EUR/USD

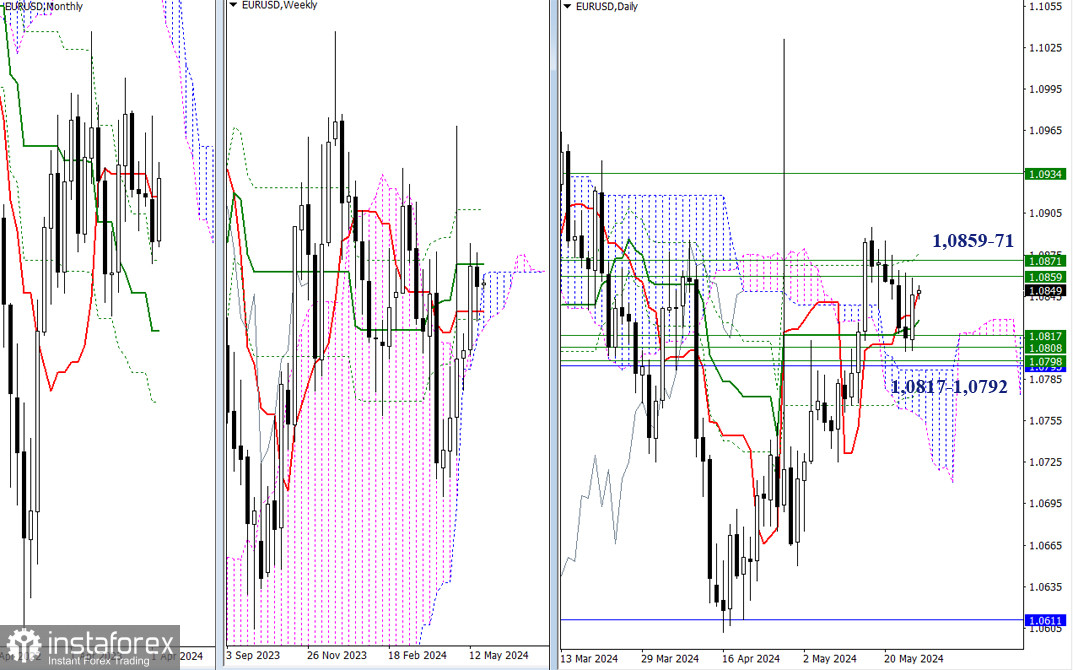

Higher timeframes

Last week ended with a rebound from the support area. If the bulls can maintain their momentum, confirm, and continue the rebound, they could overcome the nearest resistances at 1.0859 – 1.0871 (weekly levels) and re-enter the bullish territory relative to the weekly Ichimoku cloud, opening up new prospects. However, if we can't confirm the current bias, the bears will once again have to contend with support levels across different timeframes, converging around 1.0817 – 1.0792. Traders should only consider new bearish targets once the price has firmly consolidated below these levels.

