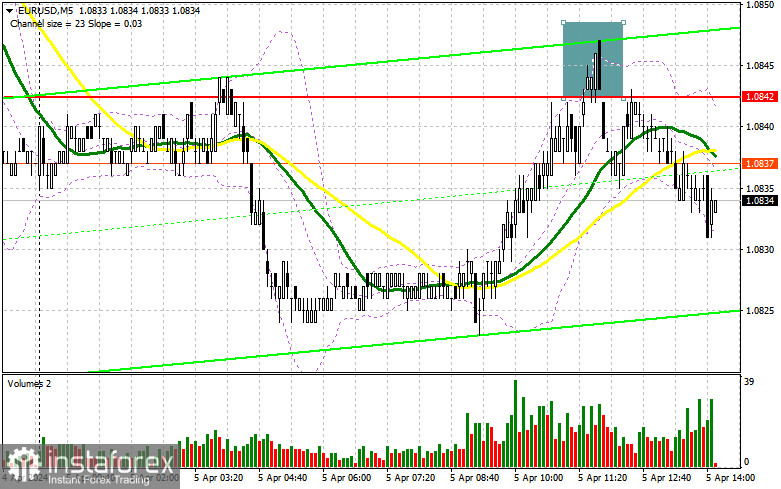

In my morning forecast, I drew attention to the level of 1.0842 and planned to make decisions based on it for market entry. Let's look at the 5-minute chart and figure out what happened there. The rise and formation of a false breakout at this level provided an excellent entry point for short positions, but even quite weak statistics on Germany and the Eurozone did not lead to a significant implementation of the sell signal. At the moment, we dropped by 10 points, and that's all for now. Obviously, all attention is on the second half of the day and the US data. From a technical point of view, everything has stayed the same, but it's unlikely that the nearest levels will matter.

To open long positions on EUR/USD, it is required:

Quite weak data on industrial order volume in Germany and a sharper decrease in retail trade volume in the Eurozone in February of this year were quite expectedly ignored by traders, although they definitely influenced the upward trend in the first half of the day. In the second half of the day, we await data on the unemployment rate in the US, as well as the number of employed in the non-farm sector and the average hourly wage. Less active growth in new jobs in March will lead to a sharp decline in the dollar and an increase in EUR/USD, whereas if the situation turns out the opposite way, the pair may sharply drop, which I will try to take advantage of. Speeches by FOMC members Thomas Barkin and Michelle Bowman are unlikely to lead to changes in the market since the situation in the committee is already clear - everyone is pulling the blanket in their direction, as I detailed in the morning forecast.

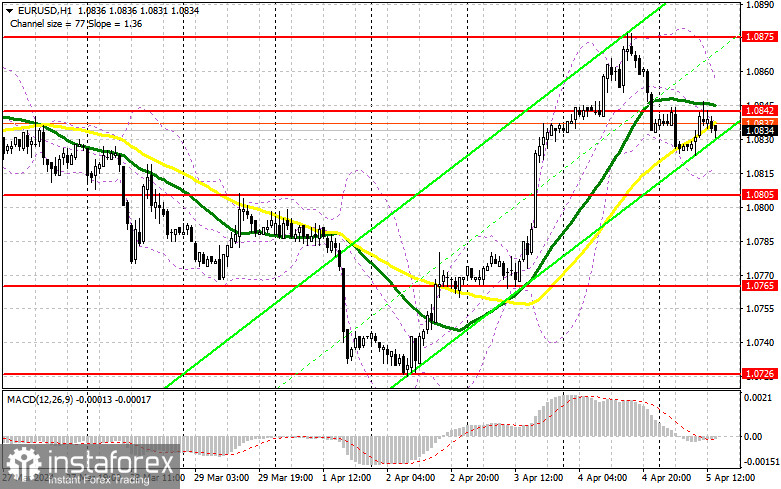

As I noted above, I plan to act on the decline after the formation of a false breakout around the new support area at 1.0805, formed as a result of yesterday's trading. This will be a suitable option for purchases in anticipation of a retest of the resistance at 1.0842, which has yet to be surpassed. Breaking and updating this range from top to bottom will strengthen the pair with a chance to surge to 1.0875. The ultimate target will be the maximum at 1.0909, where I will take profit. In case of a decline in EUR/USD and lack of activity around 1.0805 in the second half of the day after strong US data, pressure on the euro will intensify, leading to a drop with the prospect of revisiting 1.0765, where I expect larger buyers to appear. I plan to enter the market there only after the formation of a false breakout. I will plan to open long positions immediately on a rebound from 1.0726 with a target of a 30-35 point upward correction within the day.

