Is the euro weak? Or is the dollar too strong? The fact that the EUR/USD pair dropped to its lowest level in four weeks has investors asking questions. Judging by German leading indicators and European business activity, the eurozone economy is gradually rising from its knees. The timing and scope of the European Central Bank's plan for monetary easing remains the same: the market expects it to start in June and the central bank is seen to reduce the deposit rate by 75 bps by the end of 2024. Perhaps the reason behind the pair's peak is the dollar's strength?

Judging by the persistence of December FOMC rate forecasts and Federal Reserve Chair Jerome Powell's statement that they will be lowered soon, it was hard to count on a rally in the USD index. However, Forex is not just about one character. It is not enough to follow the US dollar and the Fed. You need to know what other central banks are doing and are going to do.

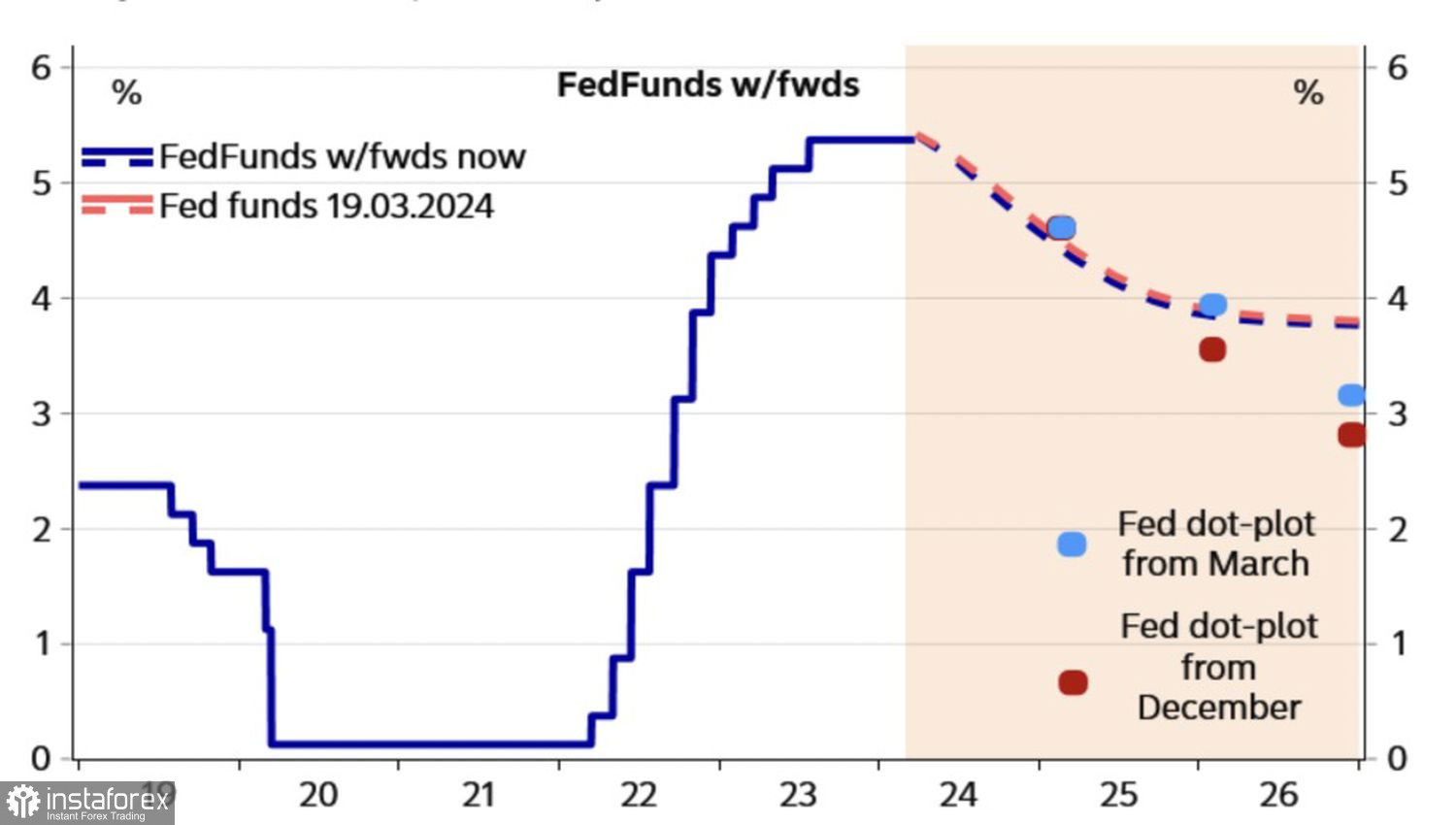

Dynamics of the Fed's forecasts for the federal funds rate

In this regard, the sudden rate cut by the Swiss National Bank from 1.75% to 1.5% became a kind of catalyst that initiated a chain reaction. If other central banks do not wait for the Fed to take the first step, it will start to resemble currency wars. Loosening monetary policy is not a means to devalue currency, which is favorable for exports. However, its side effect is a weaker currency. If the ECB and other central banks follow the SNB's lead, investors' flight to the US dollar may accelerate the EUR/USD peak process.

