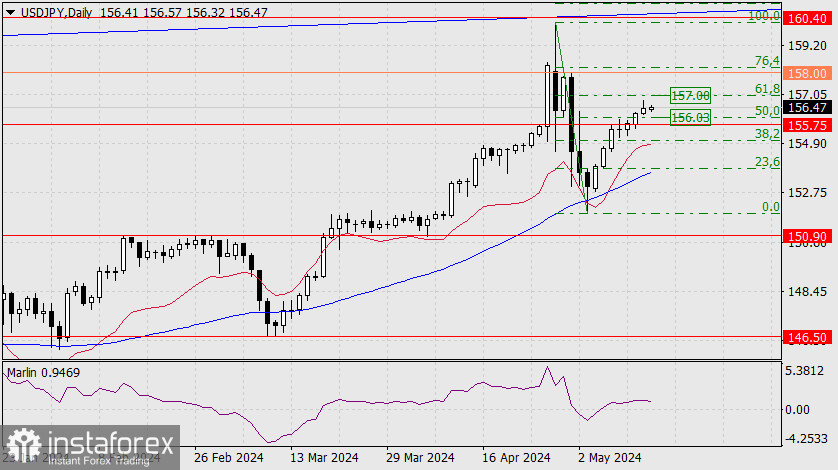

USD/JPY

The USD/JPY pair is entering a complex period of consolidation. On the daily timeframe, it is within the Fibonacci range of 50.0-61.8%. The target support at 155.75 is below this range.

If the price consolidates below this level, it could move towards the 23.6% Fibonacci level, which is approaching the MACD line. However, as long as the signal line of the Marlin oscillator moves sideways, a story similar to the period from March 20 to April 9 may continue. The only difference is that back then the consolidation led to a sharp rise, whereas this time it might result in a sharp decline.

On the hourly chart, the price is consolidating above the balance and MACD indicator lines. The MACD line is declining and entering the lower range at the 50.0% Fibonacci level on the daily chart. Below this range, there could be a third support level at 155.75 for the period from May 10 to May 13. The Marlin oscillator is in the bearish territory, indicating a 60% probability that the price will fall.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română