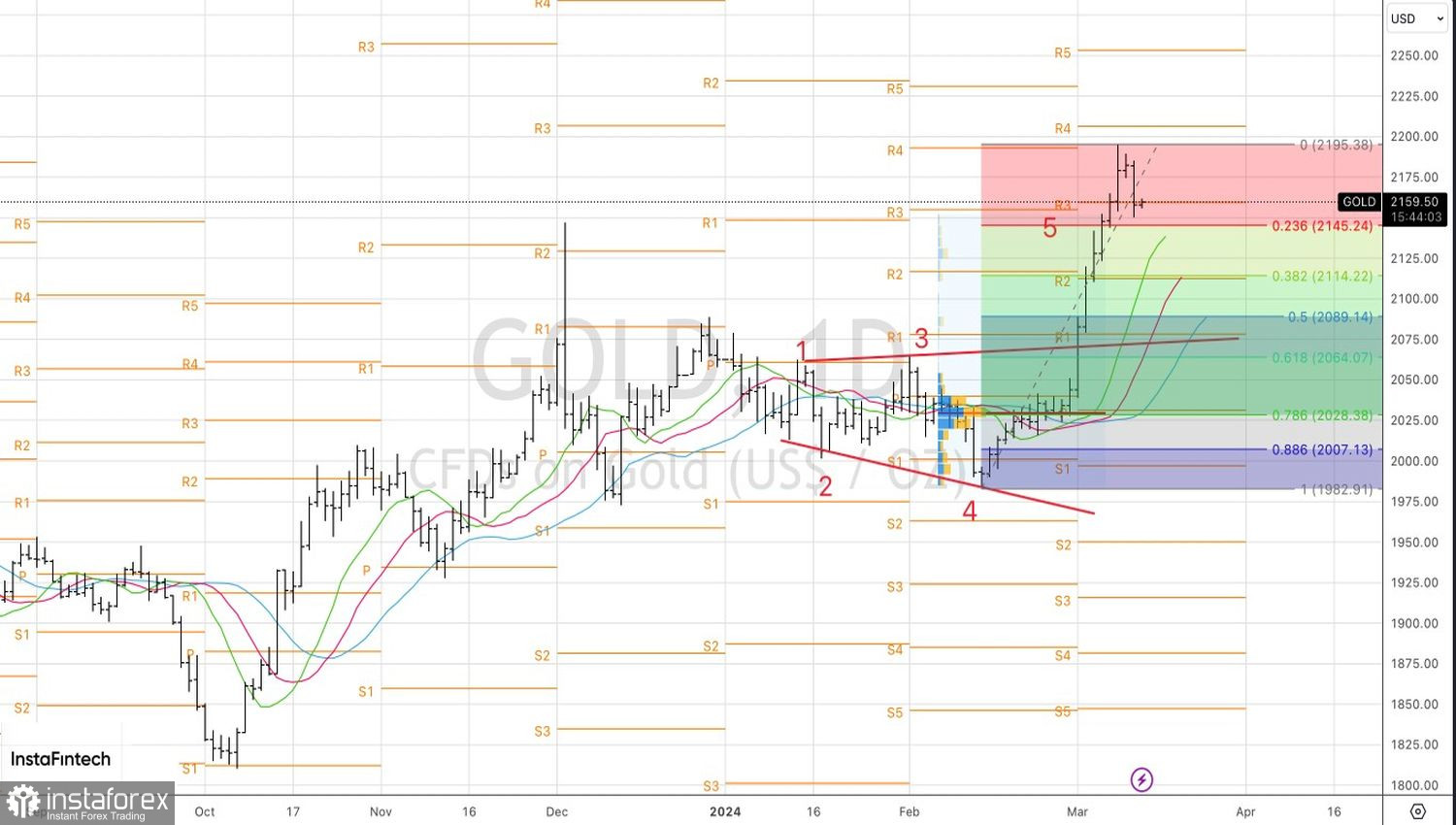

The question is not why gold is rising. More interestingly, why is it doing so rapidly. The precious metal surged from less than $2,000 to a new record of almost $2,195 per ounce in just under four weeks. Only strong statistics on American inflation for February managed to halt the bullish trend in XAU/USD. Typically, a rally of $70–80 requires some surprise, a sudden catalyst. This time, there was none. Nevertheless, the fact remains: gold has astonished investors with the speed of its ascent.

