If an asset suddenly falls after a rapid ascent, that's bitcoin. If it begins to consolidate, it's gold. The precious metal has moved away from historical highs but has found support near $2,150 per ounce and eagerly awaits the results of the March FOMC meeting. The fate of various financial instruments depends on the updated forecasts from the FOMC regarding interest rates and hints about the timing of the start of monetary policy tightening, and XAU/USD is no exception.

According to TD Securities, gold prices have been moving too quickly lately and need a breather. However, the company does not expect a collapse. It will be avoided thanks to the strong physical asset market and the still bullish positioning of financial managers. Heraeus disagrees. The rise in demand for the precious metal is linked to Lunar New Year celebrations in China. History shows that in the past ten years, the second-quarter figure has decreased on average by 21% quarter-on-quarter.

Perhaps at other times, this did not have a critical impact on XAU/USD, but when demand for the physical asset is one of the drivers of the rally, its slowdown is significant. However, gold still reacts sensitively to the monetary policy of the Federal Reserve, so consolidation ahead of the announcement of the results of the March FOMC meeting seems inevitable.

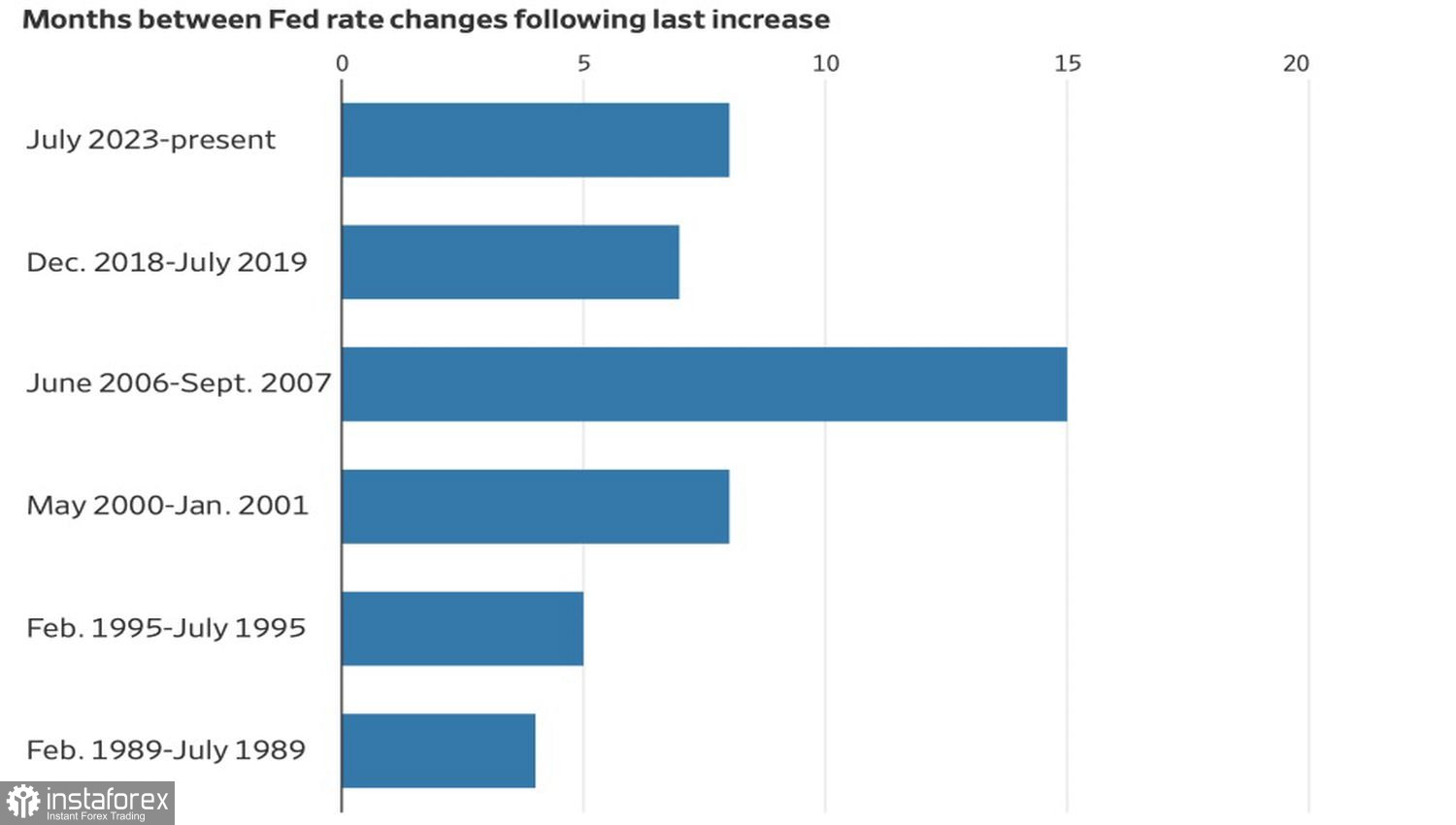

Timing of the Fed's Rate Hike

It has been eight months since the end of the monetary tightening cycle, longer than in most previous cases except for 2006–2007. During this time, the precious metal usually stabilizes or grows by an average of 20% over two years from the start of the federal funds rate reduction. The exception out of 11 cases since 1970 is the monetary easing cycle in 1995.

