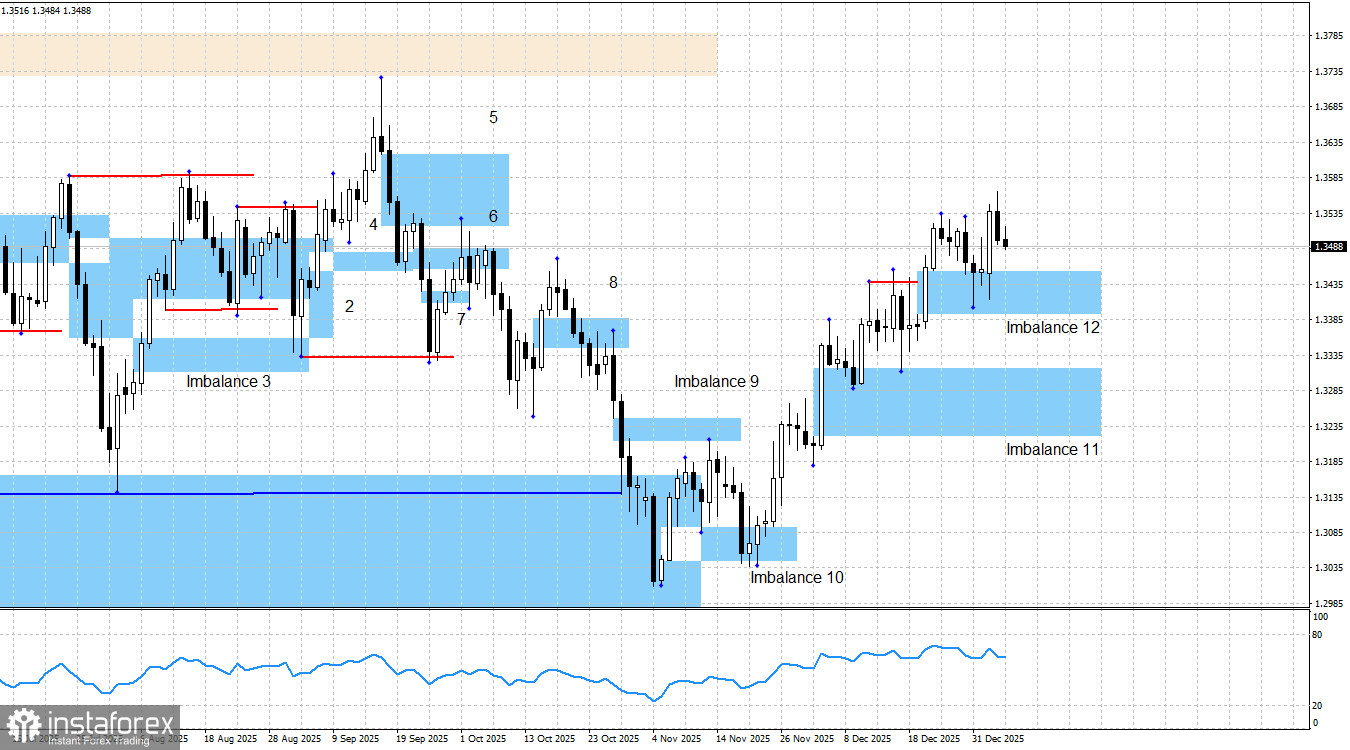

The GBP/USD pair has bounced off the "bullish" imbalance zone 12, which is a new buy signal. Despite the decline in the British pound's quotes last week, the bullish trend remains intact, and the bulls continue to dominate the market. Monday could have damaged the bullish chart picture, but it did not. Now all the trump cards are in the hands of buyers of the British pound, and all that remains for them is to hope for weak U.S. economic data on the labor market and unemployment this week. In my opinion, the probability of such an outcome is quite high. I would also note that there are currently no bearish signs or signals. There are no bearish patterns, nor are there any liquidity sweeps of bullish swings.

At the moment, "bullish" imbalance 12 remains the only viable pattern. If it turns out to be invalidated, this will not lead to an immediate cancellation of the bullish trend. It would only delay the next rise of the pound. Of course, traders are interested not in a pause but in a trend, but this week much will depend on U.S. economic data. Let me remind you that traders' main concerns are the U.S. labor market and the unemployment rate. The worse the reports on these indicators come out, the higher the chances of seeing a renewed offensive by bullish traders.

The current chart picture is as follows. The bullish trend in the pound may be considered complete, but the bullish trend in the euro is not. Thus, the European currency may pull the pound upward for as long as necessary—or vice versa. The bulls bounced off bullish imbalance 1, bullish imbalance 10, bullish imbalance 11 twice, and now also from imbalance 12, which is also bullish. Therefore, I still expect growth toward the 2025 highs—around the 1.3765 level.

On Wednesday, the news background is interesting and important, but so far traders have not received data that would force them to trade more actively. No important reports were released in the UK on Wednesday, and in the U.S. only the ADP report was published, which disappointed with its neutral reading. Thus, today traders' attention will be focused on the JOLTS report on job openings and the ISM Services PMI in the United States.

In the U.S., the overall news background remains such that, in the long term, nothing but a decline of the dollar can be expected. The situation in the U.S. remains quite difficult. The government shutdown lasted a month and a half, and Democrats and Republicans agreed on funding only until the end of January. There were no U.S. labor market statistics for a month and a half, and the latest data can hardly be considered positive for the dollar. The last three FOMC meetings ended with dovish decisions, and the latest labor market data allows for a fourth consecutive easing of monetary policy in January. In my opinion, the bulls have everything they need to continue a new offensive and return to the yearly highs.

A bearish trend requires a strong and stable positive news background for the dollar, which is hard to expect under Donald Trump. Moreover, the U.S. president himself does not need a strong dollar, as the trade balance would remain in deficit in that case. Therefore, I still do not believe in a bearish trend for the pound, despite the fairly strong decline in September and October. Too many risk factors continue to hang like dead weight on the dollar. What are the bears going to use to push the pound further down if a bearish trend is supposedly forming right now? If new bearish patterns appear, a potential decline of the pound sterling can be reconsidered.

News Calendar for the U.S. and the UK:

- U.S. – Initial Jobless Claims (13:30 UTC).

The economic events calendar for January 8 contains only one entry, which cannot be called important. The impact of the news background on market sentiment on Thursday will be absent.

GBP/USD Forecast and Trading Advice:

The outlook for the pound remains favorable for traders. Four bullish patterns have been worked out, signals have been formed, and traders can maintain buy positions. I see no informational grounds for a strong decline in the pound in the near future.

A resumption of the bullish trend could have been expected already from imbalance zone 1. At the moment, the pound has reacted to imbalance 1, imbalance 10, imbalance 11, and imbalance 12. As a potential growth target, I consider the 1.3725 level, but the pound may rise much higher. If bearish patterns form, the trading strategy may need to be revised, but so far nothing indicates a possible advance by the bears. Therefore, I recommend staying in buy positions.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română