Trade Analysis and Trading Tips for the European Currency

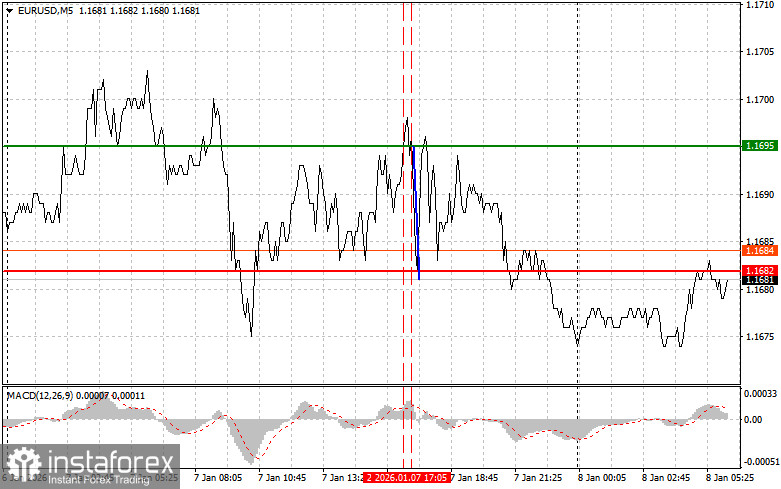

The test of the 1.1695 price level occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upward potential. For this reason, I did not buy the euro. The second test of 1.1695 took place when the MACD was in the overbought zone, which led to the implementation of Sell Scenario No. 2. As a result, the pair declined by 15 points.

The unsatisfactory pace of private-sector job growth in the United States, presented yesterday by the ADP report, prevented the dollar from realizing its growth potential against the euro. Market participants were likely expecting stronger confirmation of labor market resilience following the sharp decline seen in November. The current situation creates a degree of uncertainty, forcing traders to adopt a wait-and-see approach. Yesterday's weak macroeconomic data may indicate a slowdown in the pace of U.S. labor market growth, which puts pressure on the national currency and increases pressure on the Federal Reserve.

Today, key eurozone macroeconomic indicators will be in focus. Attention will be centered on the index reflecting producer price dynamics in the eurozone. This indicator will provide insight into the intensity of inflationary growth in the region's economy and, consequently, into possible actions by the European Central Bank. Rising producer prices may point to the need for a more cautious stance from ECB officials. The eurozone unemployment rate will also be significant. Stability or a decline in this indicator would signal a healthy labor market and its ability to cushion potential economic shocks. Rising unemployment could serve as a warning signal and fuel negative sentiment toward the euro among traders.

As for the intraday strategy, I will rely primarily on the implementation of Scenarios No. 1 and No. 2.

Buy Scenarios

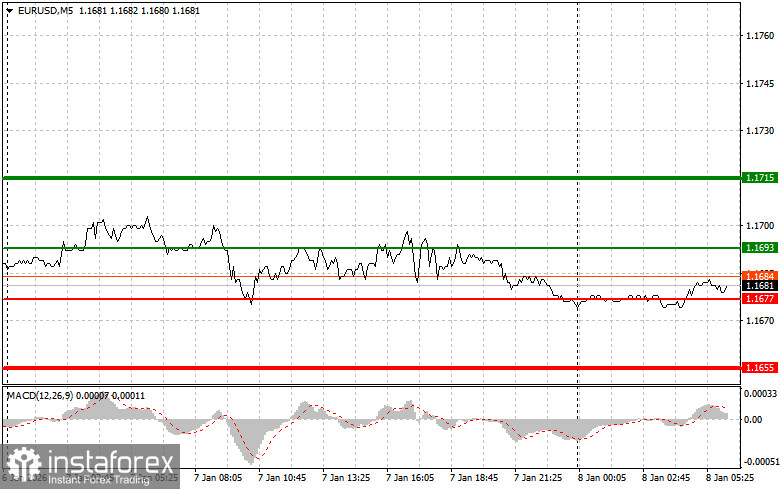

Scenario No. 1: Today, the euro can be bought if the price reaches the 1.1693 level (green line on the chart), with a target of growth toward the 1.1715 level. At 1.1715, I plan to exit the market and also sell the euro in the opposite direction, aiming for a move of 30–35 points from the entry point. Euro growth can be expected after strong data.Important! Before buying, make sure that the MACD indicator is above the zero line and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the euro today if there are two consecutive tests of the 1.1677 price level while the MACD indicator is in the oversold zone. This would limit the pair's downward potential and lead to a reversal upward. A rise toward the opposite levels of 1.1693 and 1.1715 can be expected.

Sell Scenarios

Scenario No. 1: I plan to sell the euro after the price reaches the 1.1677 level (red line on the chart). The target will be the 1.1655 level, where I intend to exit the market and immediately buy in the opposite direction, aiming for a 20–25 point move from that level. Pressure on the pair today may return only after very weak economic data. Important! Before selling, make sure that the MACD indicator is below the zero line and is just beginning to decline from it.

Scenario No. 2: I also plan to sell the euro today if there are two consecutive tests of the 1.1693 price level while the MACD indicator is in the overbought zone. This would limit the pair's upward potential and lead to a downward market reversal. A decline toward the opposite levels of 1.1677 and 1.1655 can be expected.

What Is Shown on the Chart

- Thin green line – entry price at which the trading instrument can be bought;

- Thick green line – projected price level where Take Profit orders can be placed or profits can be manually locked in, as further growth above this level is unlikely;

- Thin red line – entry price at which the trading instrument can be sold;

- Thick red line – projected price level where Take Profit orders can be placed or profits can be manually locked in, as further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to rely on overbought and oversold zones.

Important. Beginner forex traders should be extremely cautious when making entry decisions. Ahead of major fundamental reports, it is best to stay out of the market to avoid being caught in sharp price fluctuations. If you decide to trade during news releases, always place stop-loss orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use proper money management and trade large volumes.

And remember that successful trading requires a clear trading plan, such as the one presented above. Spontaneous trading decisions based solely on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română