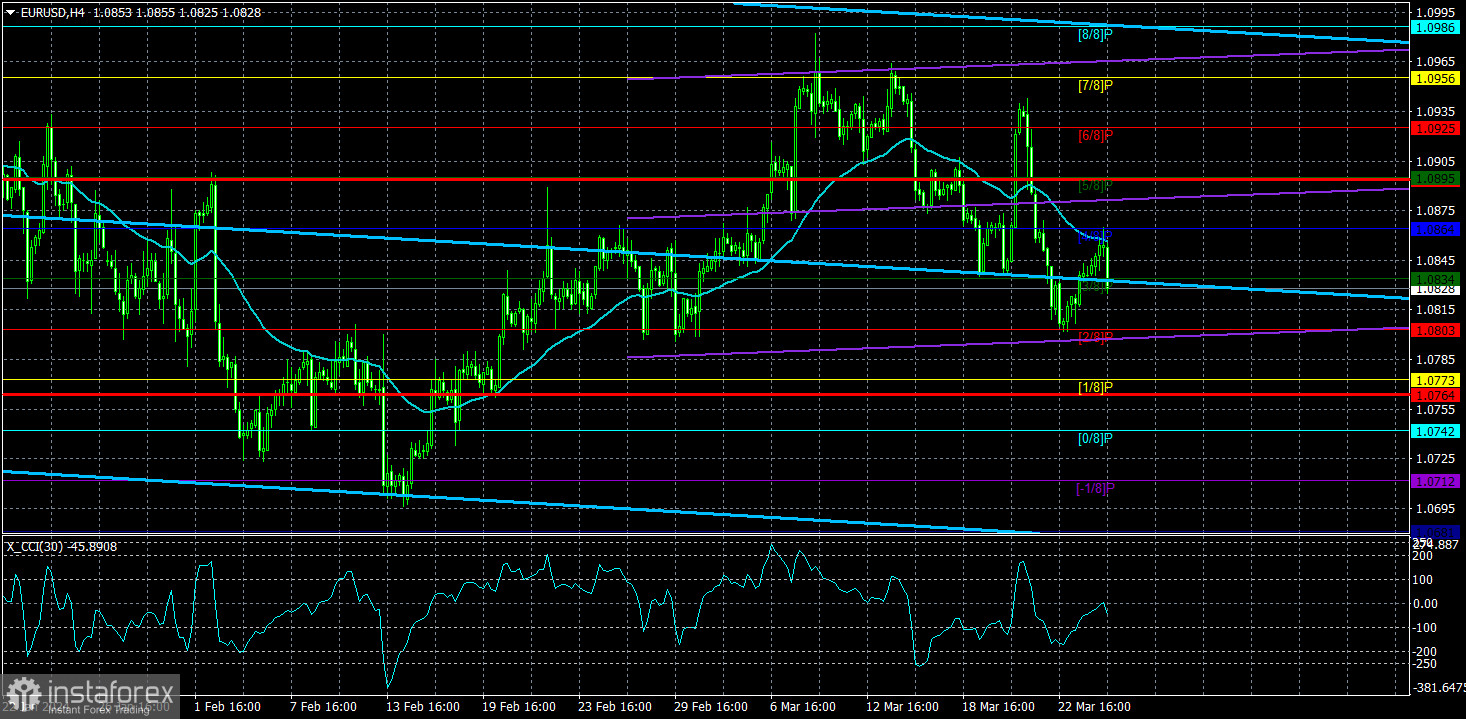

On Tuesday, the EUR/USD currency pair continued to trade calmly with low volatility. During the day, the moving average line was tested, but the downward trend remains intact. Even if there is a confident breakthrough of the moving average, it will not signify the beginning of a new upward trend. It's worth noting that on the 24-hour TF, the technical picture allows no room for double interpretation. Initially, we saw a strong correction against the new downward trend, followed by a weak correction within the framework of this same downward trend. Thus, the decline of the pair should resume almost in any case.

Of course, phrases like "should resume" or "in any case" are unsuitable for the currency market. The point is that market makers dominate the market, often making trading decisions regardless of their fundamental and macroeconomic backgrounds. However, we pay attention to news and reports, as many market participants do. With the same success, one could say that market makers pay no attention to technical analysis, but that doesn't mean it shouldn't be used now.

Therefore, with careful analysis, it becomes clear that, according to common sense and logic, the European currency should continue to decline. However, only some can command major players to sell euros and buy dollars. Hence, any forecast carries only a certain probability of execution. As long as the price remains below the 4-hour TF moving average and below the Ichimoku indicator lines on the 24-hour TF, it's evident that a resumption of the decline is more likely.

Regarding the fundamental background, several ECB representatives spoke during the first two days of the week. In particular, Christine Lagarde, Philip Lane, and Madis Muller spoke. And last week, almost half of the monetary committee members made speeches. Almost all ECB officials lean towards the necessity of starting rate cuts in June. Only some allow for an earlier or later start to the monetary policy easing cycle.

