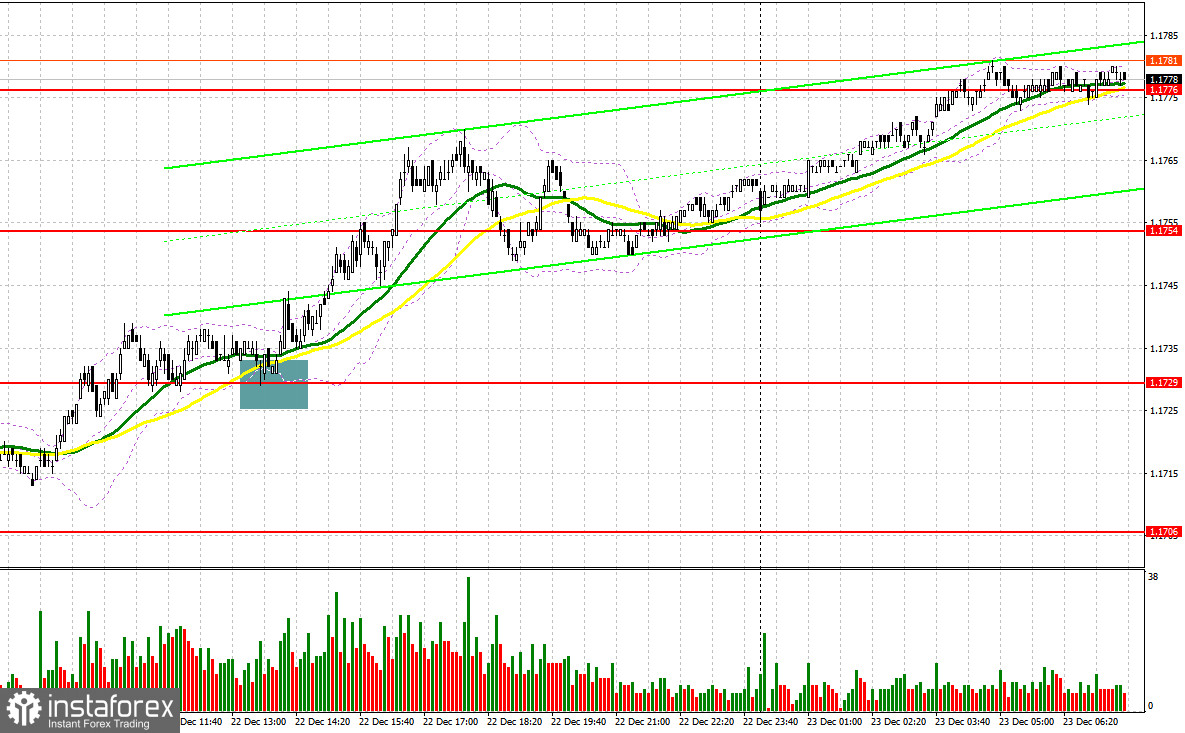

Yesterday, several market entry points were established. Let's take a look at the 5-minute chart and analyze what happened. In my morning forecast, I highlighted the level of 1.1729 and planned to base my decisions on it. The rise and formation of a false breakout around 1.1729 provided an entry point to sell the euro, but it did not lead to a significant decline in the pair. In the afternoon, the breakout and retest of 1.1729 prompted euro purchases, driving the pair up by more than 30 pips.

For opening long positions on EUR/USD:

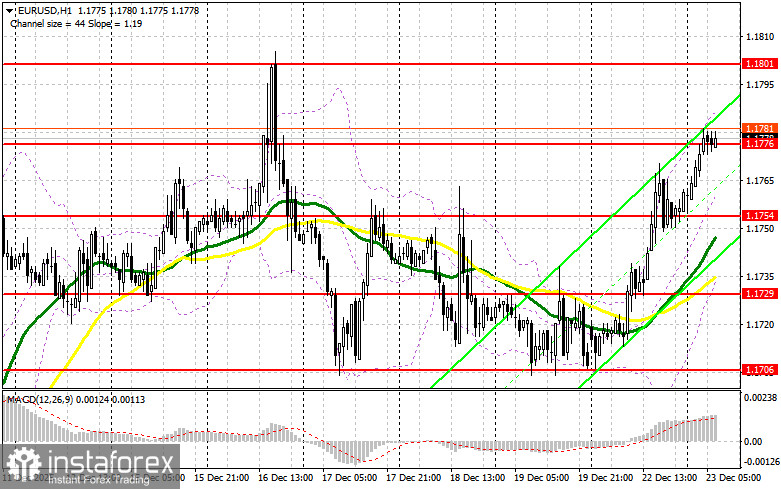

The absence of reports from the US helped the euro continue to rise against the dollar, as the probability of further interest rate cuts by the Federal Reserve significantly increased. In the first half of the day, there are no data points that could harm the euro's bullish trend. The only report of interest is the German import price index, but it is unlikely to change anything significantly. If EUR/USD experiences a slight decline, I expect to see the first signs of buyers around the support level at 1.1754, as seen in yesterday's activity. Only after a false breakout there can a long position be considered, targeting a recovery to around 1.1776, where trading is currently taking place. A breakout and retest of this range, similar to what I analyzed earlier, will confirm the decision to buy euros in anticipation of a larger jump towards 1.1801. The furthest target will be the high at 1.1840, where I will take profits. Testing this level will reinforce the bullish market for the euro. If EUR/USD declines and there is a lack of activity near 1.1754, pressure on the pair will increase, which could lead to a larger downward movement for the euro. In that case, bears will attempt to reach the next interesting level of 1.1729. Only a false breakout there would be a suitable condition to buy euros. Long positions can be opened immediately on a bounce from 1.1706, targeting an upward correction of 30-35 pips within the day.