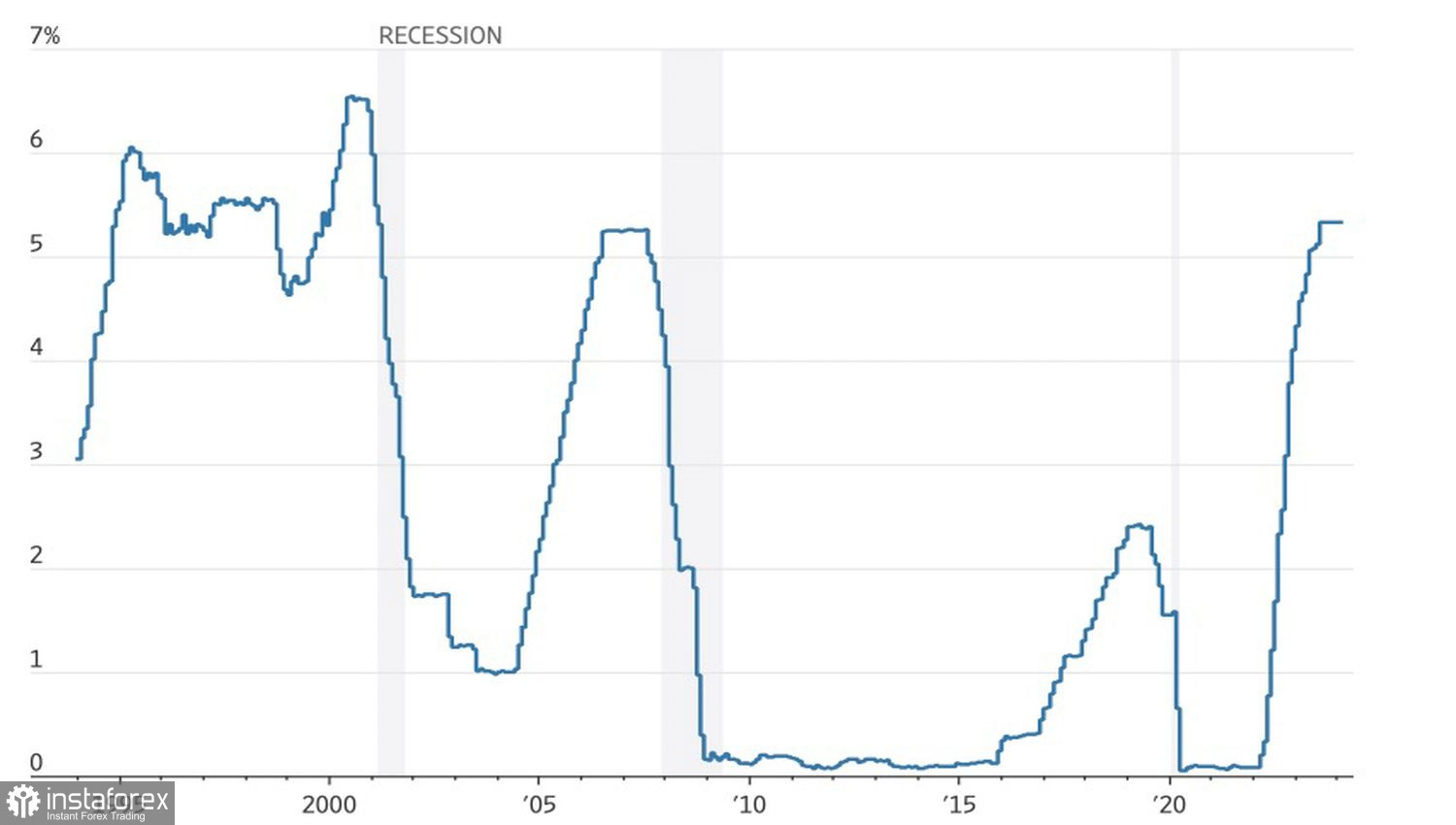

This time, XAU/USD quotes rose on expectations of the Fed lowering borrowing costs. They ignored the fact that market forecasts changed from 6 to 3 acts of monetary expansion in 2024. And this could end badly for gold. At current levels, it looks like a bubble, and if the Fed shows in updated forecasts a federal funds rate of 4.9% or higher compared to 4.6% in December, trouble could arise. The precious metal could collapse.

