Europe currently faces deindustrialization as the pace of its decline reached a staggering 6.7%. This confirms previous forecasts that the rising cost of energy sources in the region will result in serious economic consequences. However, the market did not react immediately, with dollar even falling in price, albeit slightly. It seems that the market halted movement ahead of the meeting of the Federal Open Market Committee, which will take place next week. Most likely, today's data from the US will also be ignored, as jobless claims, for instance, will increase by only about 7,000. Retail sales, which exert significant influence on economic dynamics, will also rise from 0.6% to 1.0%. In theory, this should lead to a strengthening of dollar, but since even inflation failed to move the market, expecting anything different from retail sales appears to be challenging.

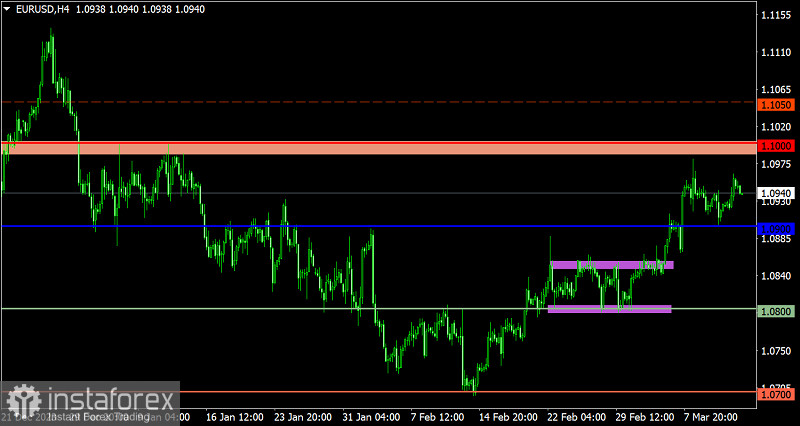

EUR/USD currently trades upward, indicating a clear speculative sentiment among market players. Despite several factors suggesting a further increase, the resistance area of 1.0950/1.1000 remains unbroken, so subsequent fluctuations at the peak of the upward cycle may still occur.

GBP/USD showed a partial recovery relative to the current correction. However, the level of 1.2800, acting as resistance, negatively affects the volume of long positions. Further growth will be seen only if the price stabilizes above this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română