For opening short positions on EUR/USD:

Sellers are not showing activity for now, and there are no significant reasons for them to do so. In the current conditions, it is better to act at the highest level possible. If EUR/USD continues to rise in the first half of the day amid the absence of important data, bears can only rely on the nearest resistance at 1.1776. A false breakout there will provide an entry point for short positions targeting the support level of 1.1754. A breakout and consolidation below this range, along with a retest from below, will present an additional opportunity to open short positions with a movement towards the area of 1.1729. The furthest target will be the 1.1706 area, where I will take profits. If EUR/USD moves higher along the trend and bears are not active around 1.1776, buyers will have a good opportunity to continue developing the bullish market. In that case, it is better to postpone short positions until the larger level of 1.1801 is reached. Selling there will only occur after a failed consolidation. I plan to open short positions immediately on a bounce from 1.1840, targeting a downward correction of 30-35 pips.

Recommendations for Further Reading:

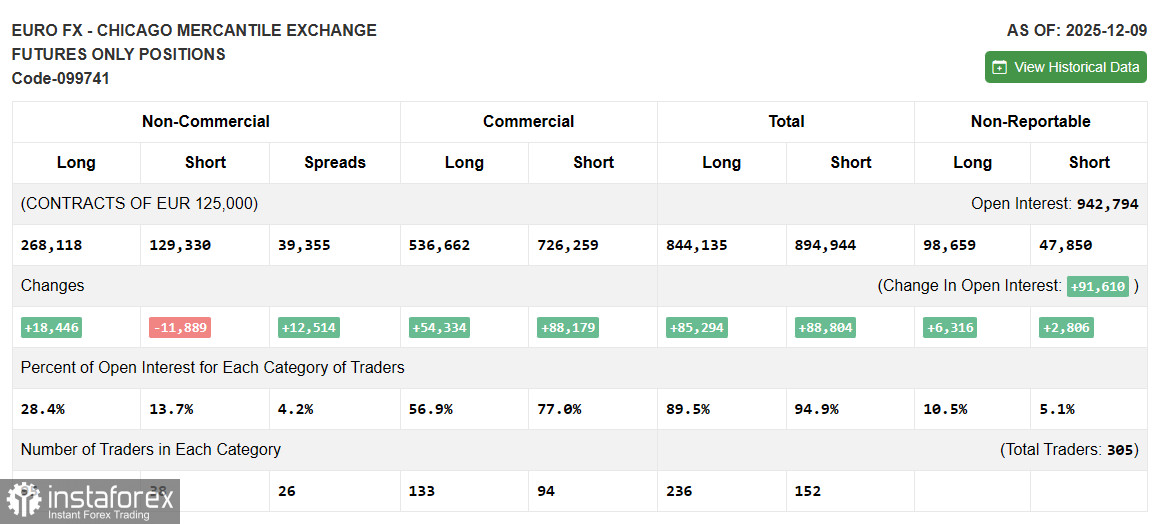

Due to the shutdown in the US, fresh data on the Commitment of Traders (COT) is not being published. As soon as a current report is prepared, we will publish it immediately. The latest relevant data is only from December 9.

In the COT report (Commitment of Traders), there was an increase in long positions and a decrease in short positions. However, this data is not suitable for building a strategy, so it doesn't require special attention. The COT report indicates that long non-commercial positions rose by 18,446 to 268,118, while short non-commercial positions decreased by 11,889 to 129,330. As a result, the spread between long and short positions increased by 12,889.

Indicator Signals:

- Moving Averages: Trading is above the 30-day and 50-day moving averages, which indicates further growth for the euro.

- Note: The period and prices of moving averages are considered by the author on the hourly H1 chart and differ from the overall definition of classic daily moving averages on the daily D1 chart.

- Bollinger Bands: In the event of a decline, the indicator's lower boundary around 1.1735 will act as support.

Description of Indicators:

- Moving Average (period 50): Indicates the current trend by smoothing volatility and noise; marked in yellow on the chart.

- Moving Average (period 30): Indicates the current trend by smoothing volatility and noise; marked in green on the chart.

- MACD Indicator (Moving Average Convergence/Divergence): Fast EMA - period 12; Slow EMA - period 26; SMA - period 9.

- Bollinger Bands: Period - 20.

- Non-Commercial Traders: Speculators, such as individual traders, hedge funds, and large institutions, who use the futures market for speculative purposes and meet certain requirements.

- Long Non-Commercial Positions: Represents the total long open position of non-commercial traders.

- Short Non-Commercial Positions: Represents the total short open position of non-commercial traders.

- Total Non-Commercial Net Position: The difference between the short and long positions of non-commercial traders.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română