Highest yields and demand for safe haven assets. These are the two key ingredients for a stronger USD in 2024. At the beginning of the year, few believed that the USD index could rise. By the end of April, only a couple of bears are sticking to their forecasts. For instance, Bank of America predicts the EUR/USD will stabilize at 1.07 in the second quarter, before appreciating to 1.10 in the third quarter and 1.12 in the fourth quarter. They say that the European Central Bank's anticipated rate cuts are factored into current pricing.

However, BofA also said that further delays in Federal Reserve rate cuts might push EUR/USD below 1.05 or even towards parity. On the contrary, if inflation might remain elevated globally, it will put major central banks on pause and put pressure on the US dollar. Allow me to disagree with this.

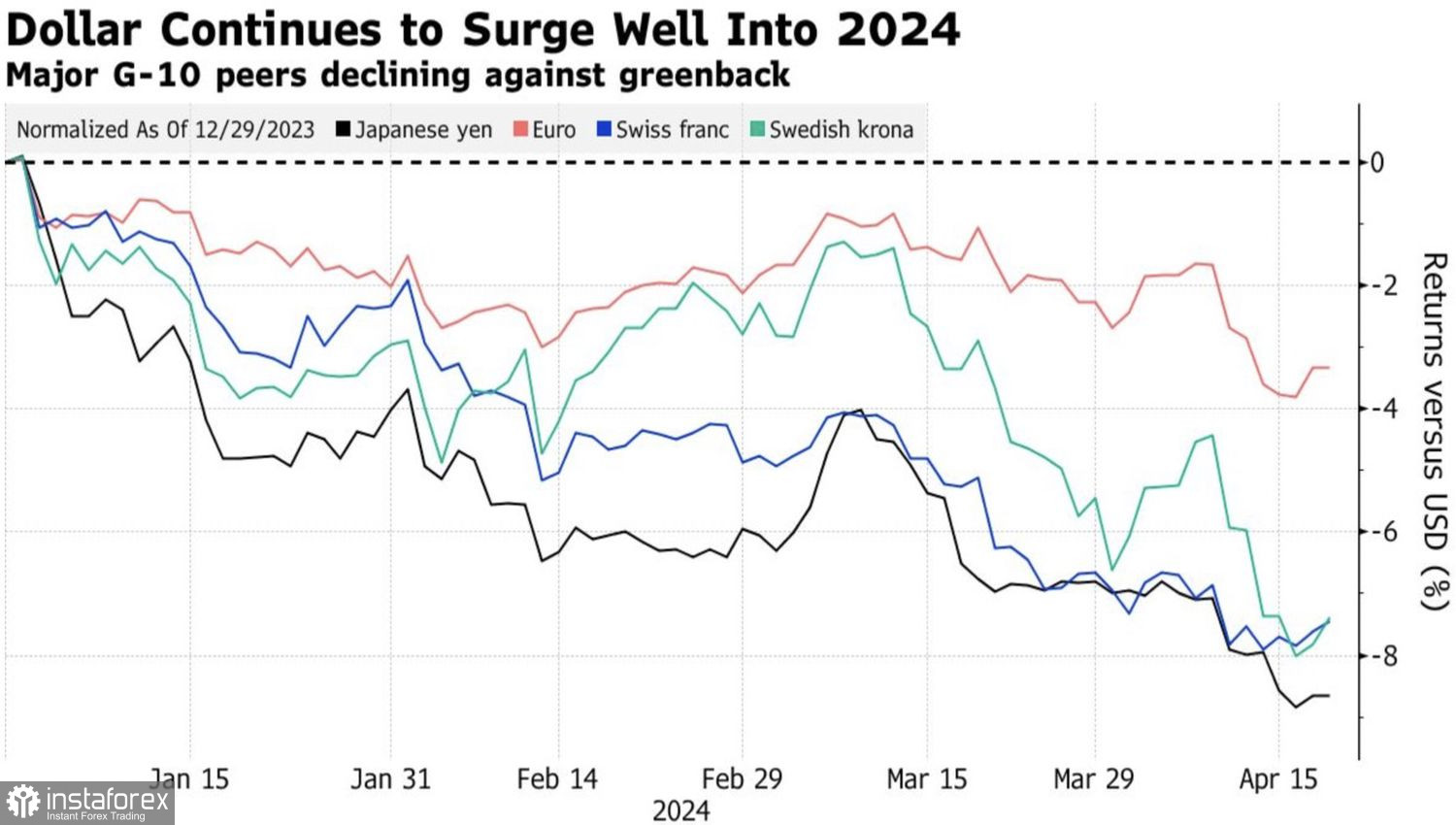

Dynamics of major world currencies against the US dollar

The American economy stands above all others. The IMF revised its forecast for 2024 U.S. growth to 2.7%, which is twice as fast as its closest competitor in the G7. The US is capable of withstanding high interest rates. Can others do the same? I highly doubt it. The longer borrowing costs remain at a high level, the higher the risks of recession in the Eurozone or Britain. It's not surprising that members of the Governing Council are talking about the need to ease the ECB's monetary policy in June. Failure to do so in time could cause irreparable damage to their own economies.

