During the recent weekend, Bitcoin and Ethereum sought to establish new annual peaks but encountered significant retractions in the wake of the Asian trading session. Notably, the maneuvers of whales within the market exhibit a level of predictability. The forthcoming halving event is anticipated to catalyze volatility, with retail investors poised to accumulate, while institutional entities, or whales, may initiate distribution phases akin to the patterns observed during the sanction of the Bitcoin spot ETF earlier this January. Presently, these significant stakeholders are progressively offloading their holdings, as each attempt to capitalize on breakout momentum and surpass annual highs precipitates notable corrections, subsequently offering buy-back opportunities. My strategy aligns with contrarian principles, opting to diverge from the herd mentality. Considering the dip experienced by Bitcoin and Ethereum during the Asian market hours, the scenario presents a strategic entry point for positions aimed at the achievement of new annual highs.

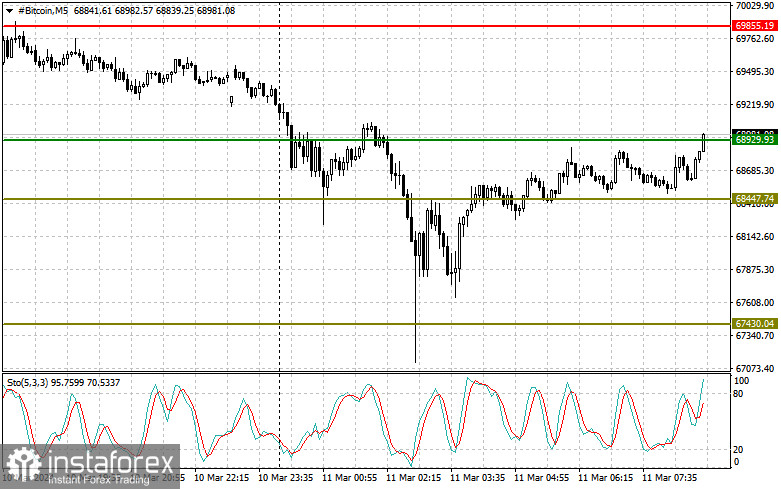

Bitcoin

Long Position Setup

My approach involves initiating a long position on Bitcoin around the $68,929 mark, with an objective to target a price escalation towards $69,855. Upon reaching this threshold, I plan to liquidate my long position and engage in a short sale at the bounce. Before executing this long strategy, it is imperative to validate that the Stochastic Oscillator is signaling oversold conditions, ideally positioned near the 20 index, to capitalize on potential upward reversals.

Short Position Setup

Conversely, I am prepared to establish a short position on Bitcoin upon the asset reaching the $68,447 level, aiming for a depreciation towards $67,400. At this juncture, I intend to close my short position and pivot to a long stance on the rebound. Before proceeding with this short strategy, ensure the Stochastic Oscillator indicates overbought conditions, hovering around the 80 index, to maximize efficiency in timing the anticipated downturn.

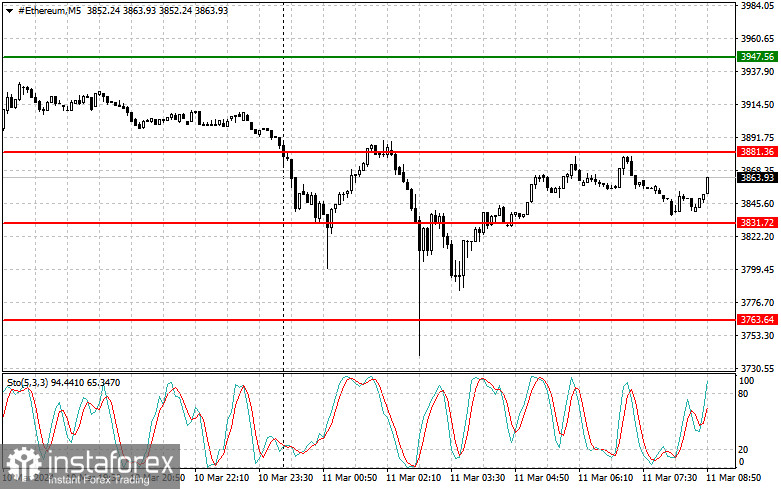

Ethereum

Long Position Setup

For Ethereum, my strategy entails entering a long position at approximately $3,881, setting sights on an ascent to $3,947. Similar to the Bitcoin strategy, the exit plan involves selling off the position at the peak and re-entering on a potential pullback. It's crucial to engage in this long position only when the Stochastic Oscillator suggests oversold territory, near the 20 mark, to optimize entry points for bullish momentum.

Short Position Setup

In alignment with a bearish outlook, I plan to short Ethereum once it touches the $3,831 threshold, with a depreciation target set at $3,763. Following the target achievement, the strategy includes exiting the short and immediately capitalizing on the rebound by going long. This shorting endeavor requires confirmation that the Stochastic Oscillator is in overbought territory, ideally around the 80 level, to anticipate and leverage the forthcoming correction.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română