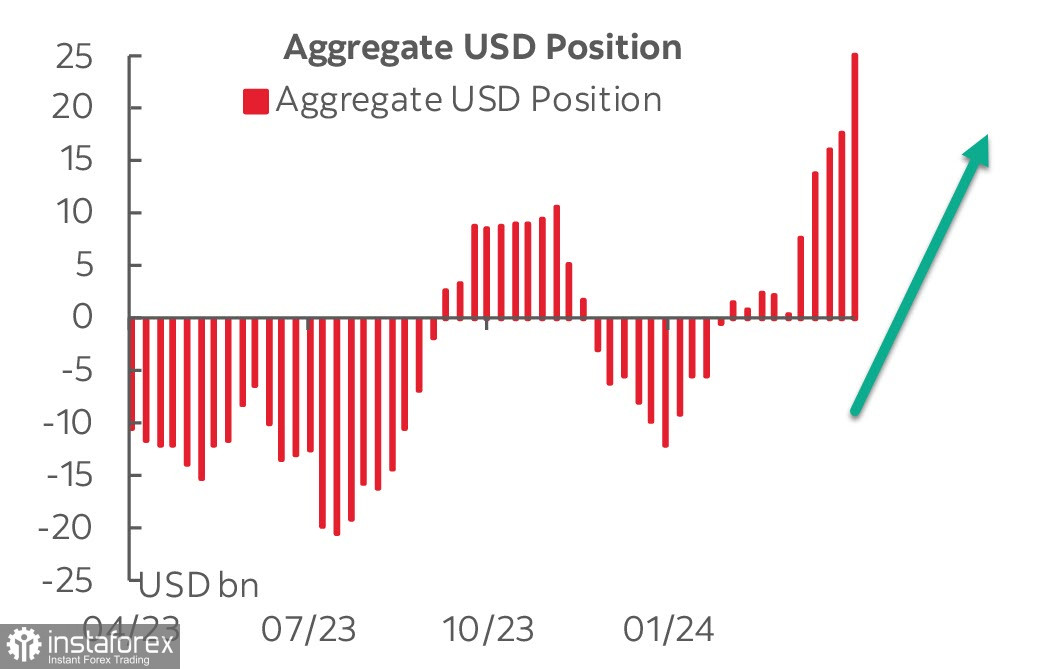

The net long USD position increased by $7.8 billion to $25.5 billion over the reporting week, hitting a 5-year high. Speculative positioning remains firmly bearish, with no signs of slowing down. The euro suffered the greatest losses, losing $2.8 billion, along with the Canadian dollar and the British pound.

Market repositioning is linked to revisions of forecasts for the first Federal Reserve rate cut and the prospect of heightened geopolitical escalation.

US retail sales have been strong, and some of the apparent slowdown in January and February has been corrected, making the assumption that strong US consumer activity and signs of resilient inflation are keeping interest rates from falling for the foreseeable future relevant again.

Federal Reserve Chair Powell supported the recent price action in the U.S. interest rate market, saying that the latest string of inflation reports show "lack of progress" and adds that "it's appropriate to allow restrictive policy further time to work. We have time to let the incoming data guide our decisions on policy."

The first estimate of the US GDP for the first quarter will be released on Thursday. It is expected to be around 2.25% y/y or slightly higher, with the Atlanta Fed's GDPNow model forecasting 2.9%, which is above consensus.

The situation looks pretty clear. The Fed's task was to contain inflation by limiting economic activity, but there are no results yet – inflation is trying to accelerate, just like the economy. Therefore, there is no basis for expecting interest rate cuts, which inevitably raises yields. Last week, 10-year U.S. Treasuries briefly hit 4.695%, the highest since November, and CME futures see the first rate cut in September and no more than two cuts this year.

We expect that the corrective phase in the dollar index will be short-lived, and after a pause, the US dollar will broadly show strength in the currency market. There are hardly any grounds to expect a reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română