The resilience of the US GDP is due to higher productivity, artificial intelligence technologies, migration, and a free fiscal policy. Bloomberg respondents see gross domestic product expanding by 2.4% on average in 2024. The figure looks understated compared to the Atlanta Fed GDPNow Estimate of +2.9%. Not to mention Goldman Sachs' forecast of +3.1%.

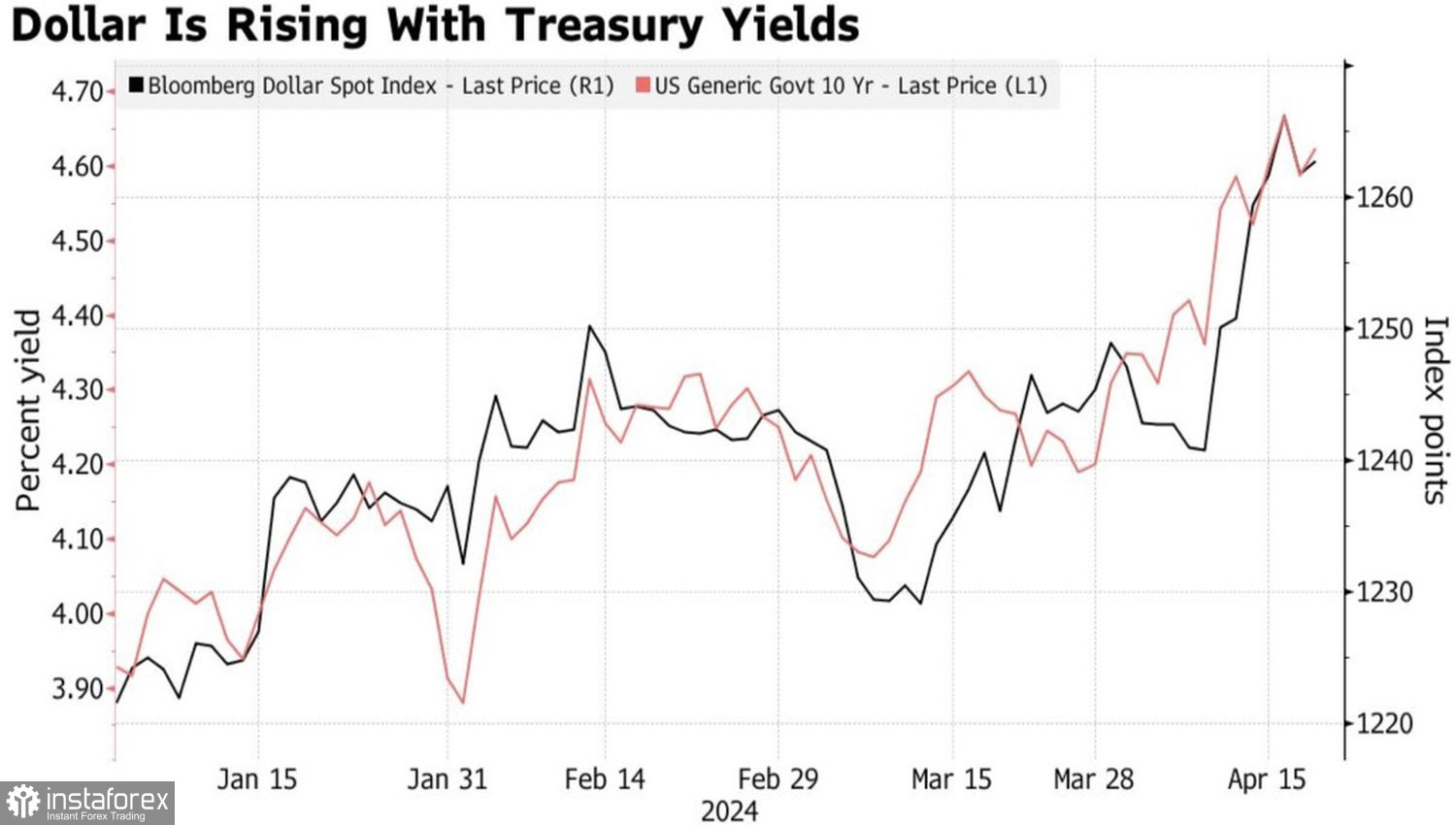

A strong economy cannot have low inflation and low interest rates. The rally in Treasury bond yields is the US dollar's guiding star in 2024. And it risks continuing as the market increasingly talks about the Fed possibly resuming its monetary tightening cycle.

