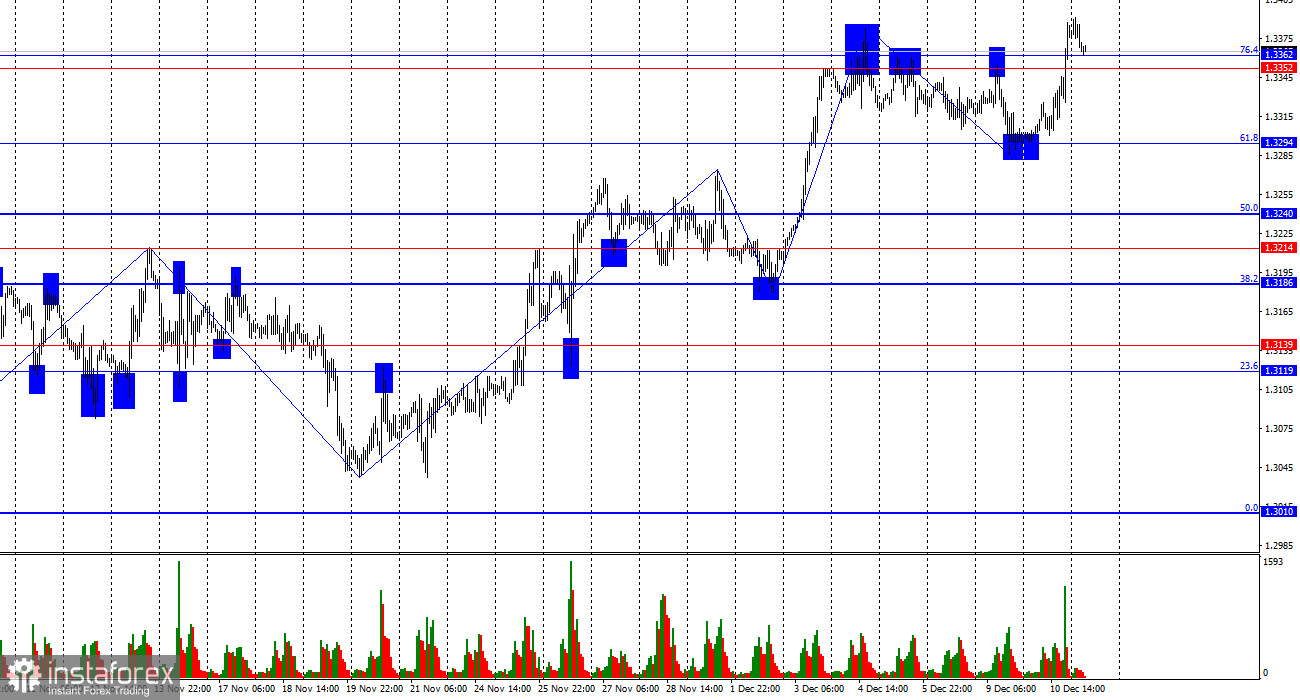

The wave structure turned "bullish" two weeks ago. The last completed upward wave broke the previous peak, while the last downward wave failed to break the previous low. Thus, the trend remains "bullish" at this time. The news background for the pound has been weak in recent weeks, but bears have fully priced it in — and the news background in the US also leaves much to be desired. Bulls are finding it difficult to continue their attacks, but their position is currently stronger than that of the bears. We can declare the end of the "bullish" trend only if the price falls below 1.3294.

The news background on Wednesday was not as straightforward as it might have seemed. The FOMC Committee made the expected decision to ease monetary policy by another 0.25%, but at the same time made it clear that the beginning of 2026 will be characterized by maintaining the current interest rate level. Moreover, throughout 2026 the FOMC plans only one additional easing, and Jerome Powell stated at the press conference that any further rate change will depend on inflation. In other words, the Federal Reserve has done everything possible to stop the decline in the US labor market, and now the focus shifts to inflation, which has been rising throughout the second half of 2025. Thus, the next easing of monetary policy should not be expected until inflation slows below 2.7–2.8%, when the Fed is confident that the indicator is on a downward trajectory. This information suggests that next year the Fed's policy will be neutral, while a "dovish" stance would be more appropriate for further weakening of the US dollar. Next week, the Bank of England will hold its last meeting of 2025 and will likely lower the interest rate as well. The market's and the pound's reaction to this event will answer the question of whether the "bullish" trend will remain until the end of the year.

