Trade review and trading tips for the British pound

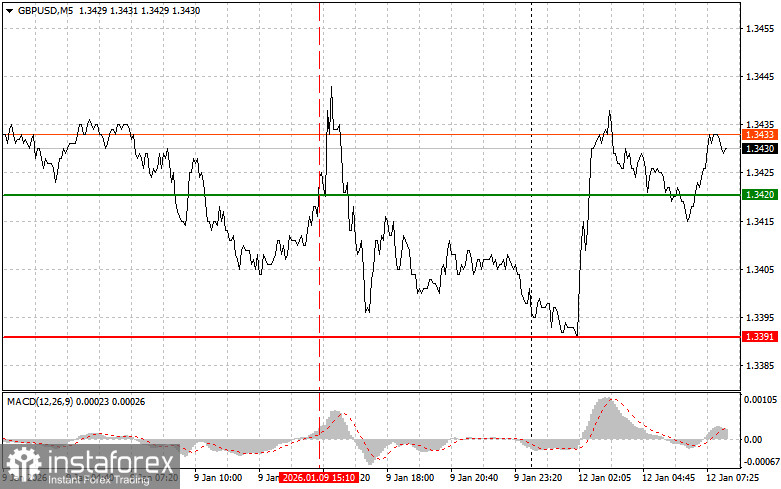

The test of 1.3420 occurred when the MACD indicator had moved well above the zero mark, limiting the pair's upward potential.

Despite weak US employment data, the dollar held its ground. Clearly, the labor market is sending contradictory signals, which adds uncertainty to the Federal Reserve's monetary policy outlook. Investors now wonder how the Fed will react to this ambiguous picture: will it continue to follow a gradual rate-cutting path, or will it adopt a wait-and-see stance while assessing additional data?

Today's absence of important economic releases from the UK suggests that the morning rise in the pound could continue. Close attention should be paid to Bank of England officials' remarks, since any signal of a policy shift, especially toward easing, could quickly cool pound-buying enthusiasm.

Regarding the intraday strategy, I will mainly rely on scenarios No. 1 and No. 2.

Buy scenarios

Scenario No. 1: I plan to buy the pound today if the price reaches the entry area around 1.3439 (green line on the chart) with a target of 1.3475 (thicker green line on the chart). Around 1.3475, I intend to exit long positions and open short positions in the opposite direction (anticipating a 30–35 pip move from that level). Expect pound strength only within the morning trend. Important: before buying, ensure the MACD indicator is above the zero mark and is just beginning to rise from it.

Scenario No. 2: I also plan to buy the pound if there are two consecutive tests of 1.3420 while the MACD is in the oversold area. This will limit the pair's downside potential and lead to an upward reversal. Expect rises to the opposite levels 1.3439 and 1.3475.

Sell scenarios

Scenario No. 1: I plan to sell the pound after a break of 1.3420 (red line on the chart), which should trigger a rapid drop in the pair. Sellers' key target will be 1.3388, where I plan to exit shorts and immediately open buys in the opposite direction (anticipating a 20–25 pip move from that level). Pound sellers may assert themselves within a new bearish market. Important: before selling, ensure the MACD indicator is below the zero mark and is just beginning to fall from it.

Scenario No. 2: I also plan to sell the pound if there are two consecutive tests of 1.3439 while the MACD is in the overbought area. This will limit the pair's upward potential and lead to a reversal downward. Expect declines to the opposite levels 1.3420 and 1.3384.

What is on the chart

Thin green line — entry price at which you can buy the instrument

Thick green line — suggested Take Profit price or level at which to manually lock in profit, since further rise above this level is unlikely

Thin red line — entry price at which you can sell the instrument

Thick red line — suggested Take Profit price or level at which to manually lock in profit, since further decline below this level is unlikely

MACD indicator — when entering the market, it is important to follow the overbought and oversold zones

Important notes: Beginner forex traders must be very cautious when deciding to enter the market. It is best to be out of the market before major fundamental reports are released to avoid being caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can lose your entire deposit quickly, especially if you do not use money management and trade large volumes.

Remember that successful trading requires a clear trading plan like the one presented above. Spontaneous trading decisions based on current market noise are a losing strategy for the intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română