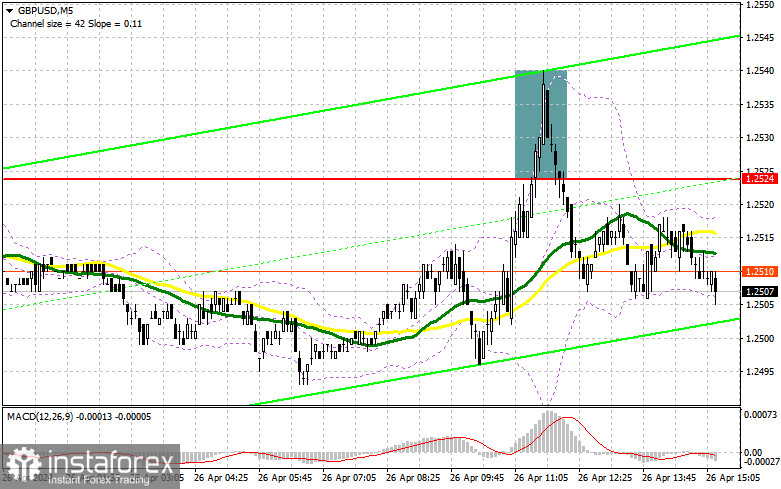

In my morning forecast, I paid attention to the 1.2524 level and planned to make decisions on entering the market from it. Let's look at the 5-minute chart and figure out what happened there. The growth and formation of a false breakdown there after an unsuccessful attempt to gain a foothold above 1.2524 allowed us to get a sell signal, which resulted in a 15-point drop in the pair, after which sellers' interest dried up. In the afternoon, the technical picture was slightly revised.

To open long positions on GBP/USD, it is required:

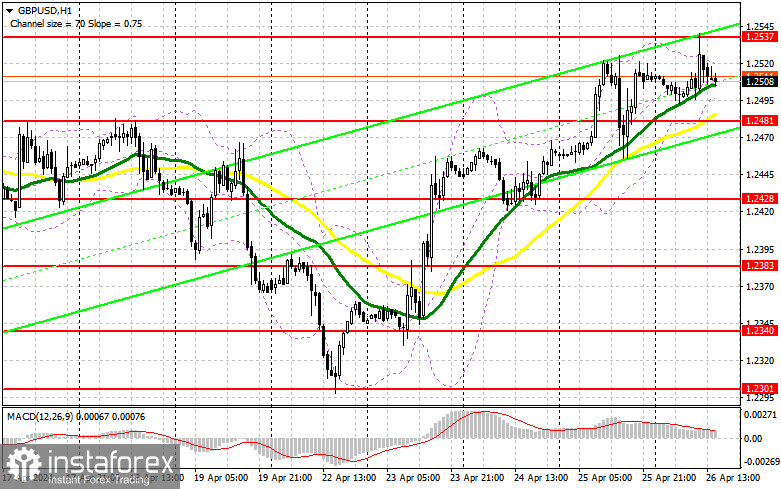

The lack of statistics on the UK did not help the pound gain a foothold near the weekly high and now the entire calculation is based on US data. Only very weak statistics related to inflation will allow the pound to update its weekly maximum again. In the case of strong indicators on the index of personal consumption expenditures, changes in the level of household spending and changes in the level of household income, the pressure on the pair is likely to increase, and buyers will have to think carefully about how to protect the nearest support of 1.2481. The formation of a false breakdown will give an entry point to buy with the aim of rising to the resistance of 1.2537, formed at the end of the first half of the day. A breakout and a top-down test of this range against the background of weak statistics will return the chance for GBP/USD growth, which will lead to new purchases and allow you to get to 1.2573. In the case of an exit above this range, we can talk about a breakthrough to 1.2621, where I'm going to fix profits. A test of this level will be a clear signal for the formation of a new trend. In the scenario of GBP/USD falling and no buyers at 1.2481 in the afternoon, and there are moving averages playing on the buyers' side, sellers will regain control of the market, dragging the pair back into the side channel at the end of the week. In this case, I will look for purchases in the area of 1.2428. The formation of a false breakdown there will be a suitable option for entering the market. It is possible to open long positions on GBP/USD immediately on a rebound from 1.2383 in order to correct 30-35 points within a day.