Dynamics of the Federal Funds Rate

RJO Futures believes that there is room for drama in the market. While investors speculate on how many steps the Fed will take in easing monetary policy, two or three, the central bank may present an unpleasant surprise. What if, after the acceleration of CPI and PPI in January–February, the Federal Reserve shows its intention to hold rates until the end of the year? This would be a real shock for XAU/USD.

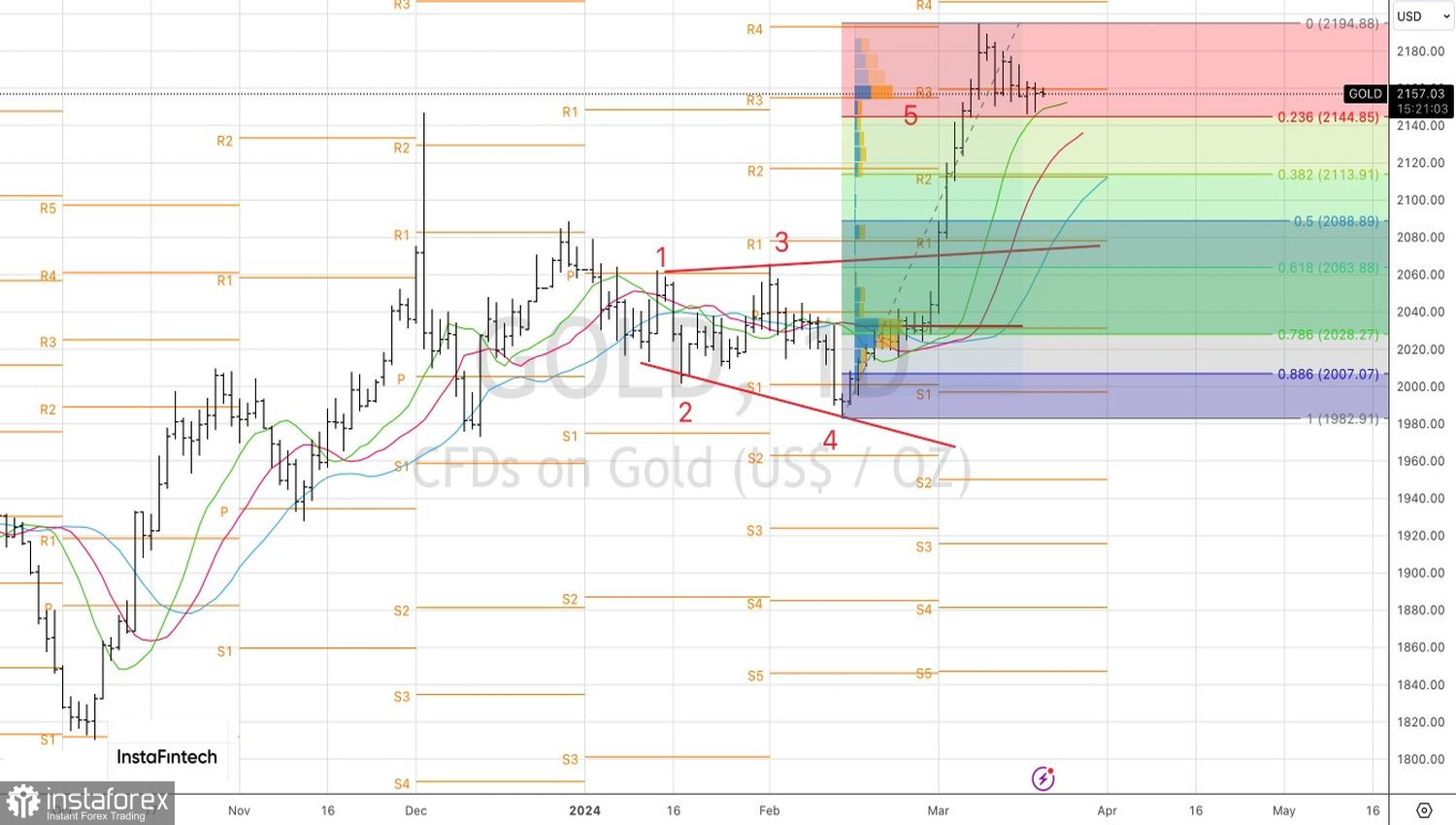

Technically, on the daily chart, a natural pullback has occurred after the formation of point 5 of the broadening wedge pattern. Bulls managed to rebound twice from support at $2,145–2,150 per ounce near the 23.6% Fibonacci level. Its breakthrough would be a reason for selling with subsequent reversal and entry into long positions from $2,115 and $2,090.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română