Trade review for Wednesday:

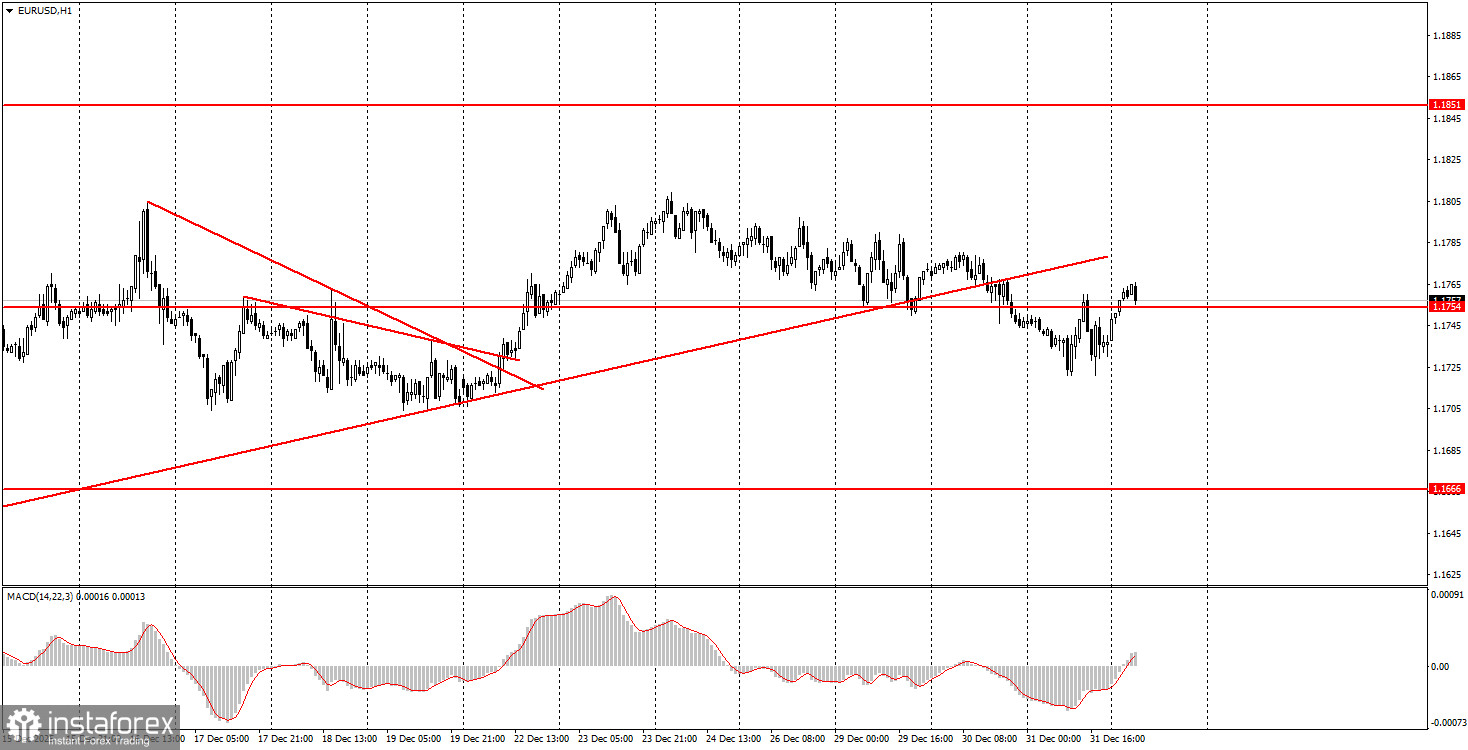

1H chart of the EUR/USD pair

The EUR/USD currency pair showed nervous, mixed movements on Wednesday, but recall that it was December 31. That says it all. For obvious reasons, there were no macroeconomic or fundamental events that day in either the US or the Eurozone; the market closed in the evening and reopened only last night, then closed again in the evening for the weekend. Essentially, the holidays are over, but the holidays continue. Formally, the price this week breached the ascending trendline, but we do not treat this as a trend change. EUR/USD continues to trade near the upper boundary of the sideways channel on the daily timeframe, between 1.1400 and 1.1830. Very soon (when the market fully "recovers" from the holidays), we expect a new test of this area. Next week, traders will begin receiving macroeconomic data, so moves may become stronger and more attractive.

