Bitcoin and Ethereum can resume gains at any moment. Major players continue to act according to the scenario of hitting new historical highs, quickly selling off, and buying at cheaper and more attractive prices. Yesterday, the exact same situation occurred with Bitcoin reaching a peak around $73,000. A pullback to $69,000 followed by a quick buyback – all this indicates that Bitcoin will continue to rise today, aiming to hit fresh historical highs. Perhaps today the first cryptocurrency will see a rise to $76,000.

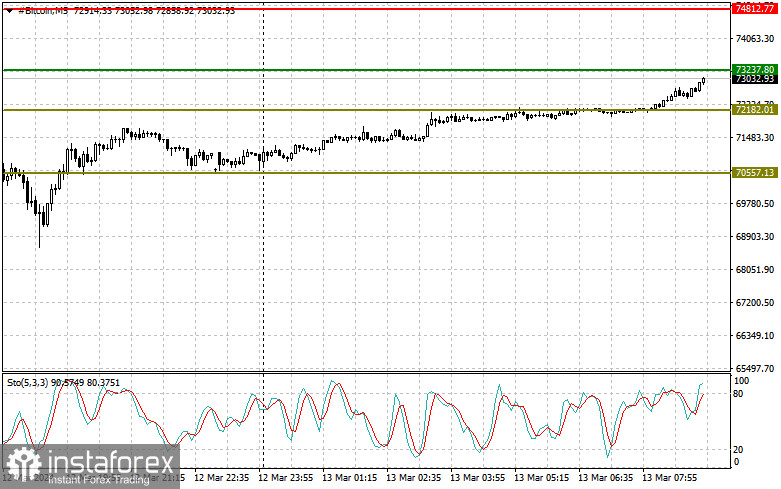

Bitcoin

Bull case scenario

Today, I recommend buying Bitcoin at around $73,240, counting on a rise to the level of $74,800. At around $74,800, it would be wise to exit the long position and go short on a rebound. Before buying on a breakout, make sure that the Stochastic indicator is at the lower boundary around the level of 20.

Bear case scenario

Today, traders are recommended to sell Bitcoin at around $72,180, expecting a decline to the level of $70,557. At around $70,557, one can exit the short position and go long on a rebound. Before selling on a breakout, make sure that the Stochastic indicator is at the upper boundary around the level of 80.

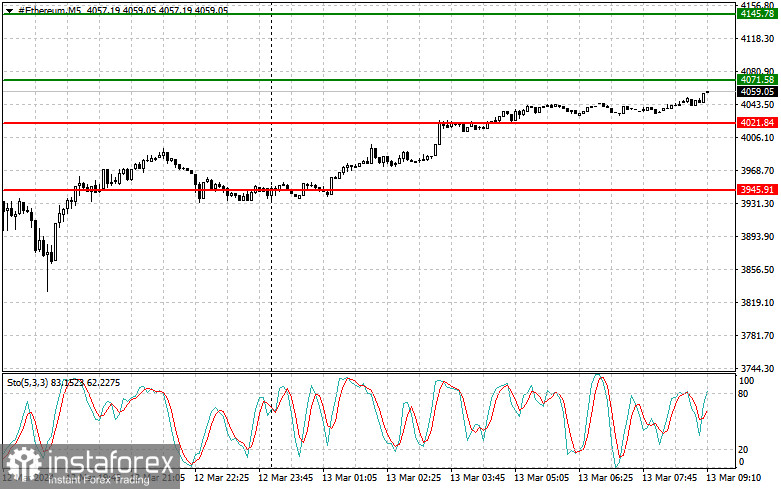

Ethereum

Bull case scenario

Today, I recommend buying Ethereum at around $4,070 with a view to reaching the level of $4,145. At around $4,145, it would be a wise decision to exit the long position and sell the asset on a rebound. Before buying on a breakout, make sure that the Stochastic indicator is at the lower boundary around the level of 20.

Bear case scenario

Today, one can sell Ethereum at around $4,020, counting on a drop to the level of $3,945. At around $3,945, traders are recommended to exit the short position and go long on a rebound. Before selling on a breakout, make sure that the Stochastic indicator is at the upper boundary around the level of 80.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română