Dynamics of the dollar and US bond yields

According to the dollar smile theory, the greenback outperforms when the US economy is either booming or in a deep slump, with weakness during periods of moderate growth. Currently, the EUR/USD bears are benefiting from American exceptionalism. But if the Fed's rival central banks keep rates unchanged for a long time, the USD index will take on increased risks of a recession in the global economy.

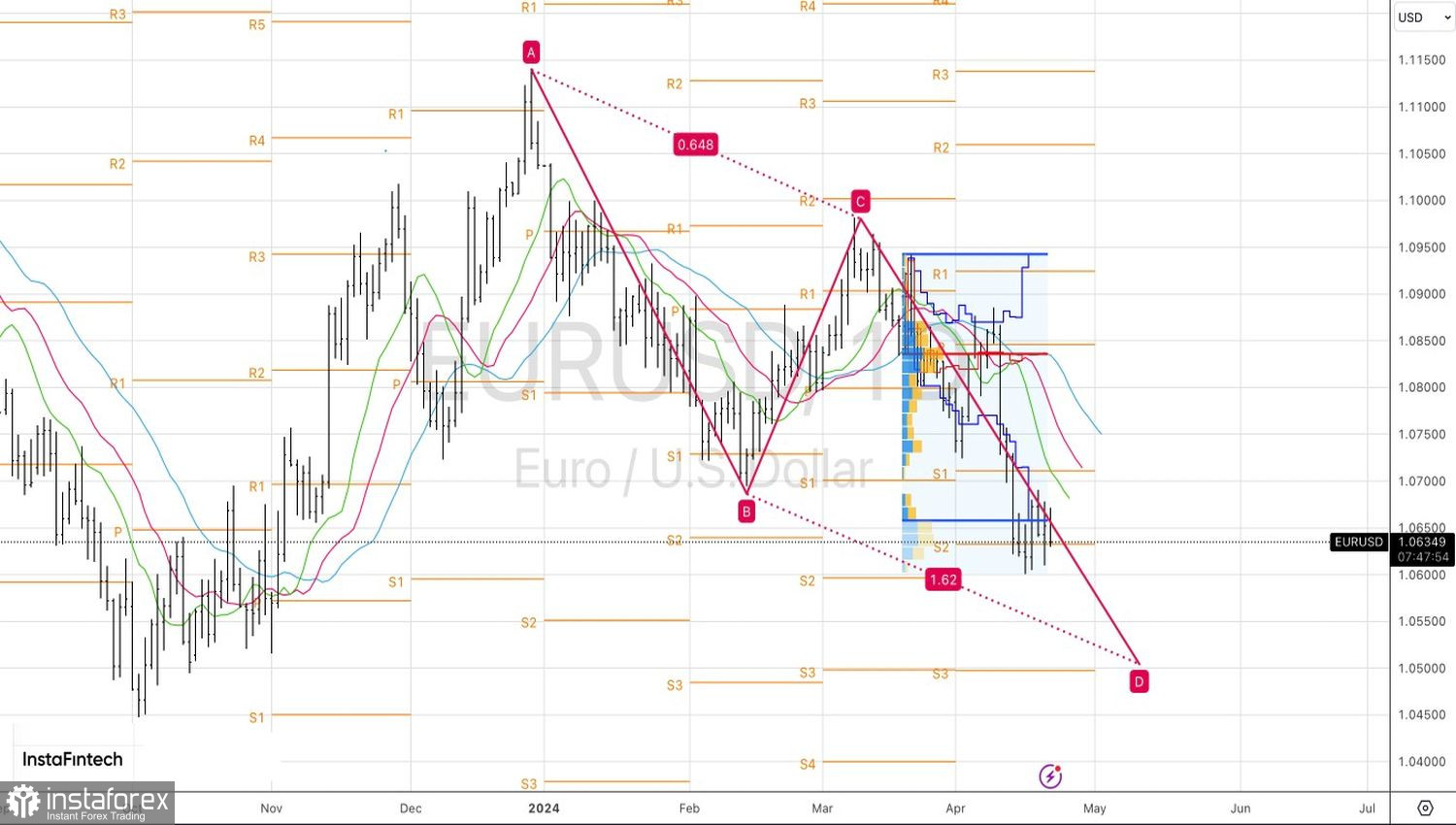

Technically, on the daily chart, the fact that the bulls can't win back the pin bar and stay above the lower boundary of the fair value range of 1.0655-1.0945 were the first signs of their weakness. The market is returning to a downtrend, and in such conditions, traders should consider selling towards 1.05.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română