The month of June as a possible date for the first rate cut in the EU means nothing. What matters is the timing relationship between the first-rate cuts in the US and the EU. Since the Fed has a good chance of postponing the first easing from June to a later date (and such a postponement would already be the second one), the fundamental background remains in favor of the US dollar. The Fed will thus keep the rate at its maximum value for much longer than the market expected. Accordingly, its stance is more "hawkish" than it might have seemed a few months ago. Therefore, we expect further strengthening of the US dollar. Of course, this doesn't mean that the pair will move downward with a 100% probability or fall daily. We see that volatility remains low, and the market is cautious. Nevertheless, any pair growth (except for corrective) would be illogical.

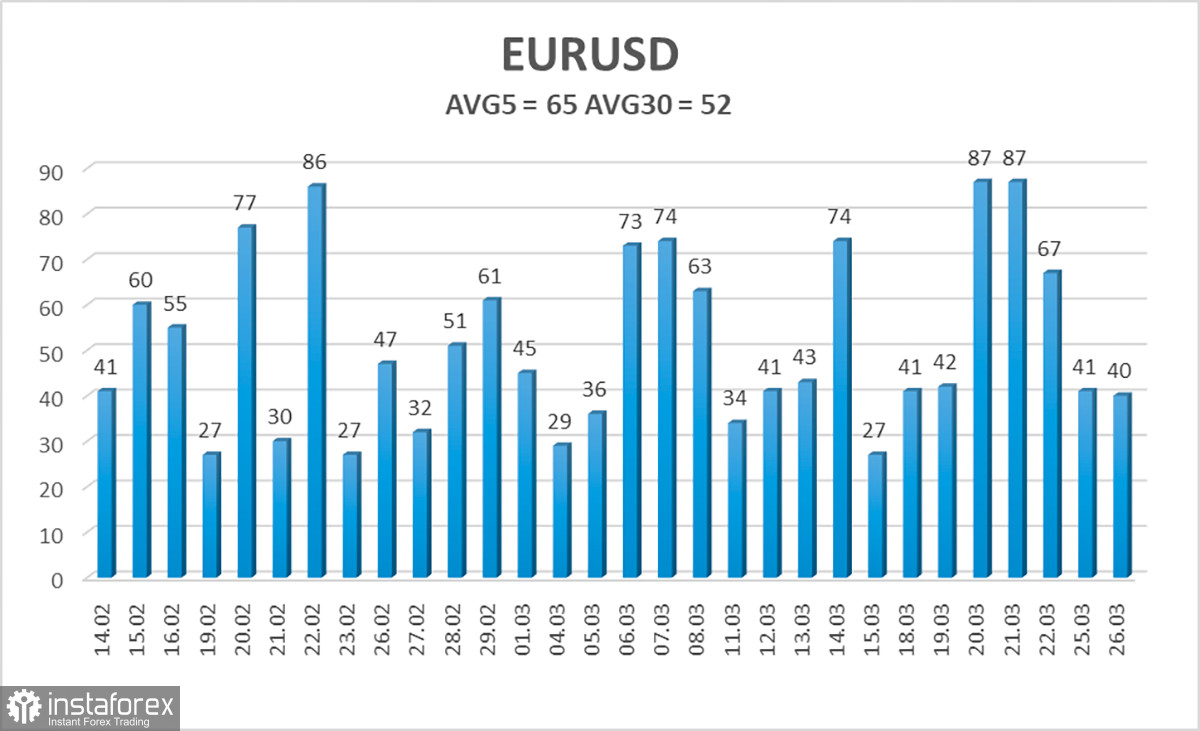

The average volatility of the euro/dollar currency pair over the last five trading days as of March 27 is 65 pips and is characterized as "average." However, it should be remembered that last week, the fundamental background was very strong, and this week, it will be weak, so volatility may decrease again. We expect the pair to move between the levels of 1.0764 and 1.0896 on Wednesday. The senior linear regression channel is still downward, thus maintaining the overall downward trend. The recent entry of the CCI indicator into oversold territory has already been worked out. Nothing prevents the pair from continuing to decline.

Nearest support levels:

S1 - 1.0834

S2 - 1.0803

S3 - 1.0773

Nearest resistance levels:

R1 - 1.0864

R2 - 1.0895

R3 - 1.0925

Trading Recommendations:

The EUR/USD pair continues to stay below the moving average line. Therefore, one can remain in short positions with targets at 1.0773 and 1.0742. The market has rejected similar purchases of euros and completed an upward correction that lasted more than a month. Therefore, we expect a decline to the 7th level and, from the perspective of several months to the level of 1.0200. After a fairly long pair rise (which we consider a correction), we see no reason to consider long positions. Even with the price consolidating above the moving average, which didn't happen yesterday.

Explanations for the illustrations:

Linear regression channels - help determine the current trend. If both are directed in the same direction, it means the trend is strong at the moment.

Moving Average Line (settings 20.0, smoothed) - determines the short-term trend and the direction for trading.

Murray levels - target levels for movements and corrections.

Volatility levels (red lines) - the probable price channel in which the pair will spend the next day, based on current volatility indicators.

CCI indicator - its entry into oversold territory (below -250) or overbought territory (above +250) indicates that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română