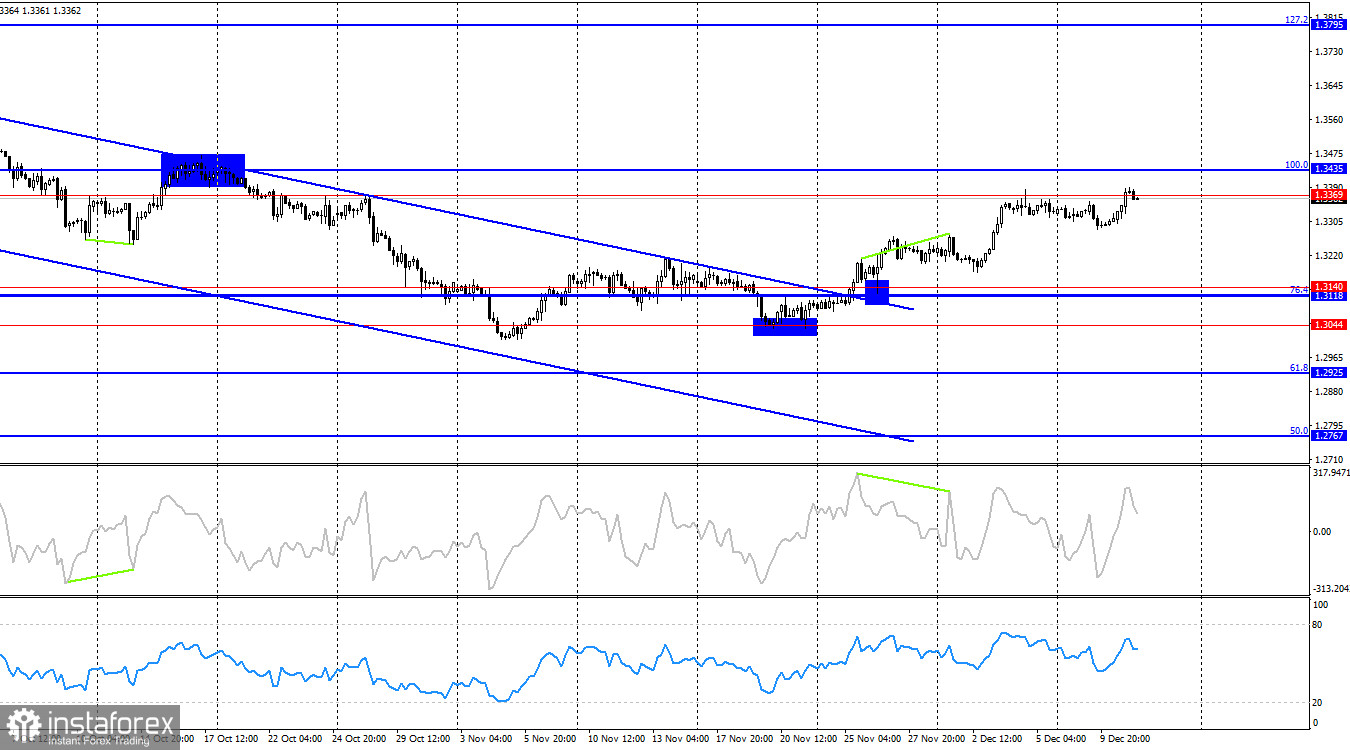

On the 4-hour chart, the pair consolidated above the descending trend channel, above the 1.3118–1.3140 level, and rose toward the level of 1.3369. A rebound from this level will favor the US dollar and a moderate decline toward 1.3140. Consolidation above 1.3435 would allow for expectations of further growth toward the 127.2% Fibonacci level at 1.3795. No new emerging divergences are observed today.

