarding the short-term prospects of the precious metal.

From the perspective of Barchart.com's Senior Market Analyst, Darin Newsom, gold should pull back.

Kevin Grady, president of Phoenix Futures and Options, said that after the swift price movement last week, he wants to wait and see what the inflation data says, emphasizing that data on the Consumer Price Index and Producer Price Index will be important risk events for gold traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română