To open short positions on EUR/USD, it is required:

As long as trading remains below 1.0842, further decline in the pair can be expected, and the morning sell signal can be worked out. Another false breakout formation around the resistance at 1.0842, similar to what I discussed earlier, especially after strong US labor market data, will provide a sell signal, leading to a drop in the pair to 1.0805. Breaking and consolidating below this range, as well as a reverse test from bottom to top, will provide another selling point with a drop in EUR/USD to around 1.0765, where buyers will become more active. The ultimate target will be the minimum at 1.0726, where I will take profit. In case of upward movement in EUR/USD in the second half of the day, as well as the absence of bears at 1.0842, which will be possible with weak labor market data, buyers will get a chance for further upward trend building. In this case, I will postpone selling until the test of the next resistance at 1.0875. I will also sell there, but only after an unsuccessful consolidation. I plan to open short positions immediately on a rebound from 1.0909 with a target of a 30-35 point downward correction.

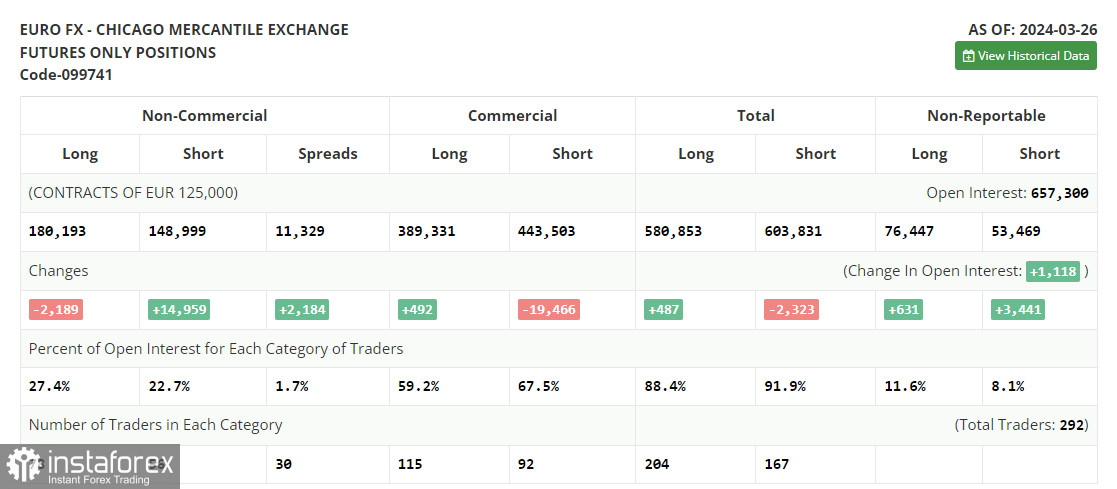

In the COT report (Commitment of Traders) for March 26th, there was a decrease in long positions and an increase in short positions. Despite the recent meeting of the Federal Reserve System and the dovish tone of committee members, no one is going to abandon the sale of risk assets until US inflation returns to decline, as clearly seen from the report. And considering the recent statements of ECB representatives, increasingly hinting at active inflation decline in the Eurozone and the possible soon abandonment of high interest rates - there are no more chances left for the European currency. For this reason, I am betting on further development of the bullish trend in the US dollar and the decline of the euro. The COT report indicates that non-commercial long positions fell by 2,189 to 180,193, while non-commercial short positions jumped by 14,959 to 148,999. As a result, the spread between long and short positions increased by 2,184.

Indicator signals:

Moving Averages

Trading is conducted around the 30 and 50-day moving averages, indicating market uncertainty.

Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classical daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator, around 1.0815, will act as support.

Description of Indicators:

• Moving average (determines the current trend by smoothing volatility and noise). Period 50. Marked in yellow on the chart.

• Moving average (determines the current trend by smoothing volatility and noise). Period 30. Marked in green on the chart.

• MACD indicator (Moving Average Convergence/Divergence). Fast EMA period 12. Slow EMA period 26. SMA period 9.

• Bollinger Bands. Period 20.

• Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions, using the futures market for speculative purposes and meeting certain requirements.

• Long non-commercial positions represent the total long open position of non-commercial traders.

• Short non-commercial positions represent the total short open position of non-commercial traders.

• The total non-commercial net position is the difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română