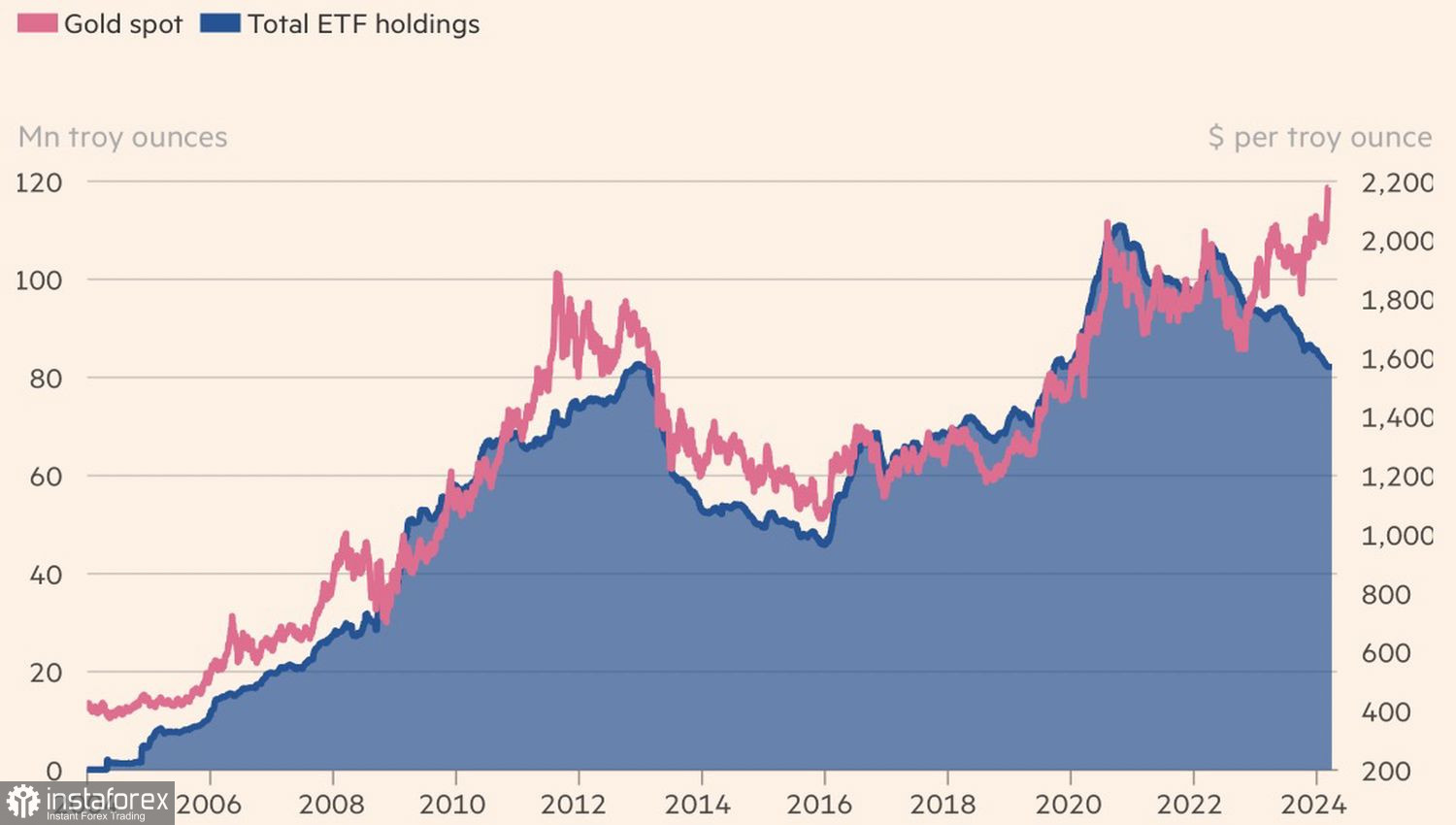

It is believed that the precious metal is sensitive to the dynamics of the dollar and the real yield of U.S. Treasury bonds. However, since the end of 2021, its value has increased by 20%, and rates on American debt, adjusted for inflation, have also risen from -1% to 1.8%. This led to a capital outflow from gold-oriented ETFs of 21 million ounces just last year. In 2024, the flight of money from specialized funds continues. In contrast, for example, to Bitcoin, which owes its new records to high demand for ETFs.

Gold and ETF Stocks Dynamics

The fourth-quarter rally in XAU/USD, initially attributed to the weakened U.S. dollar amid expectations of a reduction in the federal funds rate from 5.5% to 4% in 2024, underwent a significant shift at the beginning of the new year. Despite the U.S. dollar's longstanding dominance among major currencies, the narrative changed when Jerome Powell's announcement regarding the imminent commencement of monetary expansion prompted the dollar to lose its leading position to the pound. However, gold continued its upward trajectory unabated.