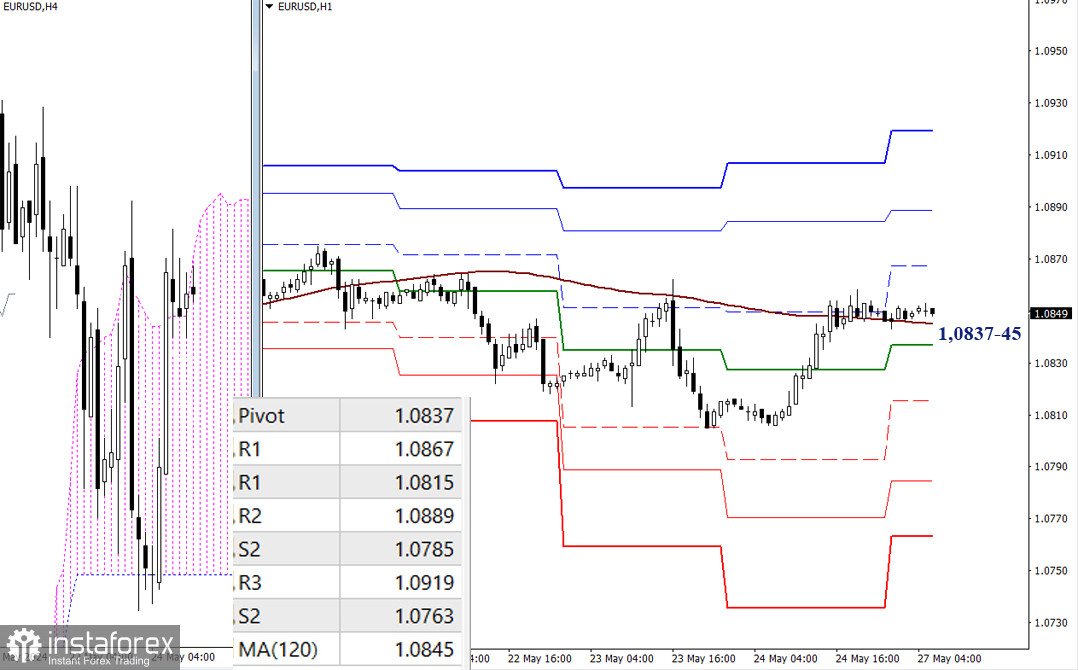

H4 – H1

On the lower timeframes, the bulls have currently managed to rise above the key levels of 1.0837 (central Pivot level) and 1.0845 (weekly long-term trend). The market is currently calm but also uncertain. If the bulls continue to develop the process, their intraday targets will be the resistances of the classic Pivot levels (1.0867 – 1.0889 – 1.0919). If the bears take over the initiative, after reclaiming the key levels, they will aim for the supports of the classic Pivot levels (1.0815 – 1.0785 – 1.0763).