As for the Fed, it talks a lot, but in reality, it may end up doing much less. Powell emphasized in his recent speeches several times that the federal funds rate could fall in response to the pickup in unemployment. Read as, in response to the slowdown in the US economy. Indeed, real interest rates are currently high and limit economic growth. The Fed's passivity may lead to a recession, as evidenced by the yield curve moving out of inversion.

US yield curve dynamics

A no-holds-barred approach. You can say anything you want. However, the dollar will only start to weaken when the Fed announces the start of monetary easing. In this case, risky assets should win, and bulls on the USD index should lose. The question is when exactly this event will occur.

At the end of 2023, investors were betting on March, but they miscalculated. At the end of the first month of spring, there was much talk about June. However, if US inflation continues to accelerate, I wouldn't be surprised to see Nordea Markets' forecast of the first federal funds rate cut in September play out. And that's a whole different story for the US dollar. More bullish.

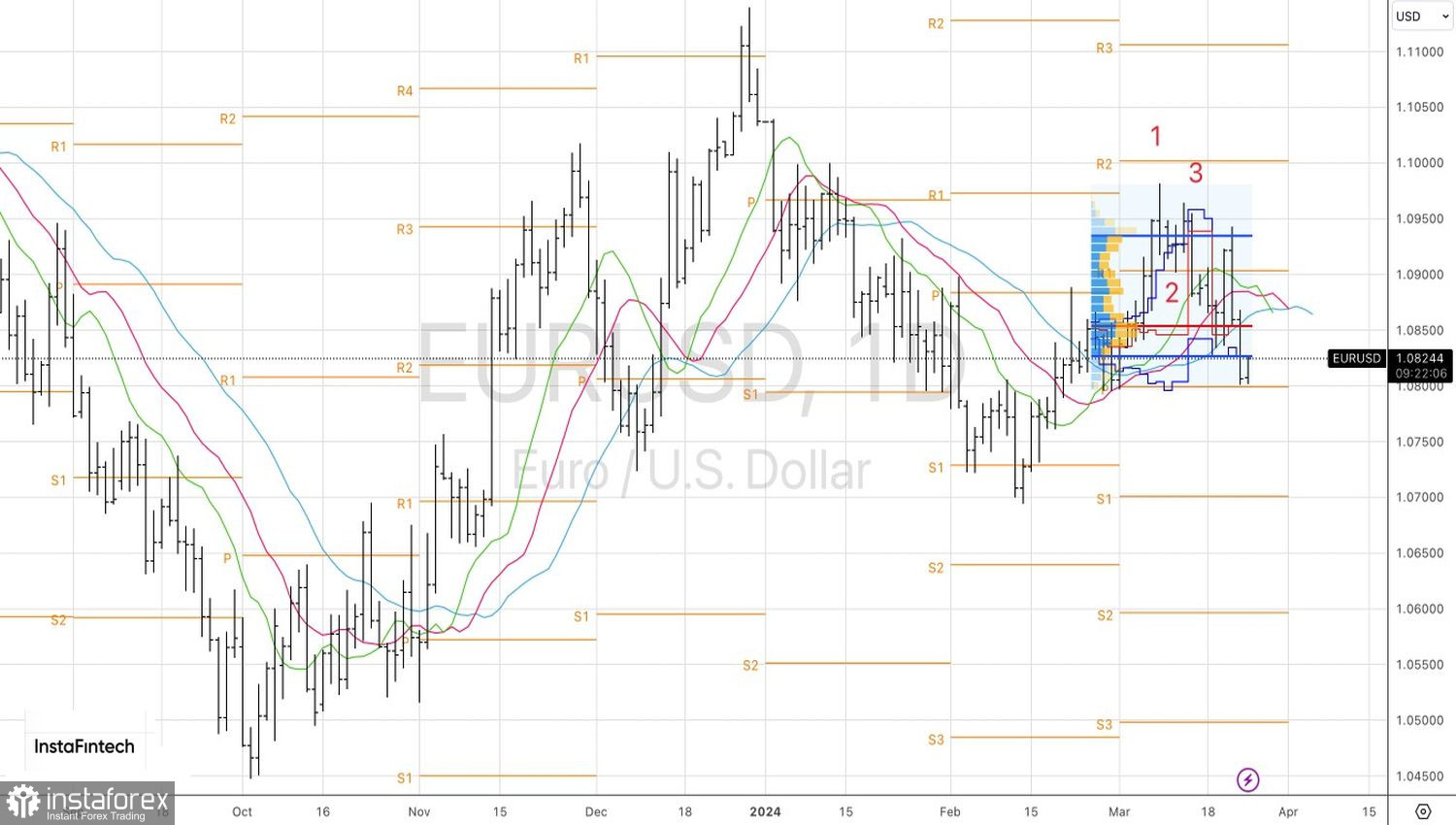

Technically, on the daily chart, EUR/USD has seen a rebound after bouncing off the lower boundary of the fair value range of 1.0800-1.0925. As long as quotes stay below 1.0855, we maintain focus on building up previously established shorts.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română