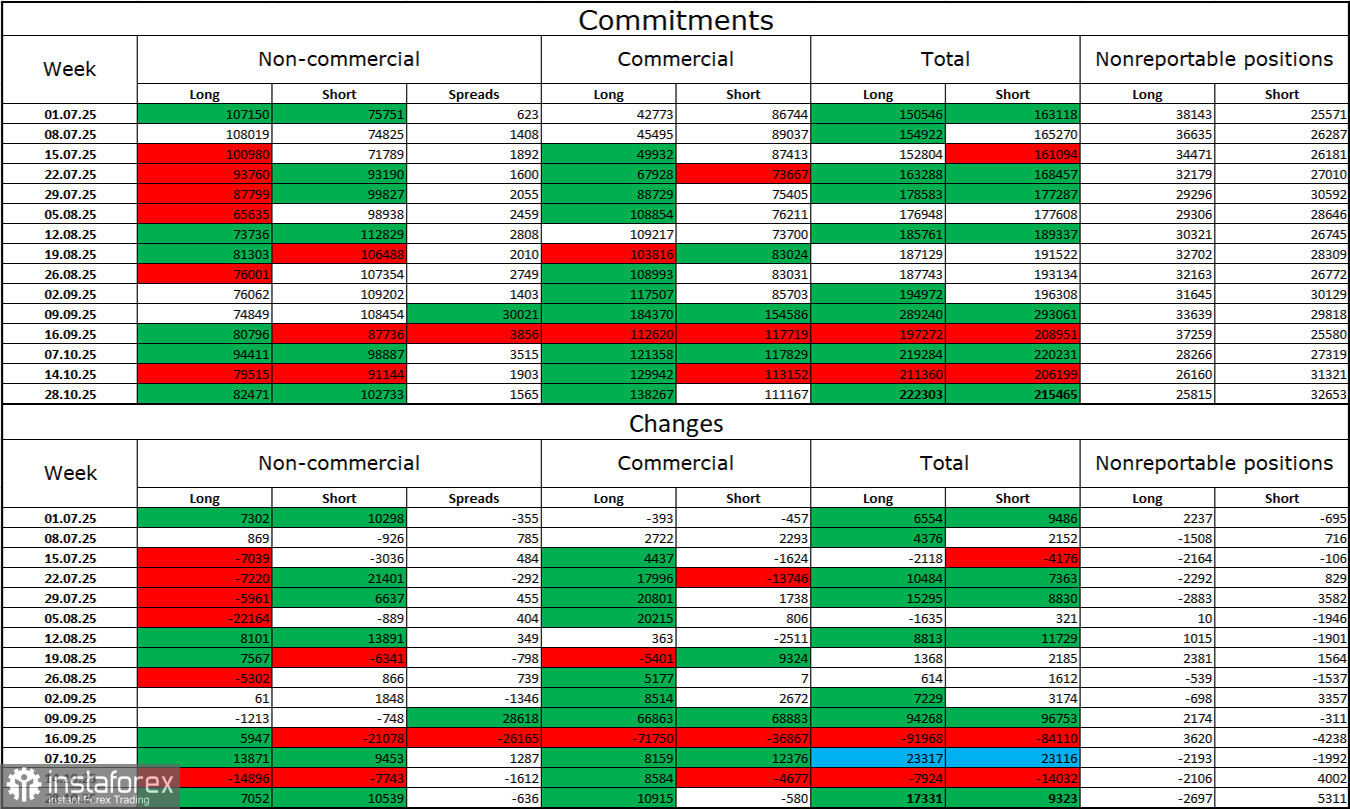

Commitments of Traders (COT) Report:

The sentiment of the "Non-commercial" trader category became less "bullish" in the last reporting week, but that reporting week was a month and a half ago — October 28. The number of long positions held by speculators increased by 7,052, while short positions increased by 10,539. The current ratio between longs and shorts is effectively 82,000 versus 102,000. However, I remind you that this data is from mid-October. The situation may now be entirely different.

In my opinion, the pound still looks less "dangerous" than the dollar. In the short term, the US currency is in demand, but I believe this is a temporary phenomenon. Donald Trump's policies have led to a sharp decline in the labor market, and the Federal Reserve is forced to continue easing monetary policy to stop rising unemployment and stimulate job creation. Thus, if the Bank of England may lower rates one more time, the FOMC may continue easing throughout 2026. The dollar weakened significantly in 2025, and 2026 may not be any better for it.

News Calendar for the US and the UK:

United States – Initial Jobless Claims (13:30 UTC).

On December 11, the economic calendar contains only one entry, a completely secondary one. The news background will not affect market sentiment on Thursday.

GBP/USD Forecast and Trader Recommendations:

Sell positions can be opened today if the price closes below the 1.3352–1.3362 level on the hourly chart, with a target of 1.3294. Buy positions could have been opened upon a rebound from 1.3294 on the hourly chart with a target of 1.3352–1.3362. These trades may be kept open today with a target of 1.3425 until a close below 1.3352.

The Fibonacci grids are built from 1.3470–1.3010 on the hourly chart and from 1.3431–1.2104 on the 4-hour chart.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română