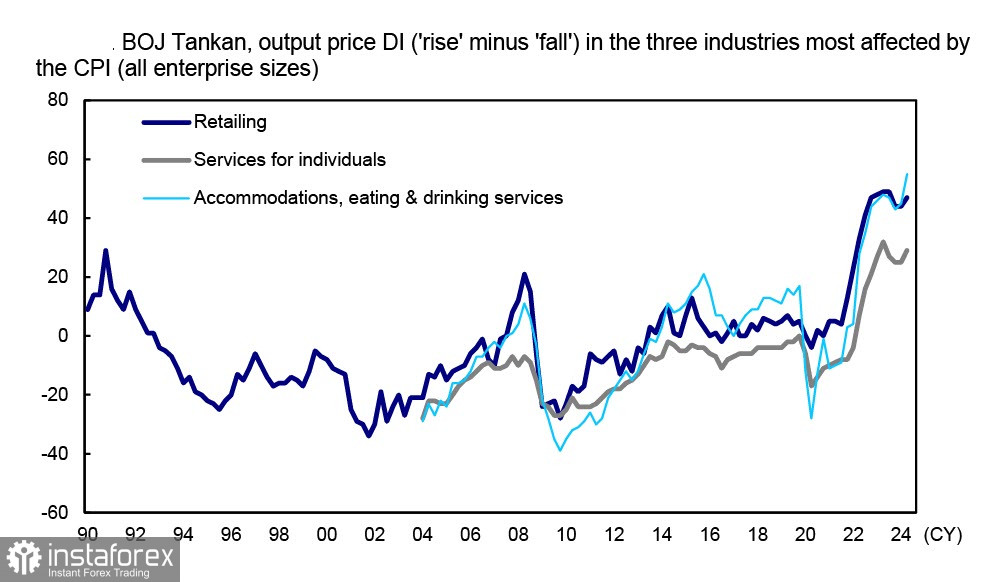

The Bank of Japan published a full set of data on the March Tankan index on April 2, a review important in terms of assessing the outlook for inflation.

As follows from the published data, output prices of output in the three industries most affected by inflation have been growing. This would be a bad sign for any country, but not for Japan, which fears a return to deflation.

The inflation forecast over the next 5 years is also positive. That is, it has increased on the whole, but excess supply is bad news for the Bank of Japan.

After the rate increase on March 19, the Bank of Japan Governor made it clear that the issue of further rate hikes was being considered in connection with the state of affairs in the economy and inflation dynamics. Markets have concluded that another rate hike will come sooner rather than later, and unprecedented ultra-loose monetary policy is being wound down.

Mizuho Bank sees several possible reasons for further rate hikes, namely the uptrend in inflation, inflation rising above the Bank of Japan's forecast, and confidence that the target level of 2% will be achieved. These factors are in favor of a stronger yen, but there is one factor that forces the BoJ to be extremely cautious - the enormous public debt. The higher the rate level, the more expensive it is to service. You can decide on further actions only if the current account is stable, that is, under the conditions of economic growth and stable external demand.

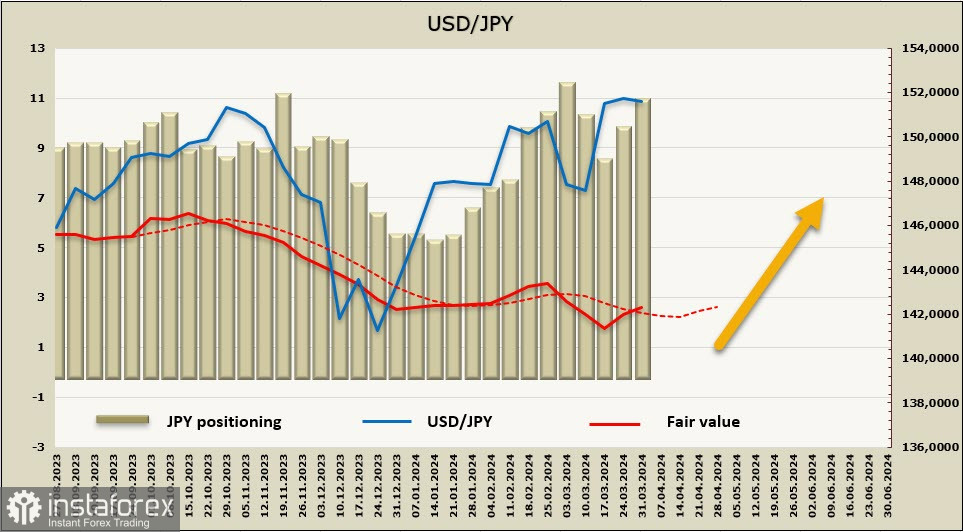

Until these conditions occur, the yen will remain the currency with the lowest yield, which will objectively contribute to its weakening. If the weakening trend continues, the government may intervene on Forex. The yen is now at its weakest since 1990. Japan's Ministry of Finance has sent a message that it will be ready to intervene in case of further weakening, which means currency intervention and a down move of the USD/JPY pair by a few hundred pips.

Hence, the bulls make no attempts to break through the level of 152 and go higher. There are resources for this, and reasons too, but the likelihood of intervention will increase many times over.

The net short position on the yen increased during the reporting week by 1.036 billion and exceeded 10.6 billion. Speculative positioning is confidently bearish, the closing price is also turning upward.

Market conditions are in favor of the USD/JPY pair moving above the resistance of 151.96. However, robust speculations are hindered by the possibility of intervention from the Bank of Japan, which is impossible to predict. The yen forex rate is largely artificial since an increase in yield is unlikely to be possible in the foreseeable future, while the yield of the US dollar, on the contrary, remains above forecasts, and the yen should logically weaken.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română