***

GBP/USD

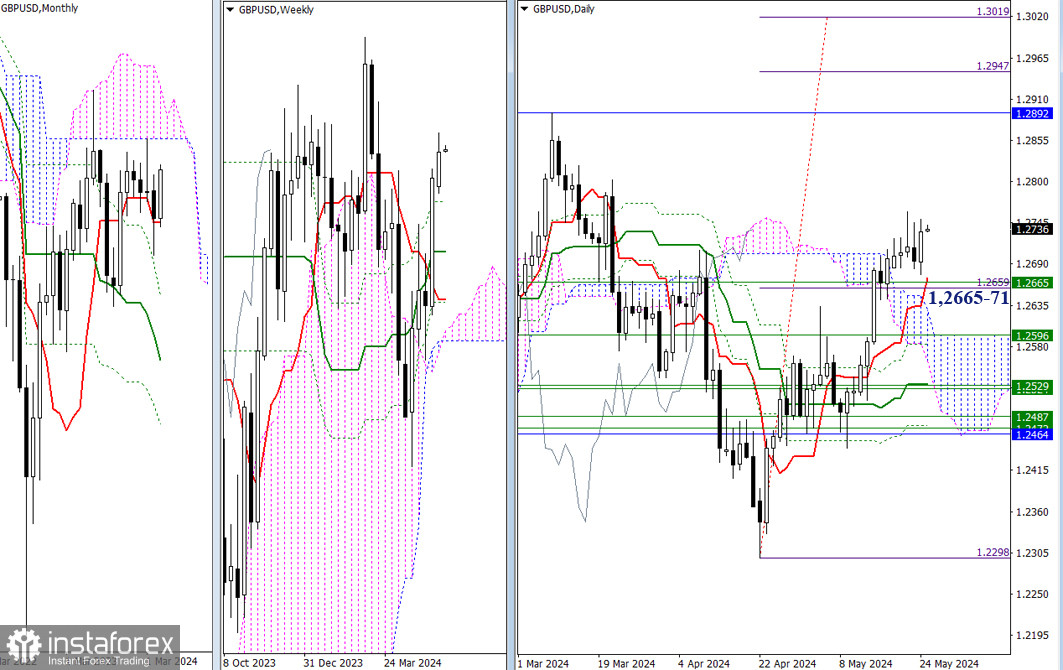

Higher Timeframes

The bulls refuse to give up. They managed to close last week on a good note, maintaining their momentum. If the movement continues, the bulls, by surpassing last week's high of 1.2760, will aim for new targets—the lower boundary of the monthly cloud at 1.2892 and the daily target for breaking through the Ichimoku cloud at 1.2947 – 1.3019. In the current situation, the nearest supports are the weekly level at 1.2665 and the daily short-term trend at 1.2671. A breakout and consolidation below these levels could shift priorities and strengthen the bearish bias.

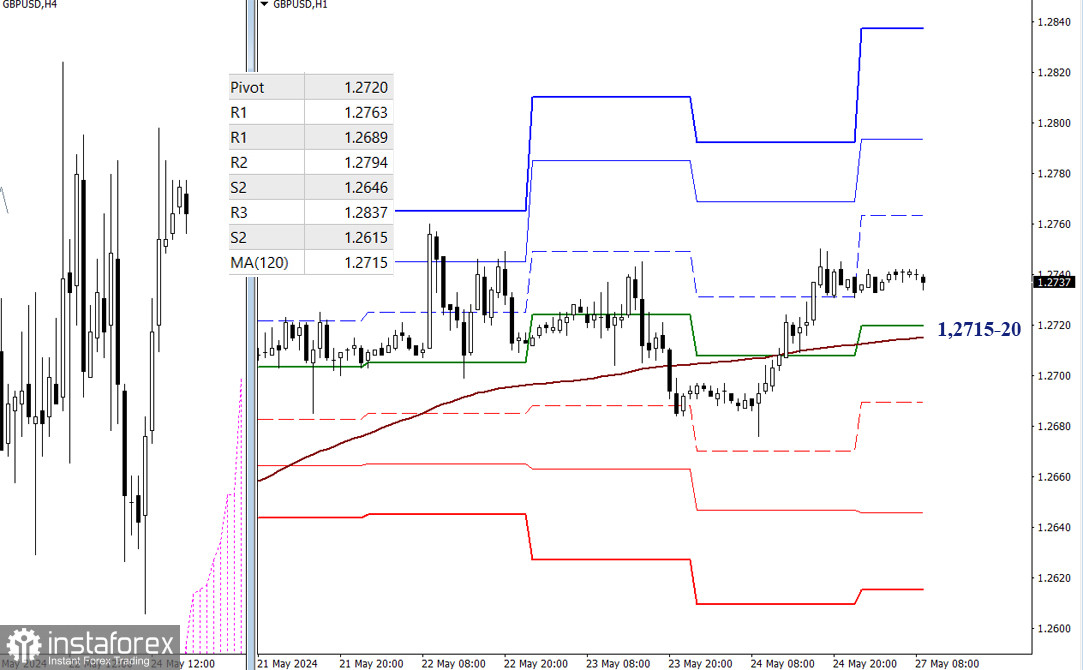

H4 – H1

The bulls currently have the advantage on the lower timeframes, as the pair is trading above key levels, and today it can converge around 1.2715-20 (central Pivot level + weekly long-term trend). The classic Pivot levels are additional reference points for the intraday movement. For the bulls, the resistances at 1.2763, 1.2794, and 1.2837 are of interest, while the bears are focused on the supports at 1.2689, 1.2646, and 1.2615.

***

The technical analysis of the situation uses:

Higher timeframes - Ichimoku Kinko Hyo (9.26.52) + Fibonacci Kijun levels

Lower timeframes - H1 - Pivot Points (classic) + Moving Average 120 (weekly long-term trend)

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română