The GBP/USD currency pair traded within a narrow range on Tuesday. The pound has not often been flat lately, but a holiday week is a holiday week. Since December 23, the price has been between 1.3474 and 1.3533 and is not going to leave this range until the New Year bells ring. Thus, we do not expect strong, trending moves either today or on Friday.

An upward trend for the British pound remains, clearly visible on the 4-hour, daily, and even weekly timeframes. Many analysts now doubt the pound's ability to continue rising in 2026. We want to reassure them a little. First, remember that we are not opposed to a downtrend or any strengthening of the US currency. If the trend (local or global) begins to change, and factors supporting the dollar appear, we will be the first to point out that dollar strength should be expected. However, the point is that the trend is not changing, and there are no growth factors for the dollar.

With great stretching, one could attribute the Bank of England's potential monetary easing in 2026 as a factor favoring the dollar. However, recall that in the second half of 2025, the dollar clearly rose more than it deserved. We have repeatedly noted that the pound was falling this autumn with or without reason. Therefore, we consider such a sharp decline in the pair to be illogical and unfair.

Now, the price has settled above the Senkou Span B line on the daily timeframe, and the EUR/USD pair is acting as a support for the pound. Explanation: The euro and the pound historically show a high degree of correlation. A drop in the euro is very rarely not accompanied by a decline in the pound, and vice versa. Since the euro is on the verge of breaking out of its sideways channel and resuming an uptrend, it is extremely hard to imagine a pound decline in 2026. The pound also has its own growth drivers. In the second half of the year, we saw a classic three-wave correction, which is therefore most likely complete. Although the BoE intends to continue monetary easing, it is still not a competitor to the Federal Reserve.

We remind you that Fed policy is much more important than BoE policy. The dollar remains the world reserve currency, so the fate of the "safe haven" and the "safest asset" depends on the Fed's stance and policy. In recent years, the dollar has been losing its "safe" status, and the global trend could have changed back in 2022, when the pound dropped almost to price parity with the dollar. No trend is eternal. With the arrival of Donald Trump, who absolutely does not need an expensive dollar, the probability of the US currency's decline has sharply increased.

What do we have in the end? GBP/USD has been in an uptrend for three years, and Trump is doing everything to ensure the dollar continues to fall.

