The GBP/USD currency pair also traded higher on Monday, and the reason could only have been one — the criminal case against Jerome Powell, which, in fact, has not even been opened yet. Nevertheless, agree that it is not an ordinary event when the head of the world's largest central bank is summoned to court. So far, it is only about giving voluntary testimony to representatives of the Department of Justice, following which a decision will be made whether Powell violated the law and his oath. Therefore, nothing terrible has yet happened to Jerome Powell personally, and there is no doubt that he will serve out his term as Fed chair to the end.

However, traders clearly did not like the continuation of this story. Many traders, when the fountain of fierce criticism from the White House calmed down somewhat this autumn (the Fed nevertheless resumed monetary easing), believed the story was over. Indeed, what was the point of dismissing Powell in court if he would resign in four months anyway? But, as we have already said, this is a public execution. Now the situation in America is as follows. You may have two opinions: either coinciding with the opinion of the leader and ruler of the nation, or incorrect. Fine if you are a farmer from Texas and share your opinion with your farmer friends after a hard day's work. But if you hold an official position, you cannot think differently from Donald Trump. In general, it is time to create a "thought police" in America and prosecute for "thoughtcrime."

Recall that in the fall, Trump fired the head of the Bureau of Labor Statistics because he did not like the official labor market data. Since then, the labor market data have not improved, but what better punishment for disobedience to the king? Probably Trump exerted exactly the same pressure on the Bureau of Labor Statistics as on the Fed, but received a refusal to "slightly adjust the official statistics." Trump needs numbers and money. The money problem is solved simply — tariffs, cuts to social and medical payments, and raising prices for government services. Numbers are a bit harder, since many of Trump's decisions and decrees so far have only worsened economic conditions.

Trump must have ironclad grounds to declare from a podium in Colorado that the economy under his leadership is growing to unprecedented levels. So he can then call "fools" all those who vote for the Democrats. Thus, in our view, summoning Powell to court, the possible dismissal and the accusations of overspending and perjury are needed for only one thing — so that all other public servants of all ranks, who for some reason do not want to follow instructions from the White House, fully realize what awaits them. The situation is similar to Venezuela. The demonstrative military operation was spectacular and effective at the same time, but hardly too difficult for the US military. It was needed only so that threats from the White House would have some basis. While Trump scatters threats of military seizure in all directions, these are only words. But when, just a week ago, Trump arranged a military invasion of another state, his words gained greater weight. Now Cuba, Colombia, Mexico, Iran, and the European Union will have to take Trump's ultimatums and military threats more seriously.

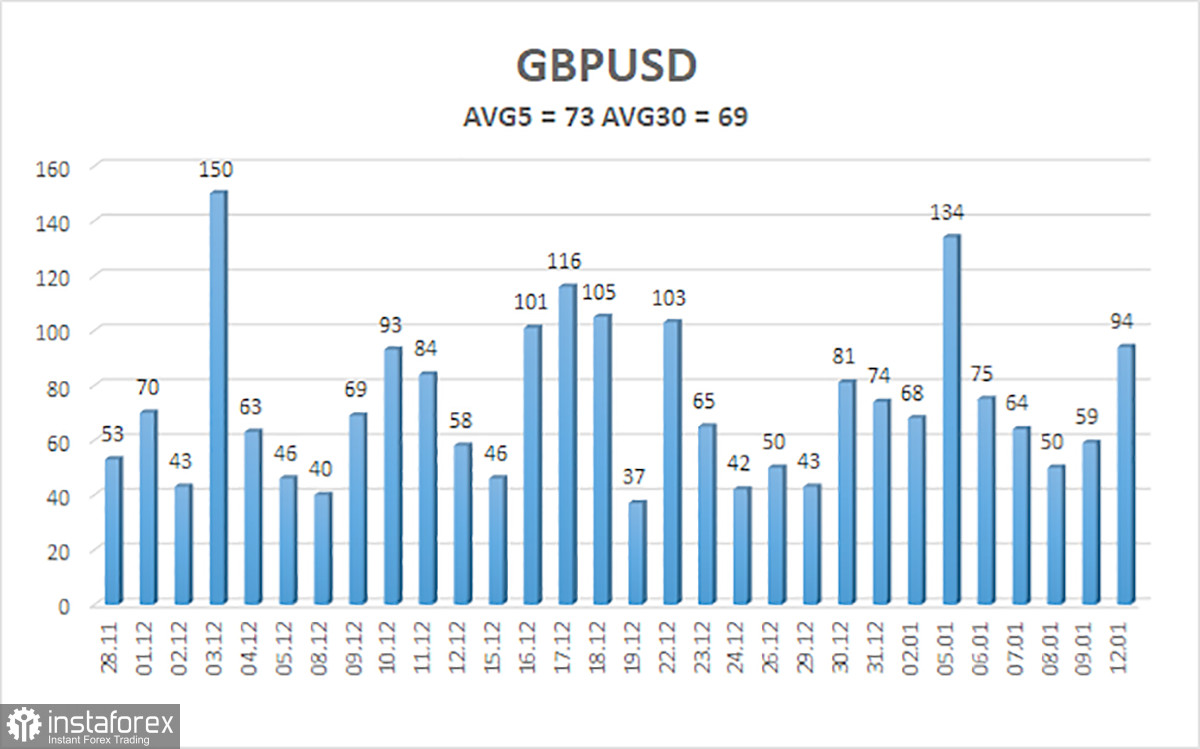

Average volatility of the GBP/USD pair over the last 5 trading days is 73 pips. For the pound/dollar pair, this value is "medium." On Tuesday, January 13, therefore, we expect movement within a range bounded by levels 1.3395 and 1.3541. The higher linear regression channel has turned upward, indicating a trend recovery. The CCI indicator entered the oversold area 6 times over recent months and formed numerous "bullish" divergences, which have consistently warned traders of a continuation of the upward trend.

Nearest support levels:

S1 – 1.3428

S2 – 1.3306

S3 – 1.3184

Nearest resistance levels:

R1 – 1.3550

R2 – 1.3672

R3 – 1.3794

Trading recommendations:

The GBP/USD pair is trying to resume the 2025 uptrend, and its long-term prospects have not changed. Donald Trump's policies will continue to put pressure on the US economy, so we do not expect the US currency to appreciate. Thus, long positions with targets at 1.3550 and 1.3672 remain relevant in the near term as long as the price remains above the moving average. A price below the moving average line allows considering small shorts with a target of 1.3306 on technical grounds. From time to time, the US currency shows corrections (on a global scale), but for a trend to strengthen, it needs global positive factors.

Explanations of the illustrations:

- Linear regression channels help determine the current trend. If both are directed the same way, the trend is strong.

- The moving average line (settings 20,0, smoothed) indicates the short-term trend and the direction in which trading should proceed.

- Murray levels are target levels for moves and corrections.

- Volatility levels (red lines) indicate the likely price channel in which the pair will trade over the next 24 hours based on current volatility.

- CCI indicator — its entry into oversold territory (below -250) or overbought territory (above +250) signals an approaching trend reversal.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română