The U.S. dollar will once again be the main showrunner in the market over the next five days. Donald Trump will "call the shots," and he will be complemented by the U.S. inflation report. I remind you that for the Fed and the outlook for monetary policy, labor market, unemployment, and inflation indicators are currently extremely important. Last week, a comprehensive package of economic data was released; only the consumer price index is missing. The unemployment and labor-market data did not answer the question unambiguously: only the negative trend in 2025 was reversed, as the unemployment rate fell, but labor-market reports again showed very weak figures. Therefore, the inflation report will have to steer the market in a certain direction. A second consecutive slowdown in inflation will push the Fed to undertake a new round of easing. Maybe not at the January meeting, but already at the March one. If inflation accelerates as a result of December, in my view, the next interest-rate cut will be seen only when the monthly payroll numbers are at least 150,000.

Alongside U.S. economic data, the market is closely monitoring any actions and statements by Donald Trump. I remind you that 2026 began with a military attack on Venezuela that lasted approximately five hours. The country's president, Nicolas Maduro, was captured and sent to the U.S. to stand trial. The trial will not take place soon, and Trump has already adopted bellicose rhetoric toward Mexico. According to him, the country is ruled by cartels, and their main market is the United States. Trump said that U.S. authorities had already managed to cut about 97% of drug supply chains to the U.S. by sea; what remains is to block land-based supplies. And Mexico is the only country bordering the U.S. to the south. Therefore, a military operation in Mexico is a very real prospect, not empty threats.

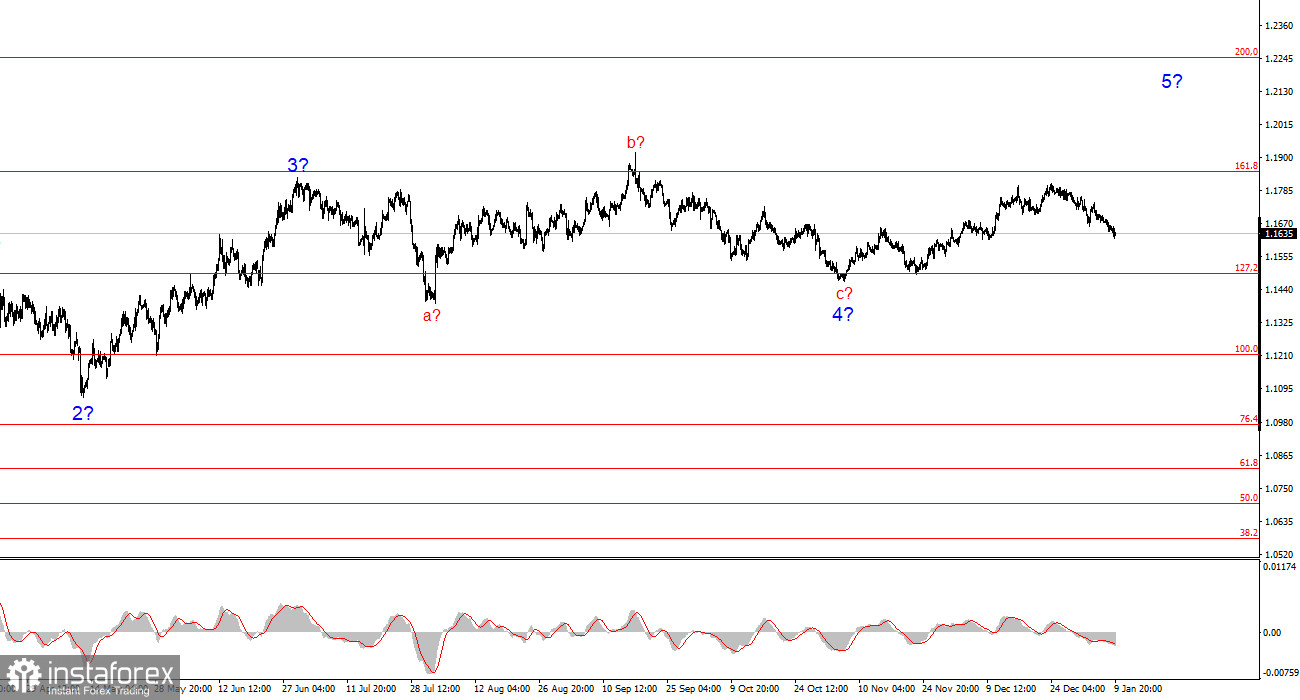

Wave picture for EUR/USD:

Based on the analysis of EUR/USD, I conclude that the instrument continues to form an upward trend. Donald Trump's policy and the Federal Reserve's monetary policy remain significant factors in the long-term decline of the U.S. currency. The targets of the current trend segment may extend to the 25th figure. The current upward wave set may be complete, so the instrument faces a near-term decline. The trend segment that began on November 5 may still take on a five-wave appearance, but, right now, it is a corrective wave.

Wave picture for GBP/USD:

The wave picture of GBP/USD has changed. The downward corrective structure a-b-c-d-e in C of 4 appears to be complete, as does the entire wave 4. If this is indeed the case, I expect the main trend segment to resume its development with initial targets around the 38 and 40 figures.

In the short term, I expected the formation of wave 3 or c with targets located near the marks 1.3280 and 1.3360, which correspond to 76.4% and 61.8% on the Fibonacci scale. These targets have been reached. Wave 3 or C has presumably completed its formation, so in the near term, a downward wave or a set of waves may be observed.

Main principles of my analysis:

- Wave structures should be simple and understandable. Complex structures are difficult to play out and often bring changes.

- If there is no confidence in what is happening in the market, it is better not to enter it.

- There is no and can never be 100% certainty about the direction of movement. Do not forget about protective Stop Loss orders.

- Wave analysis can be combined with other types of analysis and trading strategies.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română