To open short positions on GBP/USD, you need:

The bears have every chance to continue the pair's decline, but for this they need to take 1.2471. If the US data disappoints, most likely GBP/USD will continue to grow within the framework of the new trend. In this case, I will postpone sales until the 1.2537 resistance test, formed at the end of the first half of the day. Only the formation of a false breakdown there will make it possible to verify the presence of large sellers in the market, which will lead to a fall in GBP/USD to the area of 1.2481, where the moving averages are located slightly lower. A breakout and a reverse bottom-up test of this range will increase the pressure on the pair, giving the bears an advantage and another entry point to sell with the aim of updating 1.2428. The ultimate target will be the minimum of 1.2383, where I will take profit. In the scenario of a GBP/USD rise and the absence of bears at 1.2537 in the second half of the day, bulls will have the opportunity to continue building an upward trend with upward movement toward resistance at 1.2573. I will only enter short positions there on a false breakout. If there is no activity there, I recommend opening short positions on GBP/USD from 1.2621, counting on the pair's rebound downwards by 30-35 points within the day.

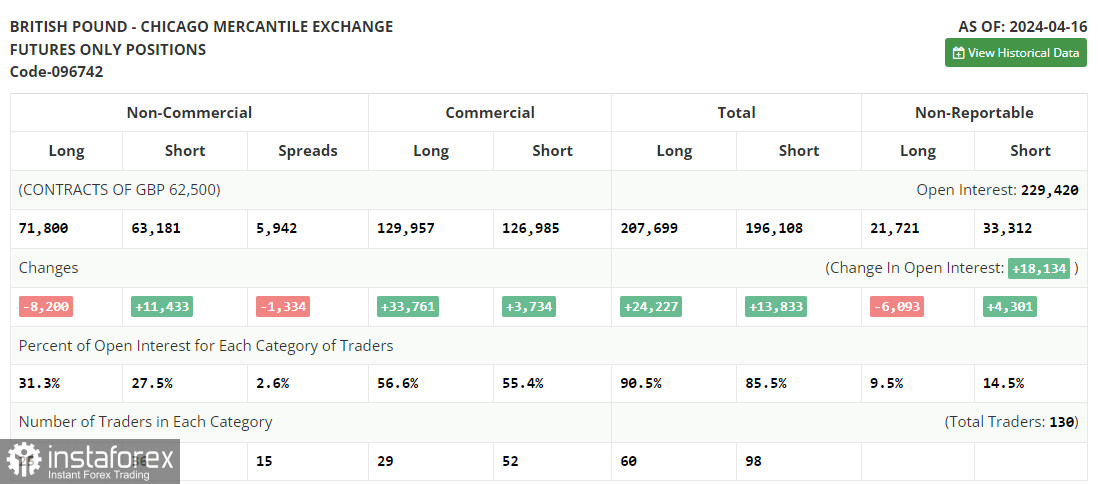

In the COT report (Commitment of Traders) for April 16, there was a sharp reduction in long positions and an increase in short positions. Pound buyers continue to leave the market, and there are objective reasons for this: recent inflation data from the UK and the US indicated the need for further combating price growth, which will surely force central banks to maintain a tough stance. Considering that the UK economy suffers from all of this much more than the US economy, it is not surprising why pressure on the British pound has sharply increased. New statements from regulator representatives also negatively affected bullish prospects for the pound. Adding to all this is the need to maintain a tough stance by the Federal Reserve, so it's unlikely to expect a strong bullish market in the GBP/USD pair. In the latest COT report, it is stated that long non-commercial positions decreased by 8,200 to 71,800, while short non-commercial positions increased by 11,433 to 63,181. As a result, the spread between long and short positions decreased by 1,334.

Indicator signals:

Moving Averages

Trading is conducted above the 30 and 50-day moving averages, indicating a bullish market.

Note: The period and prices of moving averages considered by the author are on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1.

Bollinger Bands

In case of a decline, the lower boundary of the indicator will act as support around 1.2495.

Indicator Description:

Moving average (determines the current trend by smoothing volatility and noise). Period - 50. Marked in yellow on the chart. Moving average (determines the current trend by smoothing volatility and noise). Period - 30. Marked in green on the chart. MACD indicator (Moving Average Convergence/Divergence). Fast EMA - period 12. Slow EMA - period 26. SMA - period 9. Bollinger Bands. Period - 20. Non-commercial traders - speculators, such as individual traders, hedge funds, and large institutions using the futures market for speculative purposes and meeting certain requirements. Long non-commercial positions represent the total long open position of non-commercial traders. Short non-commercial positions represent the total short open position of non-commercial traders. The net non-commercial position is the difference between the short and long positions of non-commercial traders. English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română