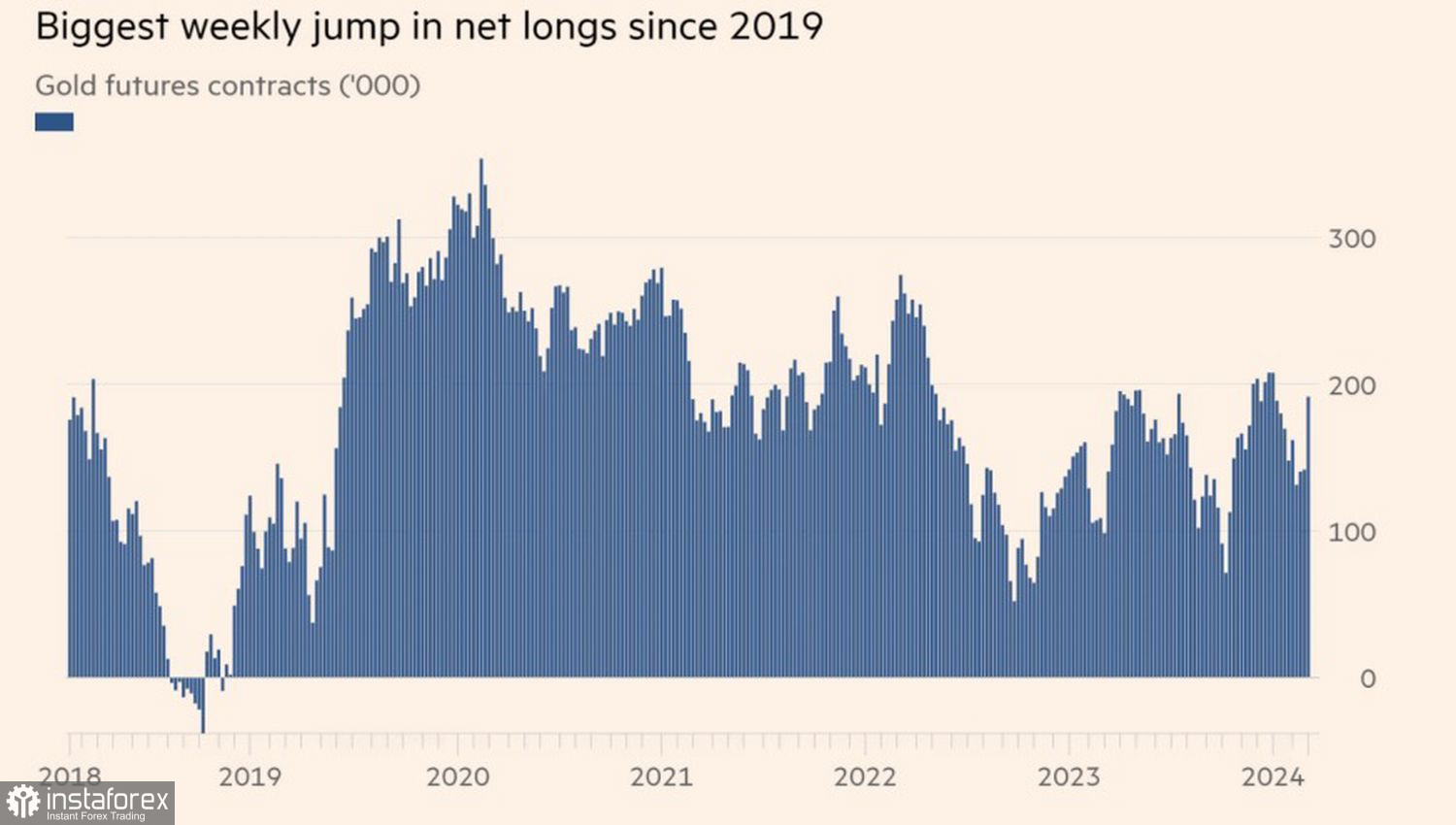

Neutral speculative positions suggest that the rally potential is far from exhausted. Citigroup, JP Morgan, and TD Securities, in agreement, set a target of $2,300 per ounce.

Speculative Positions Dynamics in Gold

So, what are the reasons for the success of the precious metal? It may be preemptively surging, anticipating a substantial interest rate reduction from the Federal Reserve. This may account for the downturn in XAU/USD following the release of U.S. inflation data for February. The data all but dismissed the likelihood of the Fed initiating monetary expansion in May, though June remains a possibility.

Support for gold comes from aggressive central bank purchases as part of the de-dollarization process, a high degree of geopolitical risks, and the highest demand from Chinese consumers concerned about the state of their own economy. However, these growth drivers for XAU/USD have been known for a long time, but they do not answer the question of why the rally has been so swift.

I believe that high-frequency trading is to blame. Gold struggled to stay above $2,050 per ounce for a long time. It conquered this level three times over time, but each time pulled back down. On the fourth attempt, the bulls succeeded.

Technically, on the daily chart of the precious metal, the implementation of the Broadening Wedge pattern continues. Pullbacks to 23.6% and 38.8% from waves 4–5 should be used for forming long positions. This refers to buying on rebounds from levels of $2,145 and $2,115 per ounce.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română