Israeli airstrikes on Syria have driven gold prices to a new record peak. Silver has reached its highest level since March 2022, and just like then, geopolitics has intervened. Armed conflicts in Ukraine and the Middle East and distrust in fiat currencies continue to serve as a boon for precious metals. Although their rally may seem surprising against the backdrop of a strengthening dollar and rising yields on U.S. Treasury bonds.

Gold and Silver Dynamics

Since the beginning of the year, gold has gained more than 11% in value due to expectations of massive monetary expansion by leading central banks led by the Federal Reserve and high demand for physical assets. The People's Bank of China acquired 225 tons in 2023, the largest increase in reserves since 1977. China imported 367 tons for non-monetary use, 51% more than in 2022. China, Russia, and other countries are pursuing de-dollarization policies, abandoning the U.S. currency and increasing the share of gold in reserves, which contributes to the growth of XAU/USD quotes.

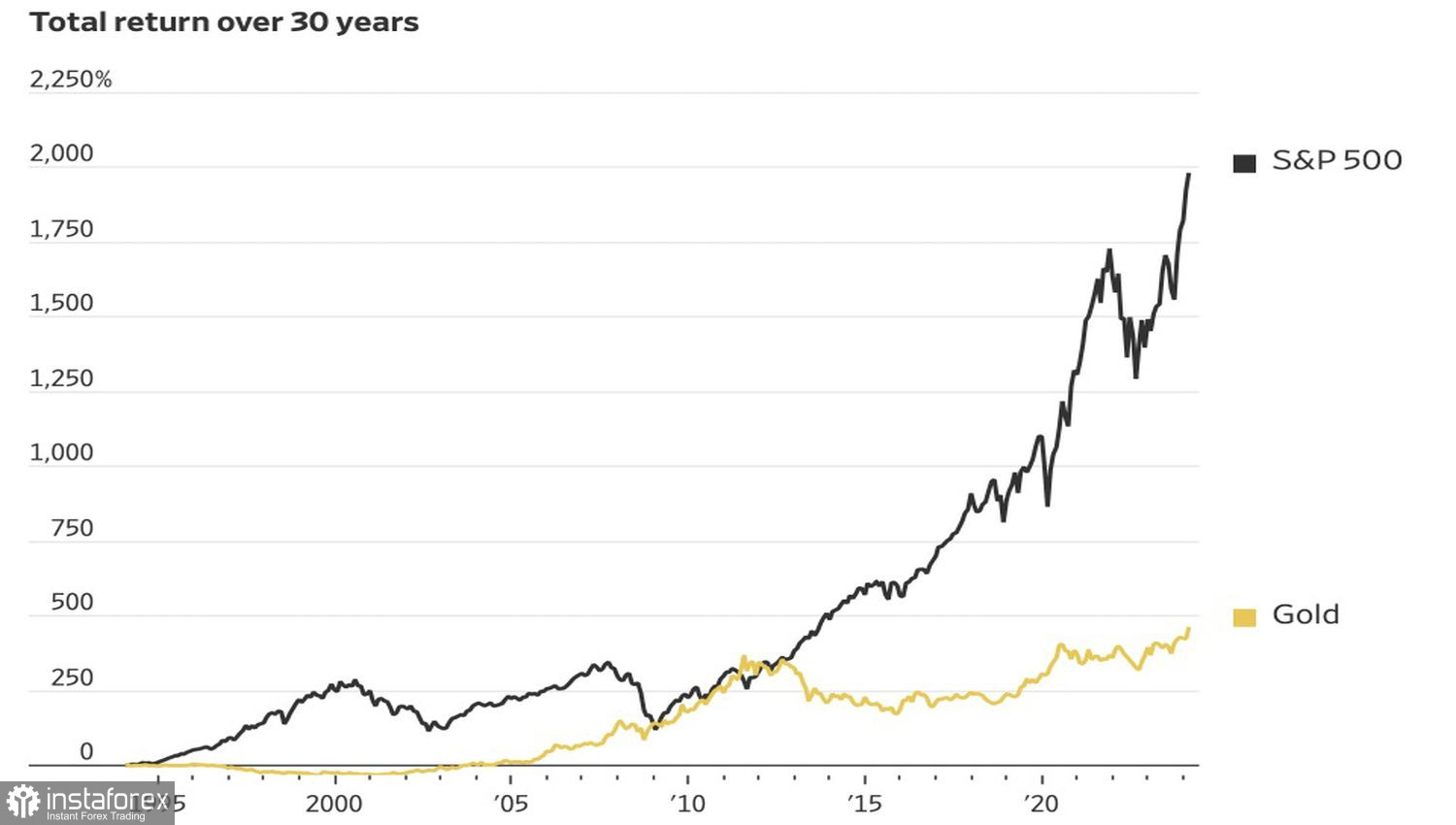

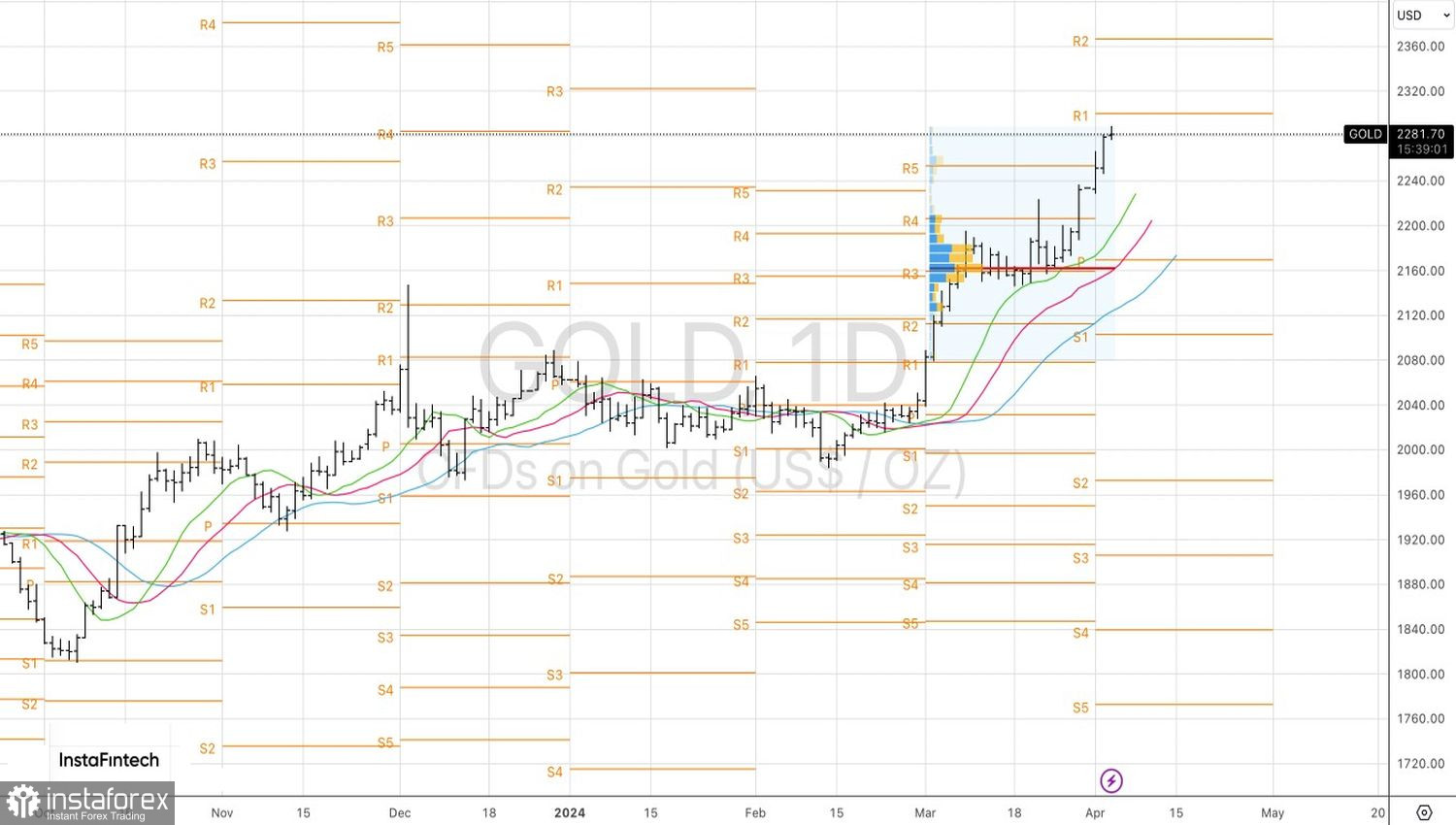

Record highs for precious metals are far from the limit. Goldman Sachs predicts the rally will continue to $2,300 per ounce, State Street Global Advisors, managing the largest gold ETF, mentions $2,400, while JP Morgan goes as far as to mention $2,500. In reality, it's all relative. For some, the current surge in XAU/USD resembles a bubble, while others consider precious metals seriously undervalued compared to the S&P 500.

Gold and U.S. Stock Market Dynamics

Considering the dominance of the U.S. dollar in the currency race of the G10 and the rising dynamics of Treasury bond yields, it remains surprising how gold has reached such heights. It is quoted in U.S. dollars, so the rally of the USD index usually brings a headwind for precious metals. Moreover, it does not generate interest income, so it is customary to consider it losing to debt obligations whose rates are rising. However, in 2024, everything is different.

The futures market believes that this year the Fed will cut borrowing costs three times, the ECB 3-4 times, and the Bank of England 3 times. Other leading regulators around the world are also poised for a serious easing of monetary policy, and the Swiss National Bank has already begun to do so. As a result, the currencies they emit suffer. It turns out that it's not the U.S. dollar that is so strong. It simply is the strongest of the weak links. And gold feels that.

It would seem that it should retreat due to the firmly standing U.S. economy. However, the stronger the States, the lower the risks of a federal funds rate cut and the higher the probability of a recession.

Technically, on the daily chart, there is a stable upward trend. Bears may try to play out the 20-80 bar, however, a rebound from pivot levels at $2,255 and $2,230 per ounce will be the basis for forming long positions. Overall, as long as precious metals are quoted above the fair value of $2,160, preference should be given to buying on pullbacks.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română