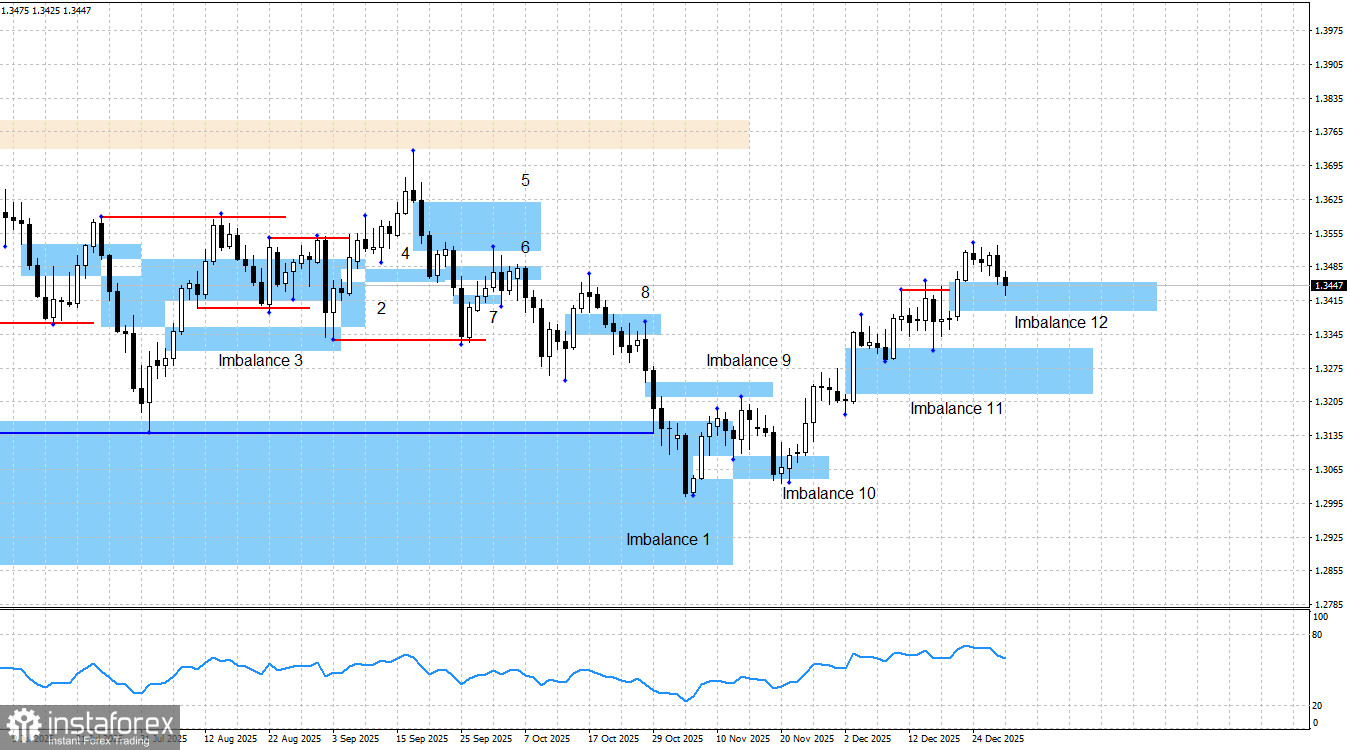

Last week, another "bullish" imbalance 12 was formed, and today the price has worked it off. Thus, today or on Friday the price may react to it, and traders may receive a new "bullish" signal. I would like to note that the "imbalance" pattern usually consists of three candles, but in our case it can be considered to consist of four. Let me remind you that an imbalance is a "price slippage." On the chart, it is clearly visible that it took two daily candles, which the price literally flew through. Above the pound, there are practically no significant resistance zones. Thus, there are no "bearish" patterns, no reactions to bearish patterns, and no liquidity grabs from bullish swings.

The current chart picture is as follows. The "bullish" trend in the pound can be considered complete, but the "bullish" trend in the euro is not. Thus, the European currency can pull the pound upward for as long as necessary. Bulls pushed off from bullish imbalance 1, bullish imbalance 10, and bullish imbalance 11 twice. A large number of buy signals were formed. A new support zone—imbalance 12—has formed below. Thus, I still expect growth toward the yearly highs, around the 1.3765 level.

On Wednesday, the news background was absent. At the beginning of the new year, new graphical buy signals may appear, which will allow traders to open buy positions again.

In the United States, the overall news background remains such that nothing but a decline in the dollar can be expected in the long term. The situation in the U.S. remains quite difficult. The government shutdown lasted a month and a half, and Democrats and Republicans agreed on funding only until the end of January. There has been no U.S. labor market data for a month and a half, and the latest figures can hardly be considered positive for the dollar. The last three FOMC meetings ended with "dovish" decisions, and the latest labor market data allows for a fourth consecutive easing of monetary policy in January. In my view, the bulls have everything they need to continue a new offensive and return to the yearly highs.

A "bearish" trend would require a strong and stable positive news background for the U.S. currency, which is difficult to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline in September and October. Too many risk factors remain hanging like dead weight over the dollar. On what basis do the bears intend to push the pound further down if a bearish trend is supposedly forming now? I cannot answer this question, so I do not believe that the dollar's decline will continue. If new bearish patterns appear, a potential decline in the pound sterling can be reconsidered.

News Calendar for the U.S. and the UK:

On January 2, the economic calendar contains no noteworthy events. The influence of the news background on market sentiment on Friday will be absent.

GBP/USD Forecast and Trading Advice:

For the pound, the picture remains favorable for traders. Three "bullish" patterns have already played out, signals have been formed, and traders can maintain buy positions. I see no informational grounds for a strong decline in the pound in the near future.

A resumption of the "bullish" trend could have been expected already from imbalance zone 1. At the moment, the pound has reacted to imbalance 1, imbalance 10, and imbalance 11. As a target for potential growth, I am considering the 1.3725 level, but the pound may rise much higher—albeit next year. If "bearish" patterns form, the trading strategy may need to be reconsidered, but this week it is more likely that another "bullish" signal will be received from imbalance 12.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română