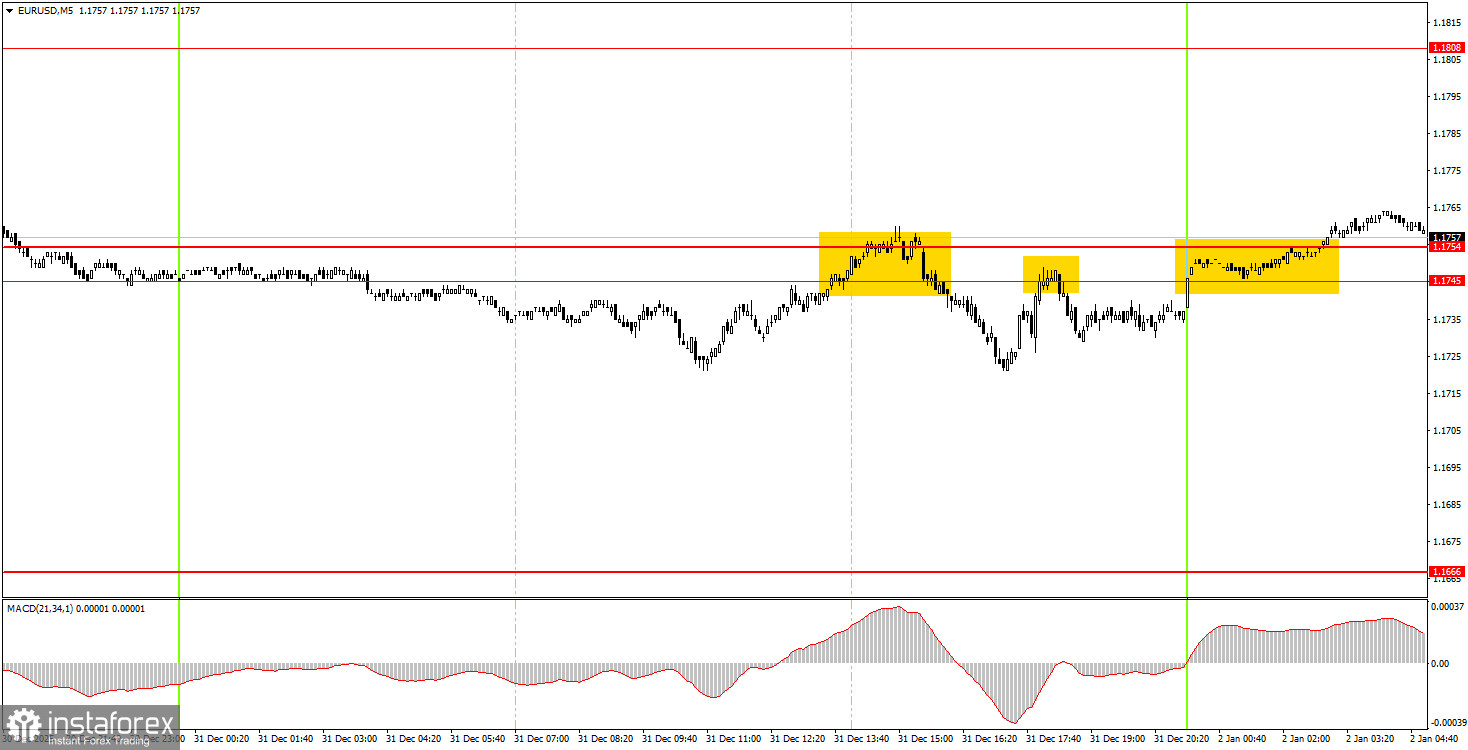

5M chart of the EUR/USD pair

On the 5-minute timeframe, two sell trade signals were formed on Wednesday in the form of two rebounds from the 1.1745–1.1755 area. Beginner traders could have reasonably traded those signals if they had wished to open trades several hours before market close and before the New Year. Last night, the pair broke through the 1.1745–1.1755 area, which is a buy signal. However, moves today may again be very weak, so we do not expect strong euro growth.

How to trade on Friday:

On the hourly timeframe, EUR/USD continues forming an uptrend despite the trendline breach. The price may soon retest the 1.1800–1.1830 area, which is the upper boundary of the daily flat. It is quite possible that this time we will see an exit from the six-month sideways channel. The overall fundamental and macroeconomic backdrop remains very weak for the US dollar; therefore, we expect the pair to rise in the medium term.

On Friday, beginner traders can trade from the 1.1745–1.1754 area. A close above this area allows opening long positions with a target of 1.1808. A close below this area allows opening shorts with a target of 1.1666.

On the 5-minute timeframe, consider the levels 1.1354–1.1363, 1.1413, 1.1455–1.1474, 1.1527–1.1531, 1.1550, 1.1584–1.1591, 1.1655–1.1666, 1.1745–1.1754, 1.1808, 1.1851, 1.1908, 1.1970–1.1988. No important events or releases are scheduled in the EU or the US for Friday. Thus, we may again face very weak moves today.

Main rules of the trading system:

- Signal strength is assessed by the time required for the signal (rebound or breakout) to form. The less time required, the stronger the signal.

- If two or more trades near a level were opened on false signals, then all subsequent signals from that level should be ignored.

- In a flat market, any pair can generate many false signals or none at all. In any case, at the first signs of a flat, it is better to stop trading.

- Trades are opened during the period between the start of the European session and the middle of the American session, after which all trades must be closed manually.

- On the hourly timeframe, MACD signals should be traded only when there is good volatility and a trend confirmed by a trendline or trend channel.

- If two levels are too close to each other (from 5 to 20 pips), they should be considered as an area of support or resistance.

- After the price moves 15 pips in the correct direction, set the stop loss to breakeven.

What is on the charts:

Support and resistance price levels — levels that serve as targets when opening buys or sells. Take Profit levels can be placed near them.

Red lines — channels or trendlines that display the current tendency and show the preferred trading direction.

MACD indicator (14,22,3) — histogram and signal line — an auxiliary indicator that can also be used as a source of signals.

Important speeches and reports (always included in the news calendar) can significantly affect the movement of the currency pair. Therefore, during their release, one should trade as cautiously as possible or exit the market to avoid a sharp reversal of price against the prior move.

Beginner forex traders should remember that not every trade can be profitable. Developing a clear strategy and sound money management are the keys to long-term success in trading.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română