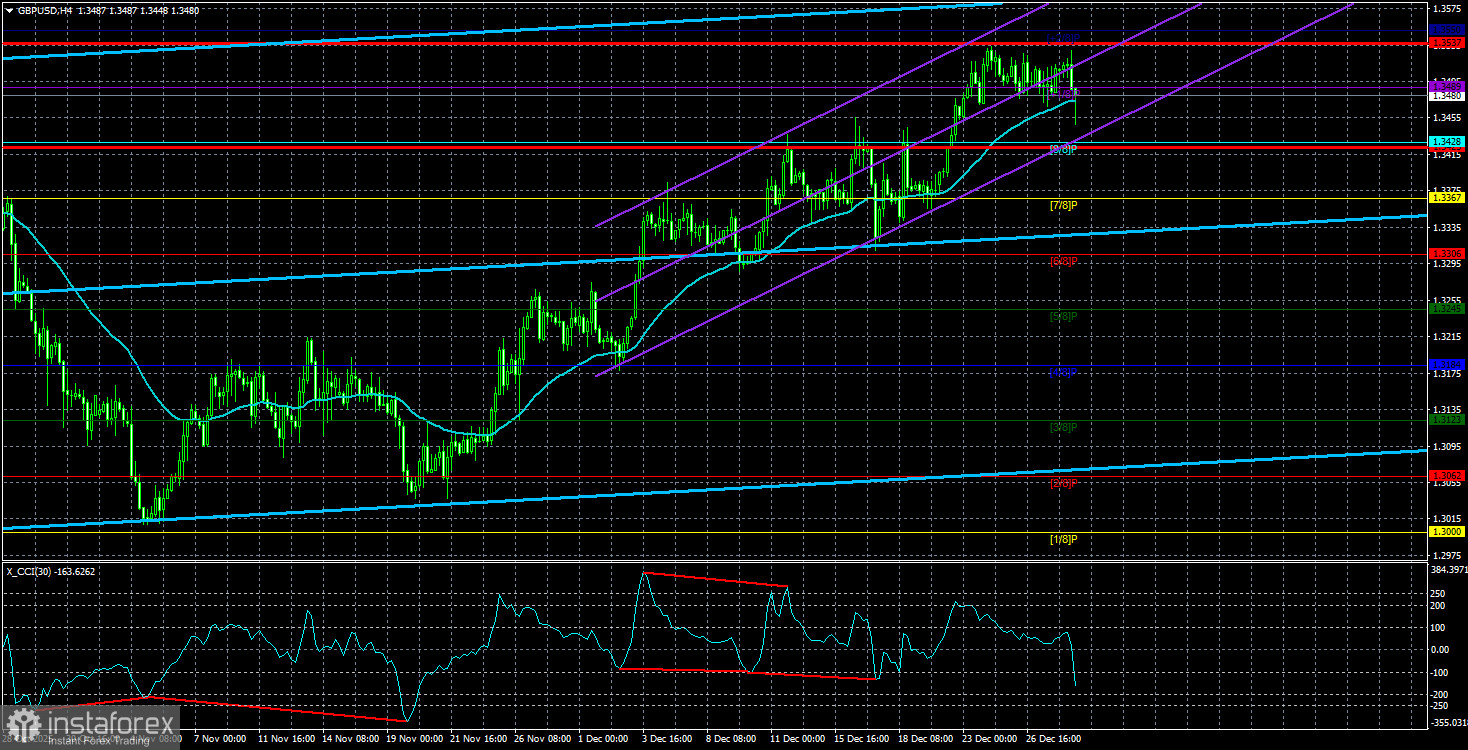

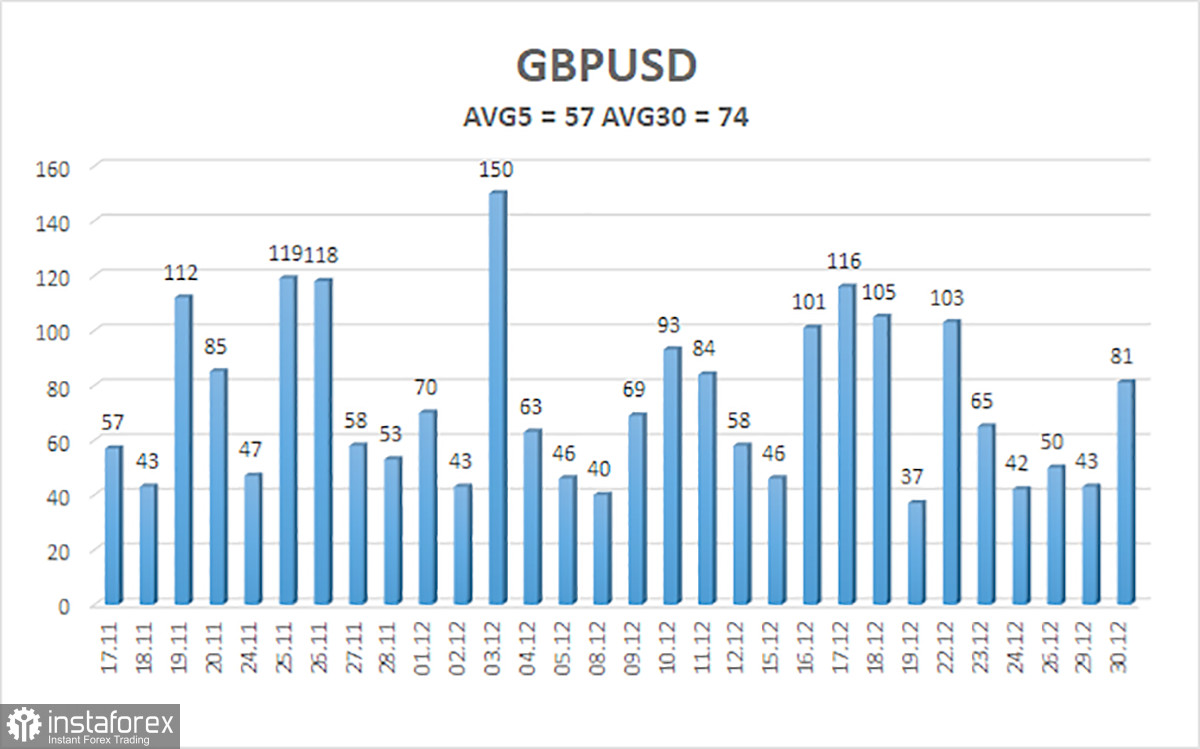

The average volatility of GBP/USD over the last 5 trading days is 57 pips. For the pound/dollar pair, this value is "medium-low." On Wednesday, December 31, we therefore expect movement inside the range bounded by 1.3423 and 1.3537. The higher linear regression channel has turned up, indicating trend recovery. The CCI indicator entered the oversold area 6 times over recent months and formed numerous "bullish" divergences, which repeatedly warned of a resumption of the uptrend.

Nearest support levels:

S1 – 1.3428

S2 – 1.3367

S3 – 1.3306

Nearest resistance levels:

R1 – 1.3489

R2 – 1.3550

Trading recommendations:

The GBP/USD pair is attempting to resume the 2025 uptrend, and its long-term prospects remain unchanged. Trump's policy will continue to put pressure on the dollar, so we do not expect the dollar to strengthen. Thus, long positions with a target of 1.3550 remain relevant for the near term while the price is above the moving average. A price located below the moving average line suggests considering small shorts with targets of 1.3428 and 1.3367 on technical grounds. From time to time, the US currency shows corrections (in the global context), but for the trend to strengthen, it needs signs of an end to the trade war or other global positive factors.

Explanations for the illustrations:

- Linear regression channels help determine the current trend. If both are directed in the same way, the trend is currently strong;

- The moving average line (settings 20,0, smoothed) defines the short-term tendency and the direction in which one should currently trade;

- Murray levels are target levels for moves and corrections;

- Volatility levels (red lines) are the probable price channel in which the pair will spend the next 24 hours, based on current volatility readings;

- The CCI indicator — its entry into the oversold area (below -250) or into the overbought area (above +250) means that a trend reversal in the opposite direction is approaching.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română